At the end of 2023, the Japanese yen appeared as the main favorite for investors on the Forex market. The consensus was that most central banks, led by the Federal Reserve, would loosen monetary policy, while the Bank of Japan, on the contrary, intended to raise interest rates. The interest rate differential would narrow, leading to a decline in USD/JPY. However, the realization of this strategy had to wait for about two months.

In January–February, investors faced disappointment. Bank of Japan Governor Kazuo Ueda had no intention of signaling a departure from negative interest rate policies, and markets moderated their expectations regarding the fate of the federal funds rate. At the end of December, they anticipated a 150 bps decrease in borrowing costs by the Federal Reserve, down to 4%. In early March, derivatives predicted only three acts of monetary expansion instead of six. The U.S. dollar strengthened, while the yen, on the contrary, became an outsider.

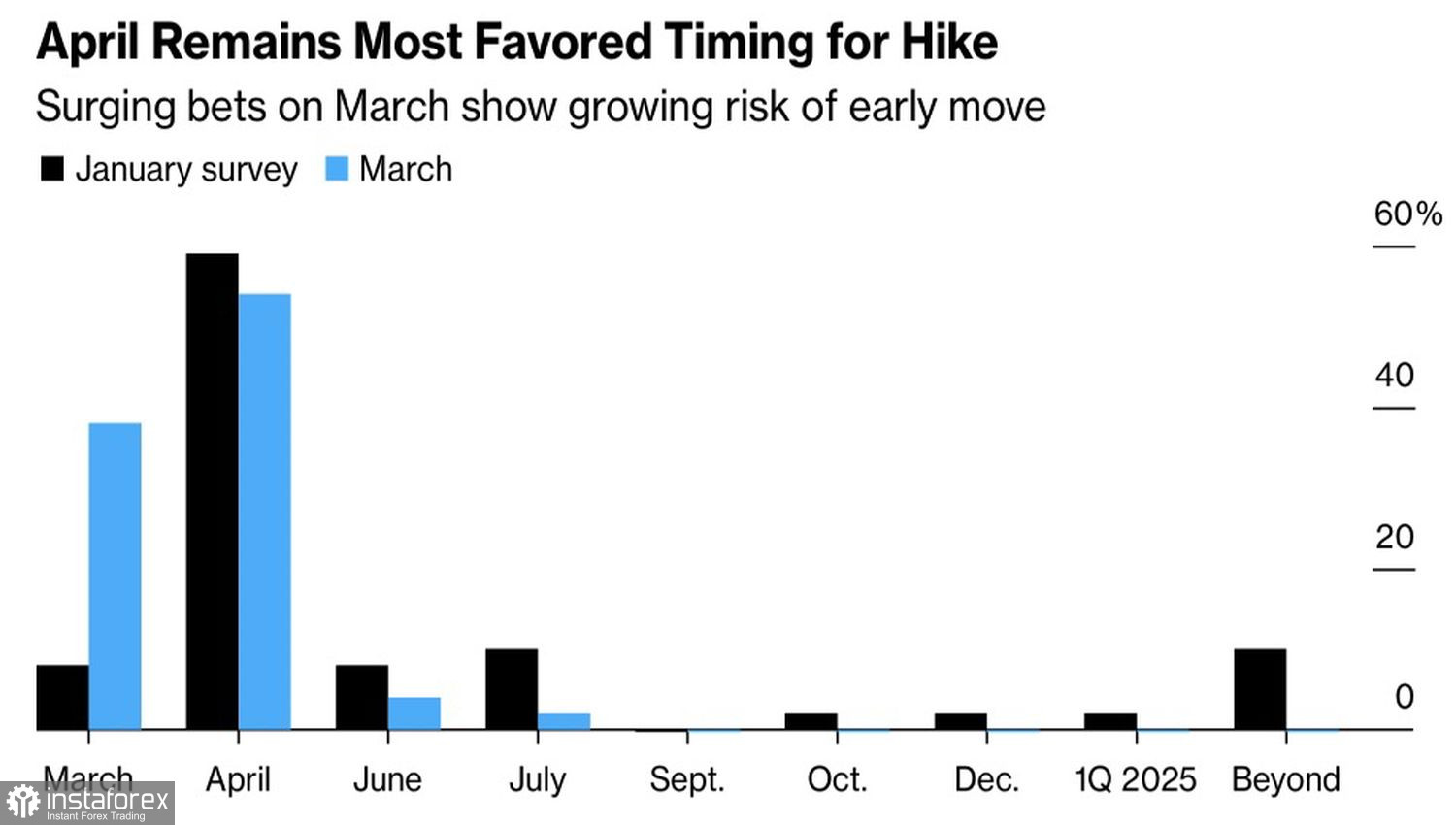

However, in spring, the divergence theme in monetary policy resurfaced from a new angle. Markets are fixated not on the scale but on the timing of the start. Rumors that the Bank of Japan could begin normalization in March became the key driver for the peak in USD/JPY. Indeed, if in the January survey, 59% of Bloomberg experts predicted that Ueda and his colleagues would raise the overnight rate in April, with only 8% preferring March, everything changed in early spring. In favor of April, 54% of economists voted, while March had the support of 38%!

