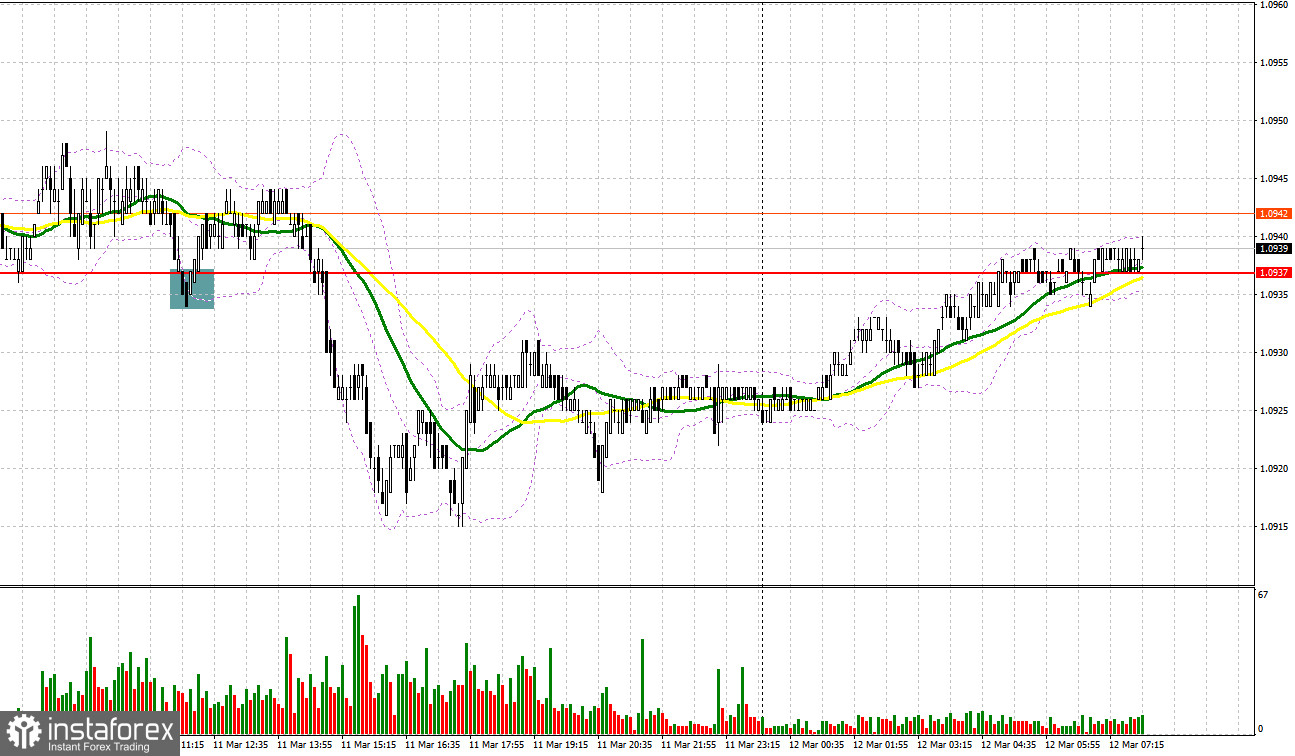

The market witnessed the generation of several entry signals yesterday. An examination of the 5-minute chart sheds light on the events that unfolded. The focus in my morning forecast was on the 1.0937 level, earmarked for decision-making on market entries. The decrease and subsequent false breakout at 1.0937 triggered a buy signal, but the extremely low volatility in the market thwarted significant pair gains. The afternoon session offered no viable entry points.

Long positions on EUR/USD:

