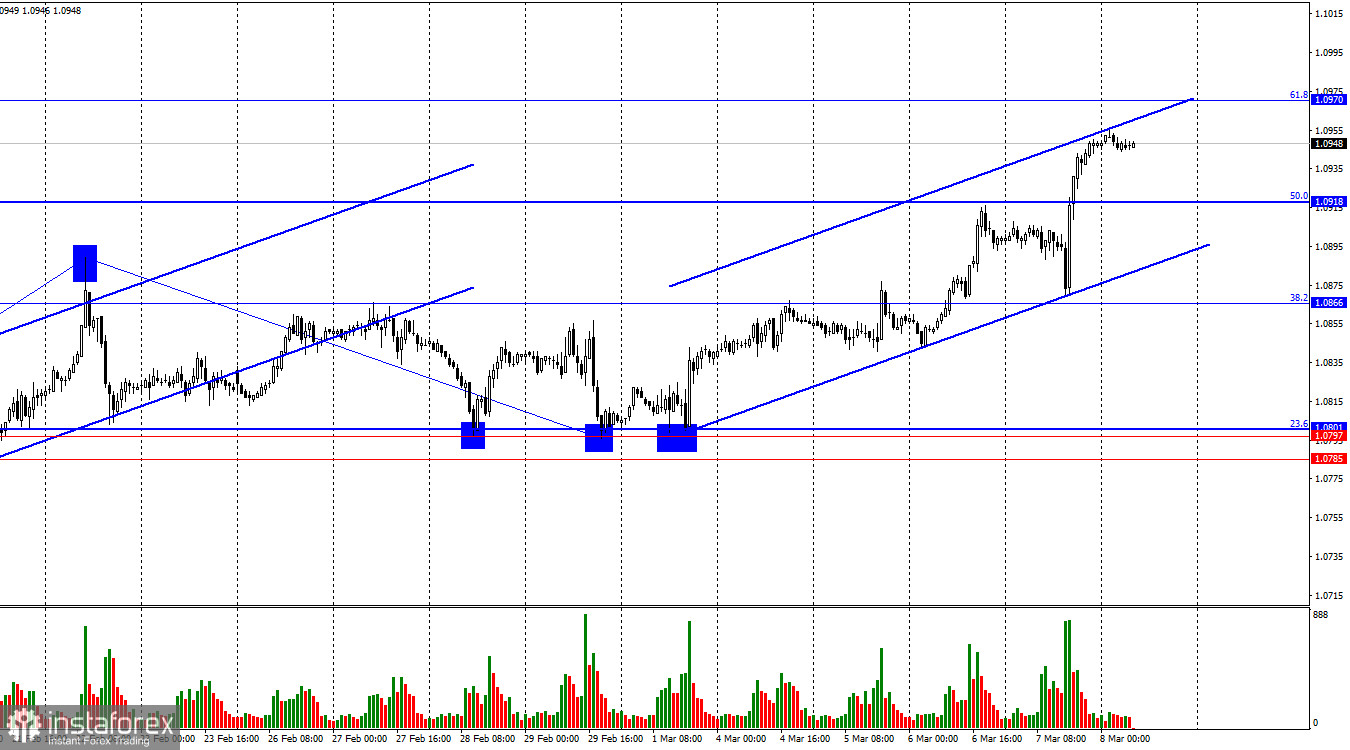

Good afternoon, dear traders! The EUR/USD pair continued its growth on Thursday and consolidated above the 50.0% retracement level of 1.0918. Thus, the growth could be continued towards the next 61.8% correction level located at 1.0970. The upward trend corridor characterizes the current mood of traders as bullish. The euro may decline only when it settles under the corridor.