Forecasts of Bloomberg experts on the timing of the start of BoJ normalization

According to Reuters' insider information, the Board of Governors is ready to wait. However, if the results of negotiations with major companies on March 13th and the results of the survey of the largest Rengo union on March 15th show a sharp increase in wages, the Central Bank may announce negative rates at the meeting on the 18th and 19th.

The Federal Reserve, according to Jerome Powell's statement, is close to reducing the federal funds rate. The U.S. Central Bank needs more inflation data similar to those released earlier, signaling the development of deflationary processes. In this regard, the proximity of actual figures for consumer prices and core inflation to Bloomberg experts' forecasts of 3.1% and 3.7%, respectively, will be a reason for new USD/JPY sell-offs.

It should be noted that divergence in monetary policy is not the only driver for the peak in the analyzed pair. The increase in volatility in the Forex market ahead of important events such as the U.S. inflation report for February, Bank of Japan, and Federal Reserve meetings leads to the closure of carry trade positions and strengthening of funding currencies, primarily the yen.

Moreover, the correction of Japanese stock indices prompts non-residents to stop hedging currency risks, contributing to the decline in USD/JPY quotes.

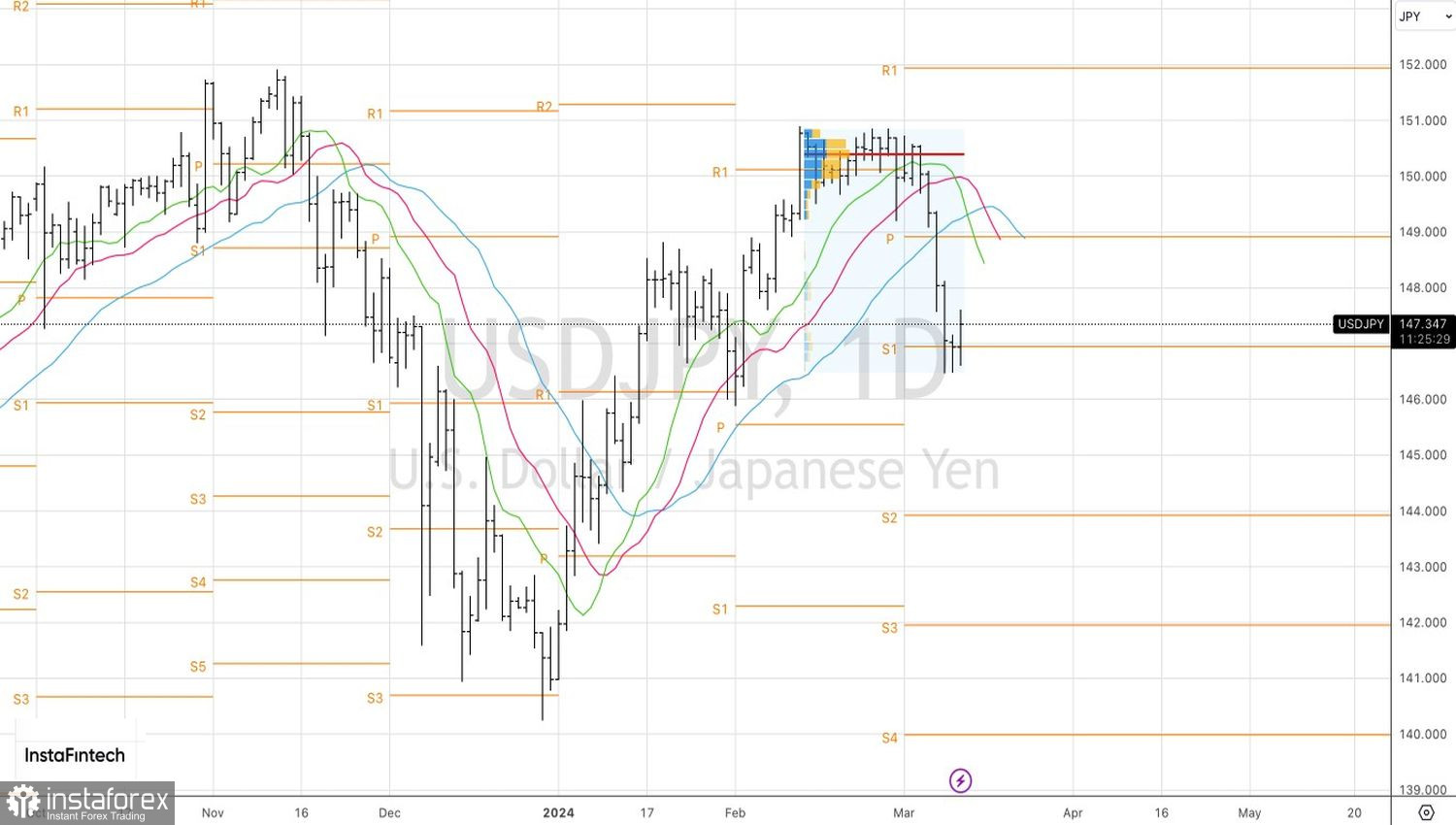

On the daily chart of the U.S. dollar against the Japanese yen, there was a breakout of consolidation. This allowed for the formation of shorts from the level of 149.8. Given the high probability of a reversal in the upward trend of USD/JPY, it is advisable to maintain and increase short positions on pullbacks.