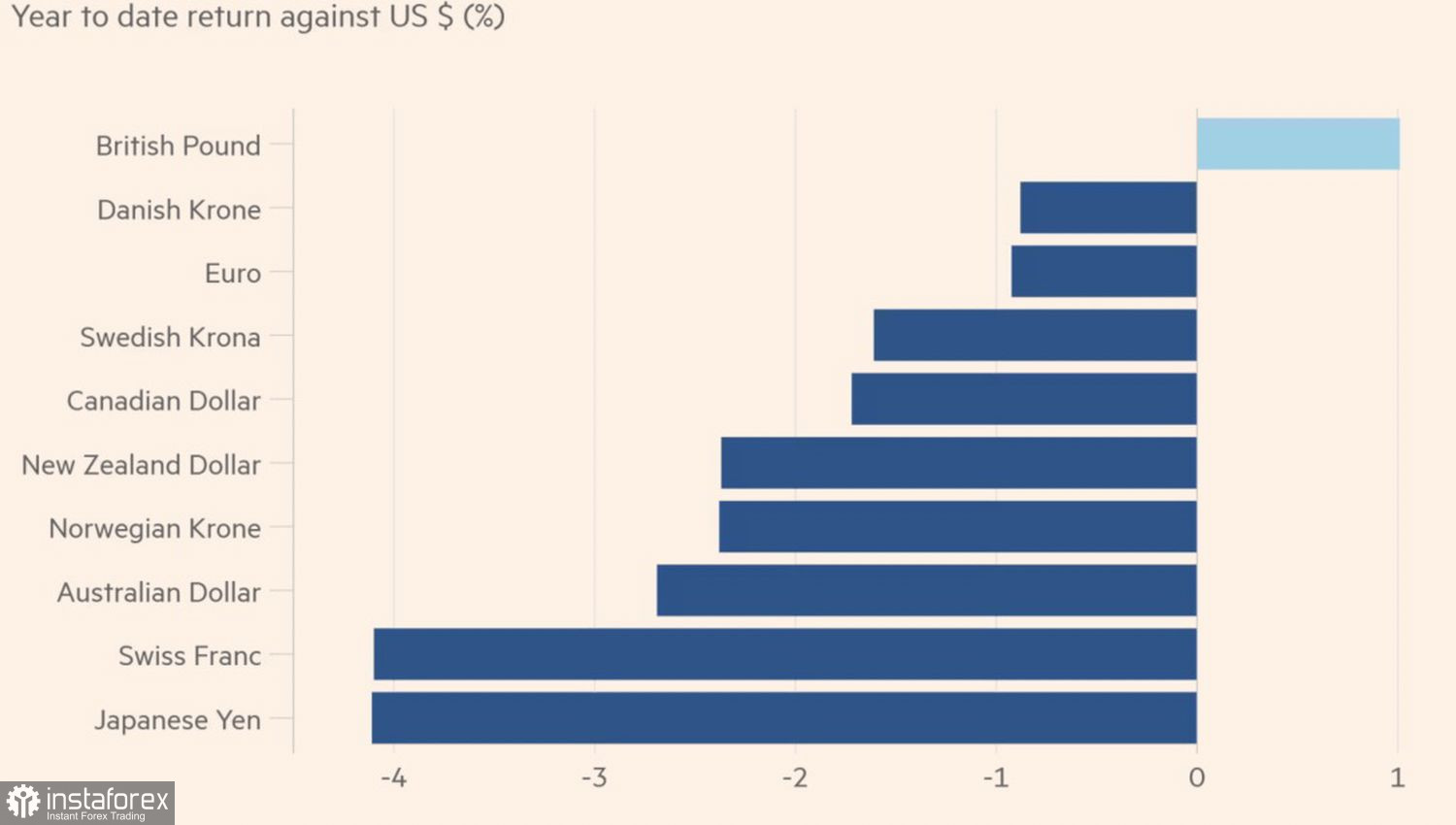

Rishi Sunak's politics may seem more dull compared to his predecessors, but it is benefiting the pound, which confidently leads the G10 currency race. Sterling has risen against over 90% of the world's 140 currencies since the beginning of the year. It lags behind only 11 counterparts, including the currencies of Kenya, Zambia, and Sri Lanka, but can they be considered competitors? The GBP/USD pair reached a 7-month peak, marking its best week since November, thanks to fiscal stimulus from Chancellor Jeremy Hunt and divergent central bank monetary policies.

Currency Dynamics of the Big Ten

Reductions in social insurance contribution rates and the freeze on duties for tobacco and alcohol did not surprise financial markets and could have been a reason to take profits on GBP/USD long positions. However, central bank statements and U.S. labor market statistics allowed the pair to soar to the highest levels since July. Federal Reserve Chairman Jerome Powell stated that the moment for a federal funds rate cut is near, and European Central Bank President Christine Lagarde hinted at a loosening of the ECB's monetary policy in June.

