Analysts around the world continue to talk about the deteriorating economic situation in the United States, the rise in unemployment, and a shrinking labor market. However, for some reason, none of them are talking about how the situation in the European Union and the United Kingdom is no better. The reason why the dollar usually drops is due to the imminent rate cuts by the Federal Reserve, as well as the threat of recession. However, neither the first nor the second has started yet. The market expected a rate cut from the Fed as early as the March meeting. Now the timing has shifted to June, and FOMC members still talk about the market's overly high expectations. The US central bank may conduct only three rounds of easing this year instead of the 5 or 6 the market expected. And this information is still not enough to fuel the dollar, as required by the news background and wave markings for both instruments.

Last week, Mary Daly, President of the San Francisco Fed, said that there is still a lot of work to be done to reduce inflation. In her opinion, it is still too early for the Fed to consider lowering the interest rate. "We need to achieve a consistent and gradual reduction in inflation to 2%. We need more evidence that consumer prices will slow down in the future," Daly believes. At the same time, the head of the San Francisco Fed believes that if the jobs market cools further, this could be a significant reason to move to a more accommodative policy a little earlier. I remind you that unemployment rose to 3.9% in February, but the Nonfarm Payrolls figure showed a good values (although below market expectations). However, market expectations are one thing, and Fed expectations are quite another. The market, analysts, and economists can expect any values, but what matters is what figures Nonfarm Payrolls show without tying them to forecasts. And in my opinion, it shows very good values from month to month, so it is very difficult to confirm where the labor market is heading right now.

Based on all of the above, I doubt that the Fed will start to lower rates in June, which again puts the US dollar in a more favorable position. However, there is no guarantee, as the market is only focused on buying. If the EUR/USD pair has a good chance of falling, then for the GBP/USD pair, the wave pattern is too tangled to make such unambiguous conclusions.