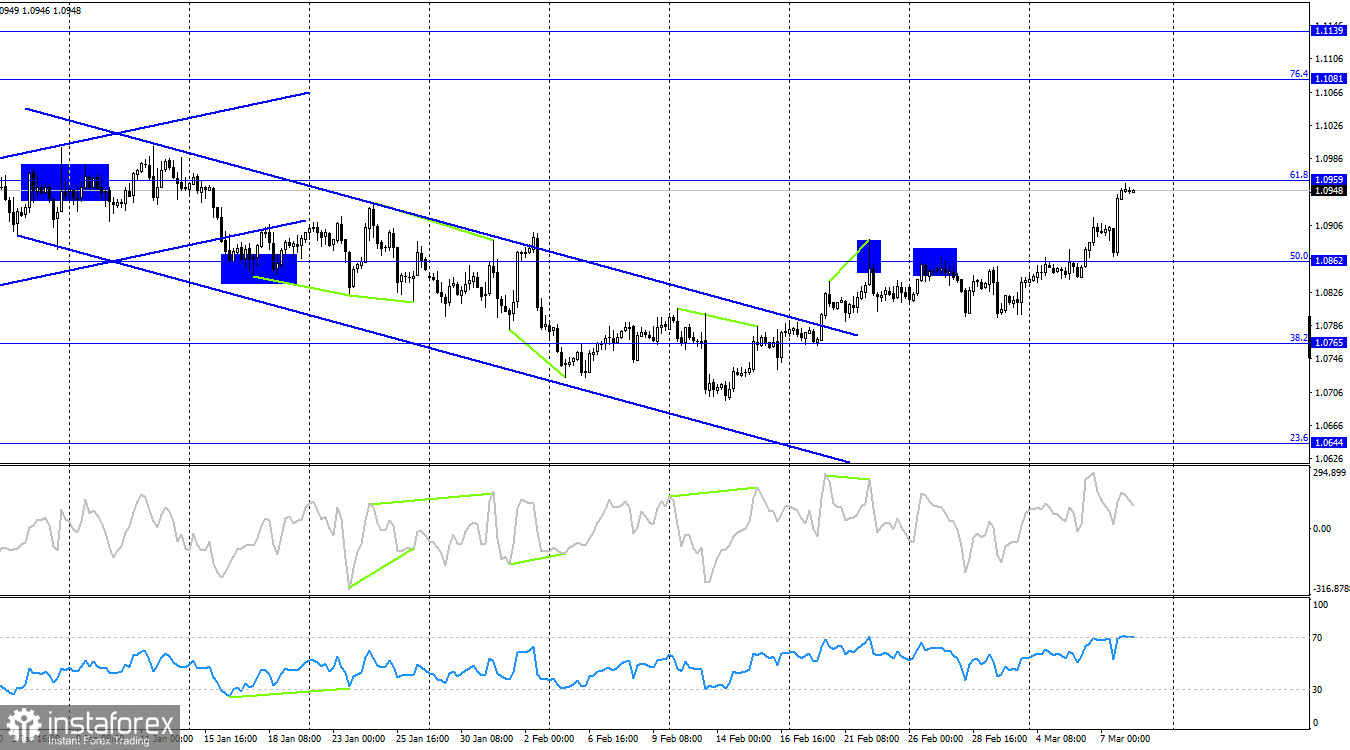

The situation with the waves remains clear. The last completed wave up confidently broke through the peak of the previous wave (from February 12), and the last wave down did not even come close to the previous low. Thus, at this time, we have a bullish trend, and there are no wave signs of its completion. The new wave up managed to break through the peak seen on February 22, thus allowing us to expect an even stronger bullish onslaught in the near future, which is what we are actually seeing at the moment. Despite the weak support of the euro by the informational background, bulls continue to attack.

The information background on Thursday was important and strong, but only in its essence. Let me explain what I mean by this. The ECB meeting and Christine Lagarde's speech are always important events. But for which currency were these events favorable yesterday? Is it for the dollar or the euro? This question cannot be answered clearly. In the speech after the meeting, Lagarde did not give a single hint that interest rates might start to fall later than planned, that is, in the early summer. She noted that inflation is falling even faster than the ECB had hoped, but the regulator still did not have enough evidence that inflation would return to 2% in the medium term. Thus, Lagarde's rhetoric has not changed. It is still difficult to understand why the market was buying the euro. However, we have a graphical picture that clearly indicates the dominance of bulls.

On the 4-hour chart, the pair consolidated above the 50.0% retracement level of 1.0862, which allows us to expect the continuation of growth towards the next 61.8% retracement level of 1.0959. There are no impending divergences in any indicator today. The quotes rebound from the level of 1.0959, which will work in favor of the US currency, and some fall towards 1.0862. The fixing of quotes above the level of 1.0959 will increase the chances for the continuation of growth in the direction of the next Fibo 76.4% level at 1.1081.