Markets are anticipating the Bank of England to start monetary expansion in August and two repo rate cuts in 2024. For Washington and Frankfurt, the scale of monetary expansion is estimated at 75–100 basis points. Not surprisingly, considering the slower wage growth in the UK. Bloomberg experts forecast that in November–January, the growth rate will slow down to 6.2% from its August peak of 7.9% YoY.

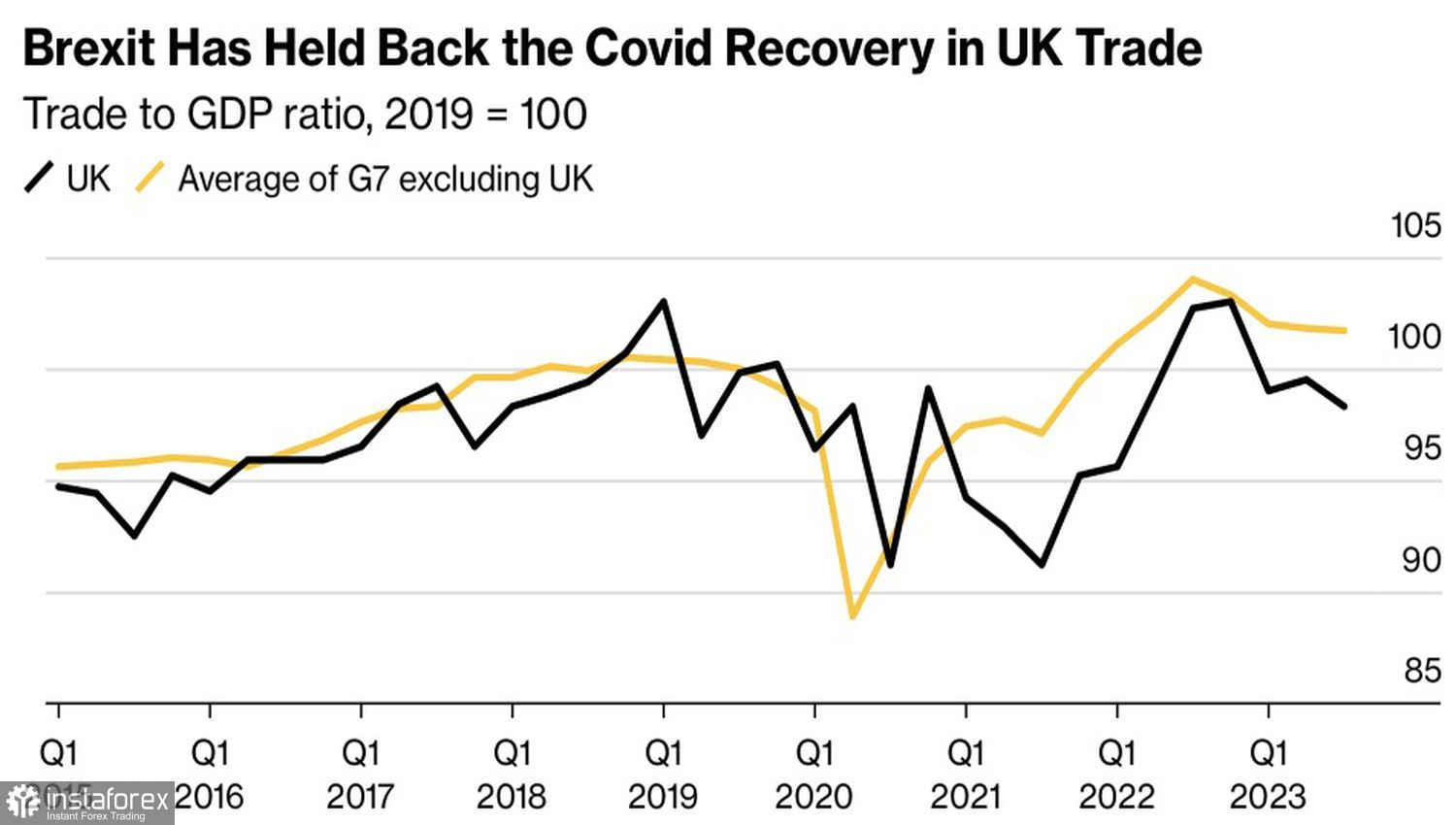

Meanwhile, Sunak's uneventful policies and the belief in the improvement of the British economy create a tailwind for GBP/USD. Due to Brexit, the pandemic, the armed conflict in Ukraine, and the energy crisis, the country faced a recession. Investors believe that the UK has hit rock bottom and will start bouncing back. Moreover, dull policies mean lower volatility, which has a positive impact on the pound. Investors are tired of the shocks associated with the governments of Boris Johnson and Liz Truss.