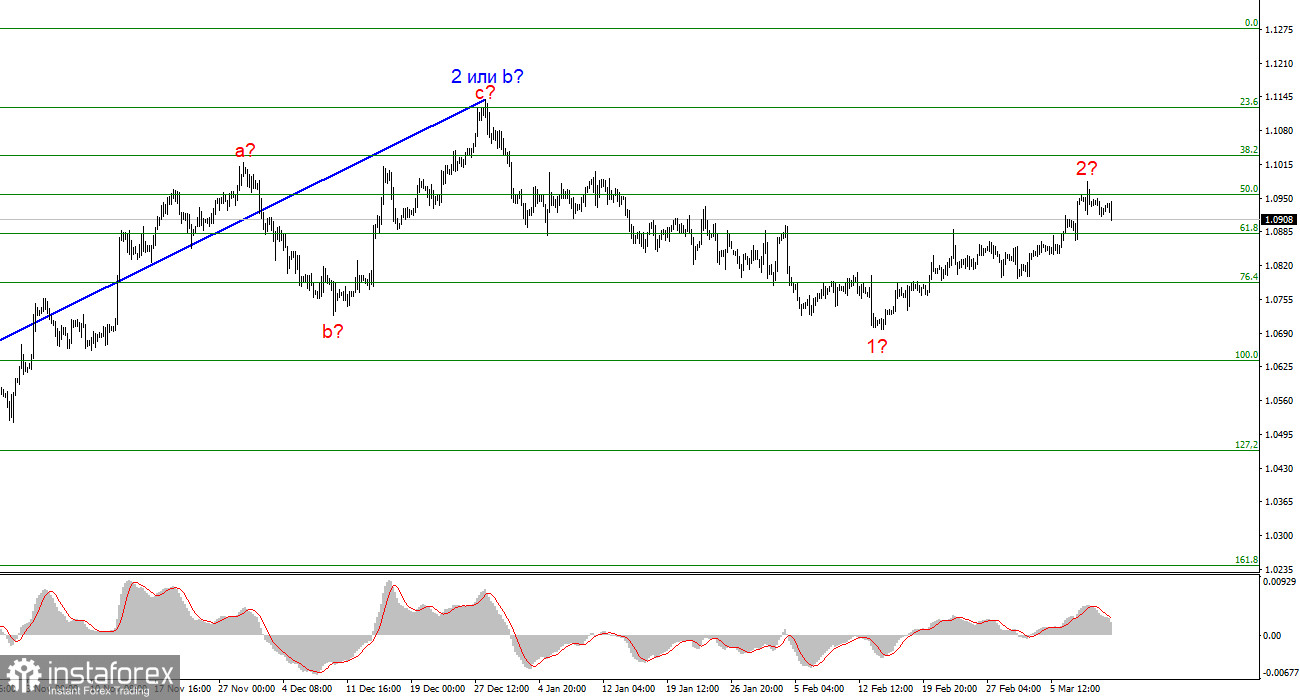

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Wave 2 or b is complete, so in the near future, I expect an impulsive downward wave 3 or c to form with a significant decline in the instrument. An internal corrective wave is currently being formed, which could end. I am considering short positions with targets around the level of 1.0462, which corresponds to 127.2% according to Fibonacci.

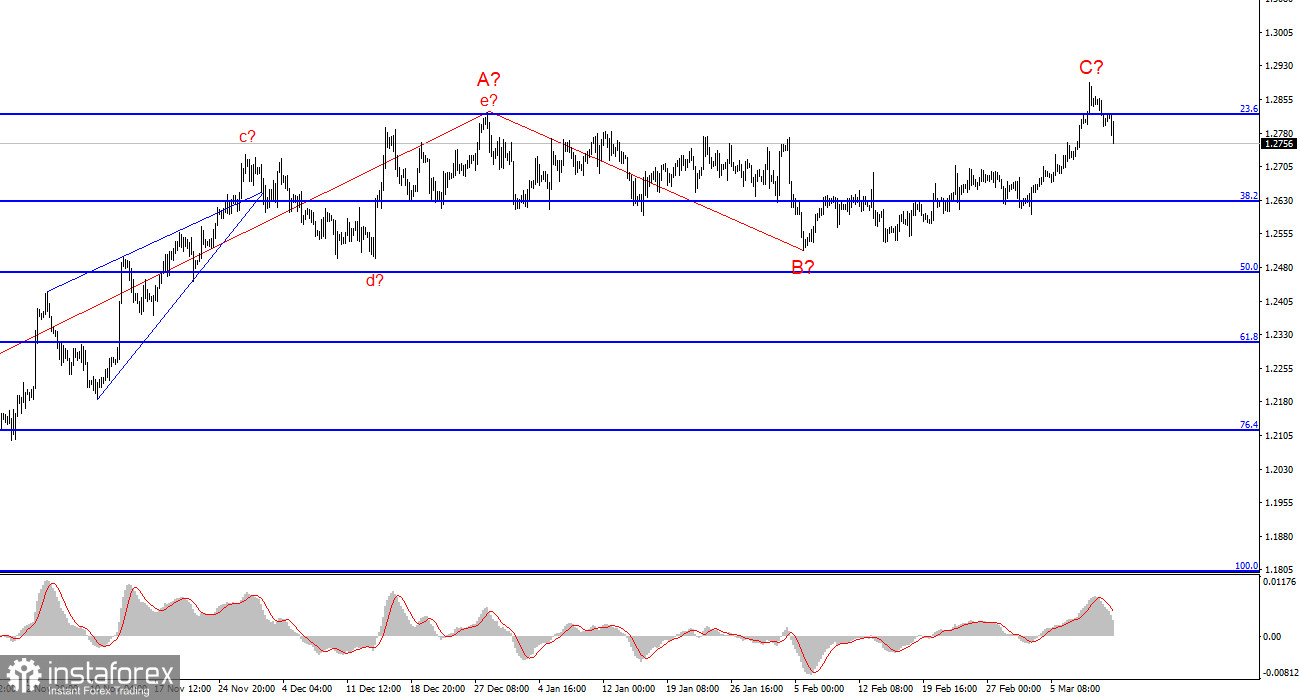

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c will start sooner or later. However, unless wave 2 or b ends, the instrument can still rise to the level of 1.3140, which corresponds to 100.0% according to Fibonacci. A successful attempt to break through the level of 1.2877, which is equivalent to 76.4% according to Fibonacci, will indicate that the market is ready to increase the demand for the instrument. However, at this time it is futile, so the construction of wave 3 or c could already start.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.