Although it showed signs of cooling, in general, the labor market has remained unchanged. However, yesterday's trend may show serious progress today. Forecasts show that inflation in the United States is expected to accelerate from 3.1% to 3.2%. If these expectations are confirmed, it will mean that the Federal Reserve will not start its interest rate cut cycle until the summer, whereas the prevailing opinion is that it could happen as early as spring. If the market revises its expectations, this will inevitably strengthen the dollar. Moreover, the UK labor market data will only mount pressure on the pound. After all, the unemployment rate will likely increase from 3.8% to 3.9%.

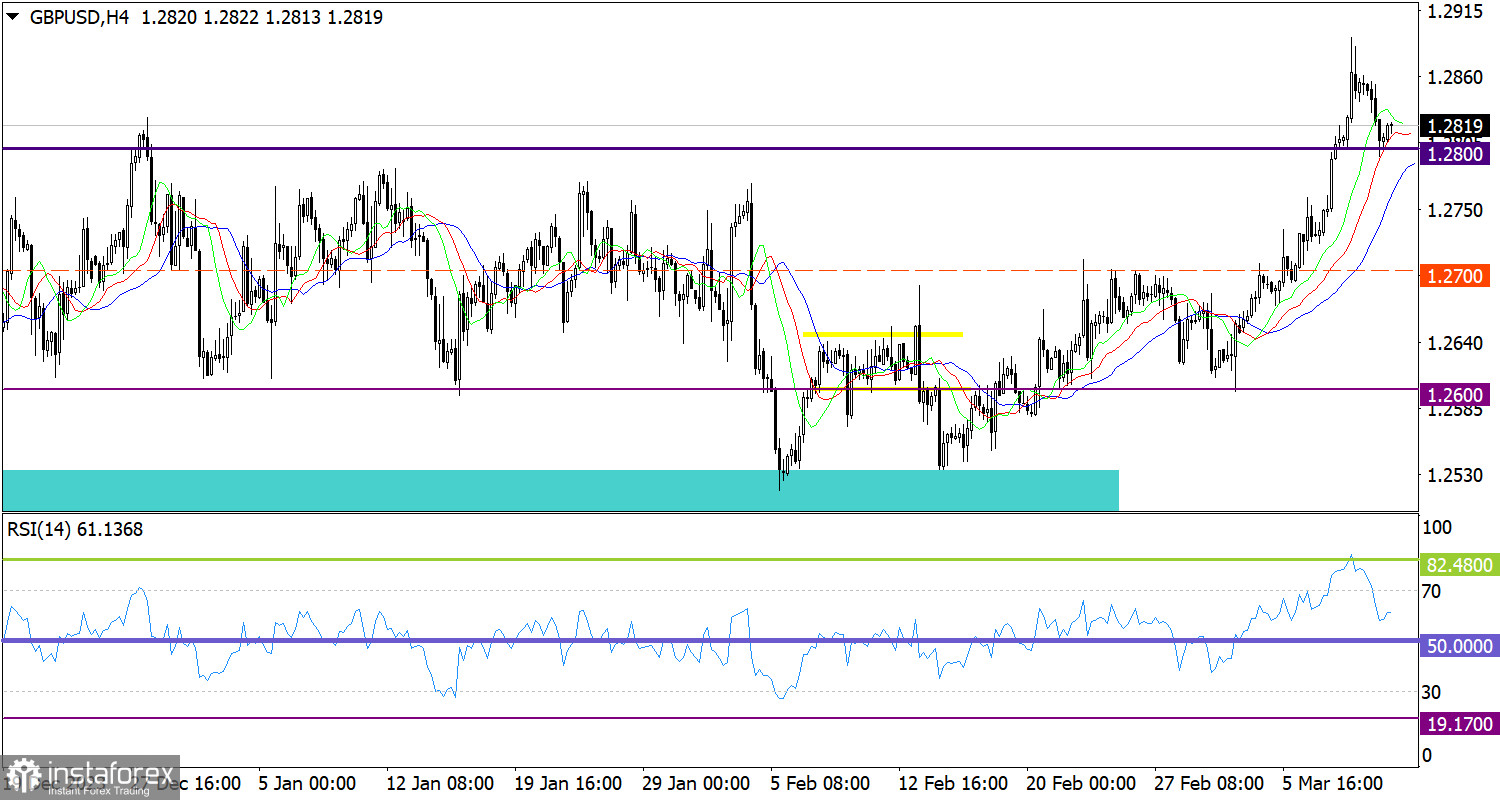

The GBP/USD pair is going through a retracement phase where the quote reached the level of 1.2800. However, this movement did not lead to any crucial changes, and the upward cycle from mid-February persists.

On the four-hour chart, the RSI technical indicator has reached the overbought zone, which is at 82.48. As a result, the volume of long positions in the pound has decreased, which is logical in terms of technical analysis.

On the same chart, the Alligator's MAs are headed upwards, indicating an upward cycle.

Outlook

In this situation, the level of 1.2800 acts as support, and selling volumes have decreased around this area. In case the retracement phase ends, the pound may recover its value, and even test the local high. The bearish scenario will come into play if the price settles below the aforementioned level, at least in the four-hour period. In this case, the volume of short positions may increase.

Complex indicator analysis points to a bounce from the level of 1.2800 in the short-term timeframe, while intraday indicators indicate a downtrend.