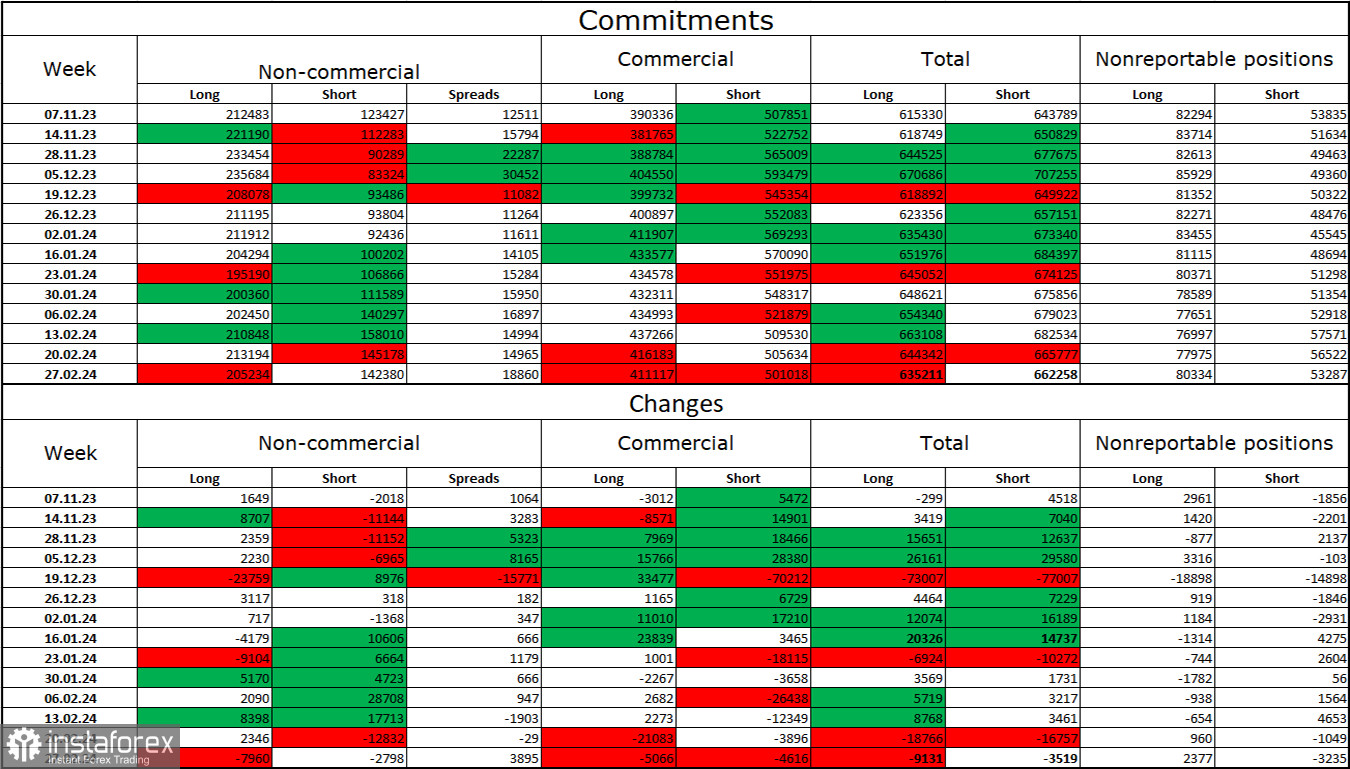

Commitments of Traders (COT) report:

Speculators closed 7,960 long contracts and 2,798 short contracts in the last reporting week. The sentiment of the non-commercial group remains bullish but continues to weaken. The total number of long contracts now stands at 205k and short contracts at 142k. I still believe that the situation will continue to shift in favor of bears. Bulls have dominated the market for too long, and now they need a strong information background to keep the bullish trend going. At the same time, the total number of open long positions is less than the number of short positions (635K vs. 662K). However, this balance of power has been observed for quite a long time.

Macroeconomic events in the USA and EU:

EU - German Industrial Production (07-00 UTC).

EU - GDP growth rate, Q4 (10-00 UTC).

US - Nonfarm payrolls (13-30 UTC).

US - Unemployment rate (13-30 UTC).

US - Average wages and salaries (13-30 UTC).

On March 8, the macroeconomic calendar contains several interesting reports, including nonfarm payrolls and US unemployment, which are the most important. The influence of the information background on traders' sentiment could be strong today.

Outlook for EUR/USD and trading tips:

Traders may go short after a rebound from the level of 1.0959 on the 4-hour chart, with targets at 1.0918 and 1.0866. It is also possible to open short orders after the price closes under the ascending corridor on the hourly chart, with the target at 1.0801. Buy orders could be opened after a consolidation above the level of 1.0862 on the 4-hour chart with a target of 1.0932. The target has been worked out. New buy orders could be considered if the price closes above the level of 1.0959 with a target of 1.1081.