UK's External Trade Dynamics and Other Countries

Not surprisingly, hedge funds have more than tripled their net long positions on the pound since the beginning of the year, asset managers have become neutral, and Bank of America predicts an increase in GBP/USD quotes to 1.37, recommending its clients to buy the pair. According to the bank, even parliamentary elections do not threaten the pound. In the U.S., presidential elections will bring greater volatility, and the growing popularity of euro-skeptics in the Eurozone puts pressure on the euro.

Further improvement in the British economy, combined with the Bank of England's sluggishness, provides grounds for the continuation of the analyzed pair's rally.

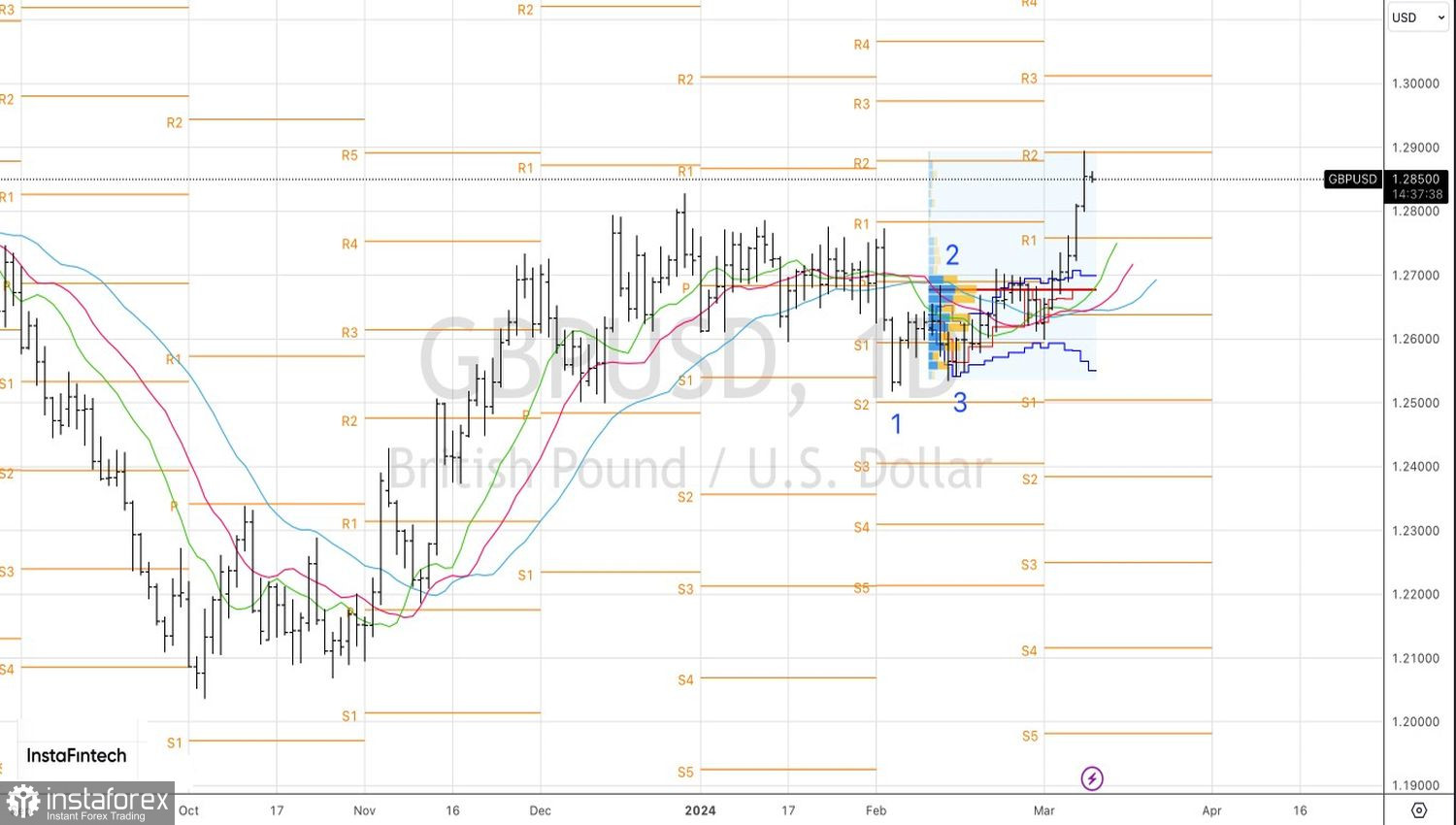

Technically, on the GBP/USD daily chart, there is a recovery in the upward trend. As long as the pound trades above the pivot-level support at $1.2755–1.278, the emphasis should be on buying and periodically adding to previously formed long positions on pullbacks. Targets are set at 1.301 and 1.312.