EUR/USD

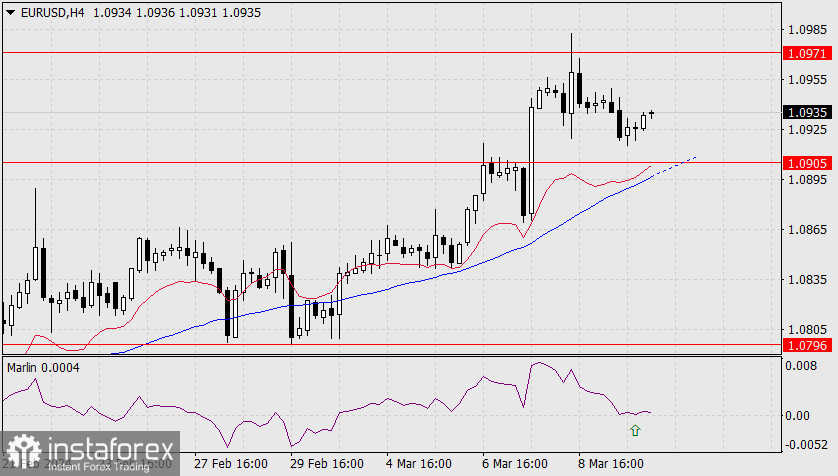

On Monday, the 50.0% Fibonacci level held back the EUR/USD pair from falling, which we see on the daily chart. There are two more significant supports below the corrective level: the target level of 1.0905 and the MACD indicator line. Consolidation below them will open the target of 1.0796, located near the 23.6% Fibonacci level.

Today, the US CPI data for February will be released. The core index is expected to decrease from the previous 3.9% YoY to 3.7% YoY, and the CPI is expected to remain unchanged at 3.1% YoY. We don't expect this report to help the dollar, so there is a chance that the pair will rise further. The target is the range of 1.1001/10. The Marlin oscillator does not provide any clues on this matter.

On the 4-hour chart, the signal line of the Marlin oscillator is on the zero neutral line, and since it has been lying on this line for 5 candles already, it can go in either direction. Such neutral indicators confirm the attention on today's news. So, we await the release of the US CPI and determine whether the euro has the advantage to rise.