Most market participants still hope that the Federal Reserve will begin easing its policy in June, with three interest rate cuts expected this year.

On Thursday this week, market participants will receive new insights into whether it is worth increasing short positions on the dollar. At 12:30 GMT, the Bureau of Labor Statistics of the U.S. Department of Labor will release fresh data on the dynamics of manufacturing inflation.

Today, in the absence of significant publications in the economic calendar, market participants, especially those monitoring the pound's dynamics, paid attention to GDP and industrial production volume data in the UK. These reflected a 0.2% GDP growth in January and a decline in the industrial indicator from +0.6% to -0.2% (from +0.6% to +0.5% in year-on-year terms). Meanwhile, a crucial indicator in manufacturing dropped from +0.8% to 0.0% (from +2.3% to +2.0% year-on-year).

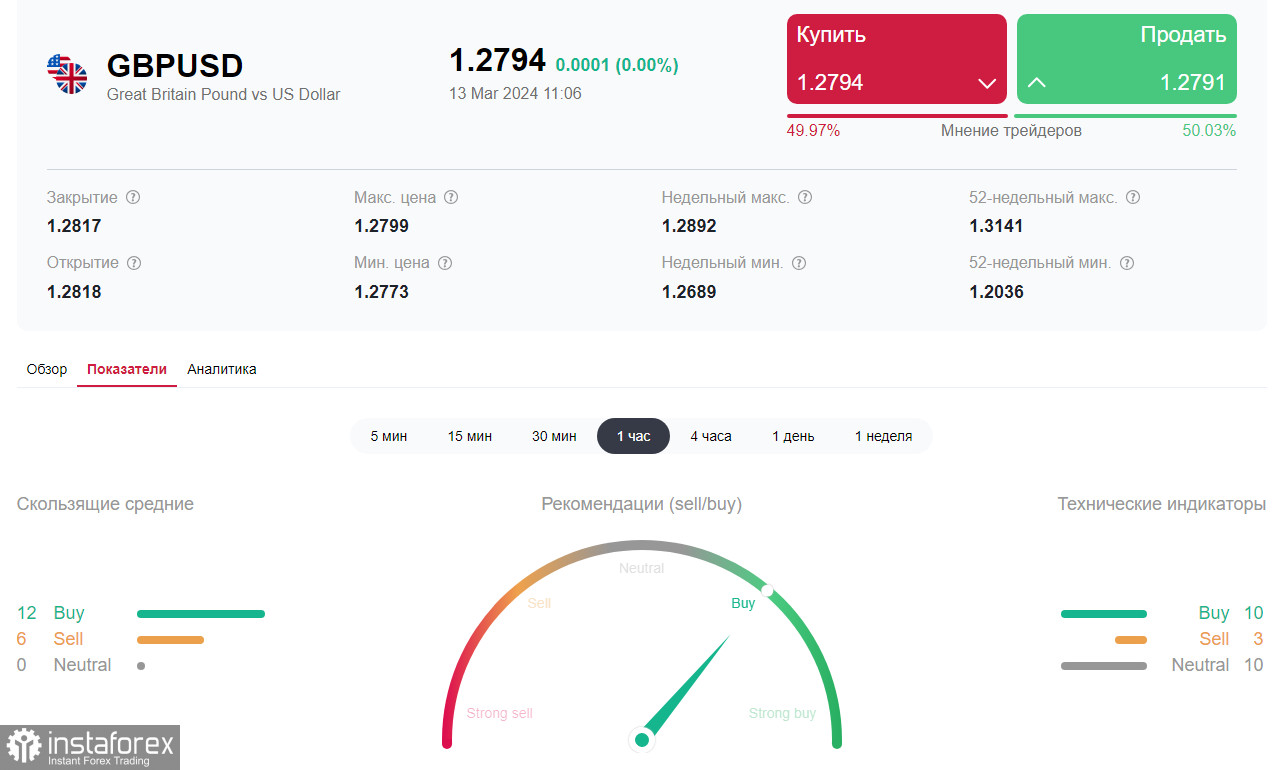

The pound declined against the dollar after this publication, but moderately so. Soon after, the GBP/USD pair resumed its upward movement, almost returning to the opening price of today's trading day and reaching 1.2792.

Nevertheless, the latest macroeconomic data from the U.S. and the UK have a more negative impact on the GBP/USD pair than positive.

Investors particularly evaluate yesterday's release of the UK labor market data, confirming its slowdown. According to these data, employment fell by 21,000 in January (forecasted to increase by 10,000), and the unemployment rate rose from 3.8% to 3.9% (forecasted at 3.8%). The growth of British wages also slowed down, marking the slowest pace since 2022. These data increased the likelihood of the Bank of England transitioning to a more accommodative monetary policy, possibly as early as May, according to some economists.

If data from the UK continues to deteriorate, the likelihood of such an outcome (the Bank of England reducing interest rates in the coming months) will strengthen. This constitutes a fundamental negative factor for the pound and the GBP/USD pair.