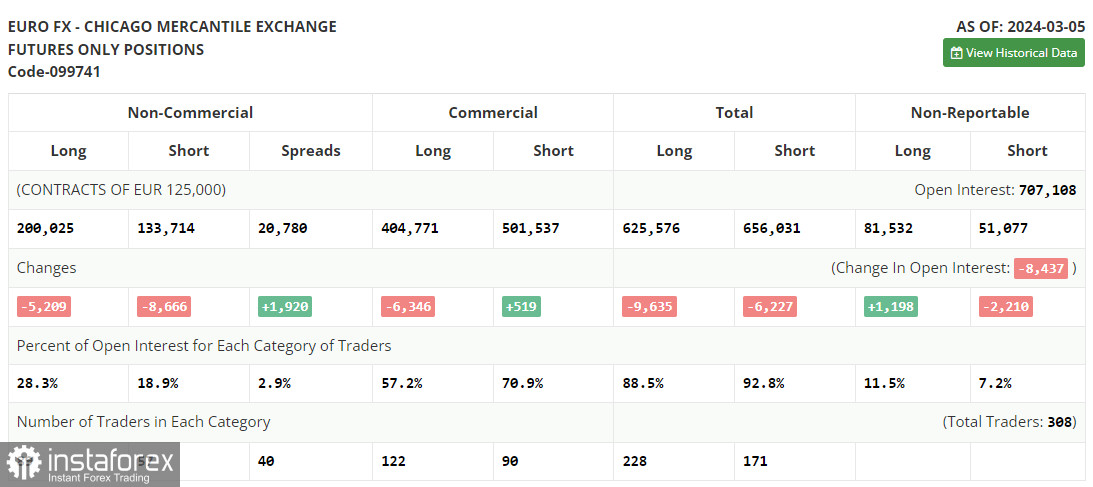

A review of the futures market and the changes in Commitment of Traders positions before addressing the EUR/USD's directional prospects is essential. The March 5 COT report showed a reduction in both long and short positions. Neither the European Central Bank meeting outcomes nor the US labor market data sprung any surprises on traders, maintaining the momentum for risk asset buyers. However, the upcoming inflation data from the eurozone and the US could be pivotal. A downtrend in US inflation may herald new monthly highs for the European currency. The COT report revealed a decline in non-commercial long positions by 5,209 to 200,025, whereas non-commercial short positions fell by 8,666 to 133,714, expanding the spread between long and short positions by 1,920.

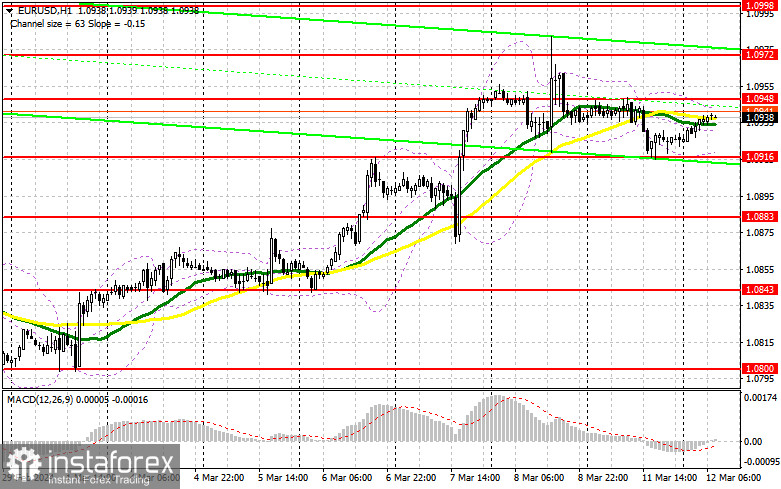

Key data releases today include the German Consumer Price Index and the Eurozone Finance Ministers' Council meeting. The euro's trajectory could maintain its upward momentum if inflation aligns with economists' forecasts. Conversely, disappointing data could prompt a euro decline, a scenario for which I am prepared. My preferred strategy involves acting after a decline and a false breakout near the nearest support at 1.0916, aiming for a recovery target at 1.0948. A breakout and downward renewal of this range provide another opportunity for purchase, with an aim for a new peak around 1.0972. The ultimate target is the 1.0998 area for profit-taking. Should EUR/USD fall without significant activity at 1.0916, the potential for a continued downward correction increases. An attempt at entry following a false breakout near the subsequent support at 1.0883 will be made. Immediate long positions from a rebound at 1.0843 are planned, targeting an upward correction of 30-35 points within the day.

Short positions on EUR/USD:

Sellers must prevent the pair from exceeding the 1.0948 resistance, established by the previous day's dynamics, in the morning session. Defending this level with a false breakout serves as a suitable strategy for initiating short positions, aiming for a downturn towards 1.0916. A sustained move below this range, followed by a bottom-up retest, will provide another sell entry point, targeting 1.0883. The ultimate goal is the annual low at 1.0843, where profits will be secured. A test of this level could signify a return to a downward trend. In the event of an upward move in EUR/USD during the European session and a lack of sellers at 1.0948, buyers might attempt to reach a new high at 1.0972. Actions at this level will be taken only upon a false breakout. Plans include opening short positions on a rebound from 1.0998, aiming for a downward correction of 30-35 points.

Indicator Insights:

Moving Averages:

The current market positioning around the 30 and 50 moving averages suggests a sideways market trend.

Note: The moving average periods and prices are considered by the author on the H1 timeframe and differ from the classical daily moving averages on the D1 chart.

Bollinger Bands:

A downturn will find support at the indicator's lower boundary around 1.0916. Conversely, an uptrend will encounter resistance at the upper boundary around 1.0948.

Indicator Glossary:

- Moving average: Identifies the current trend by smoothing volatility and noise. Period 50 is indicated in yellow; period 30 in green.

- MACD Indicator (Moving Average Convergence/Divergence): Evaluates convergence/divergence of moving averages. Fast EMA 12, slow EMA 26, and SMA 9.

- Bollinger Bands: Period 20.

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions engaging in the futures market for speculative purposes, adhering to certain criteria.

- Long non-commercial positions represent the aggregate long open interest of non-commercial traders.

- Short non-commercial positions denote the aggregate short open interest of non-commercial traders.

- The total non-commercial net position is the difference between the short and long positions of non-commercial traders.