EUR/USD

Higher Timeframes

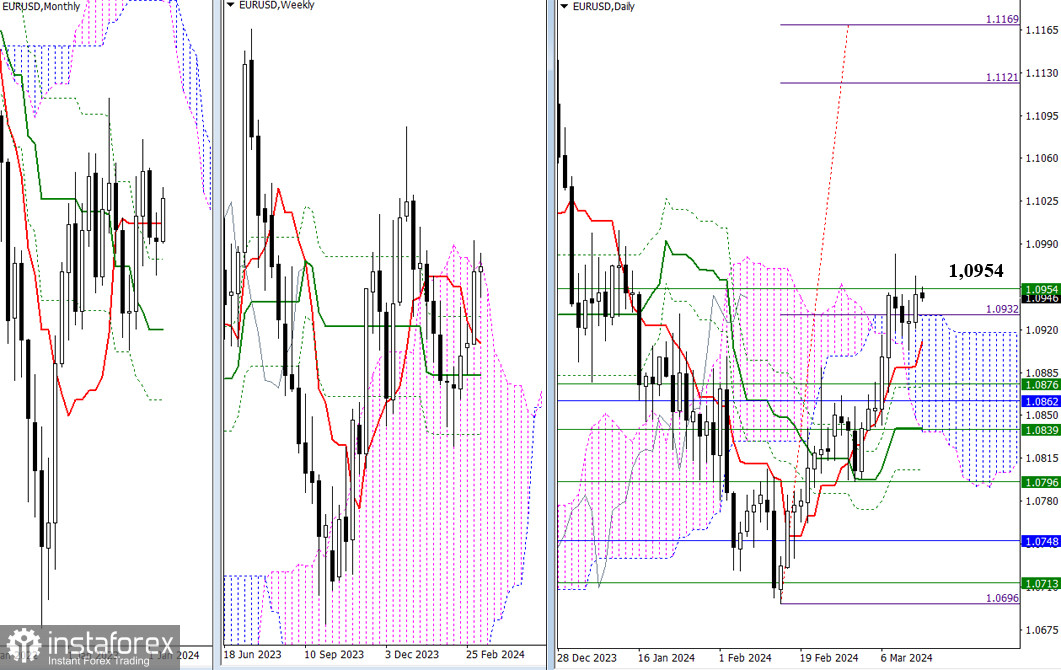

Bullish players managed to close above the upper boundary of the daily cloud (1.0932) over the past day. If the weekly candle can overcome the limits of the weekly Ichimoku cloud (1.0954), then there will be good prerequisites for further ascent. The next target benchmarks are the high at 1.1140 and the daily target at 1.1121 – 1.1169. In case of another failure, the market may utilize the nearest supports, combining levels of different timeframes (1.0932 – 1.0910 – 1.0876 – 1.0852).

H4 – H1

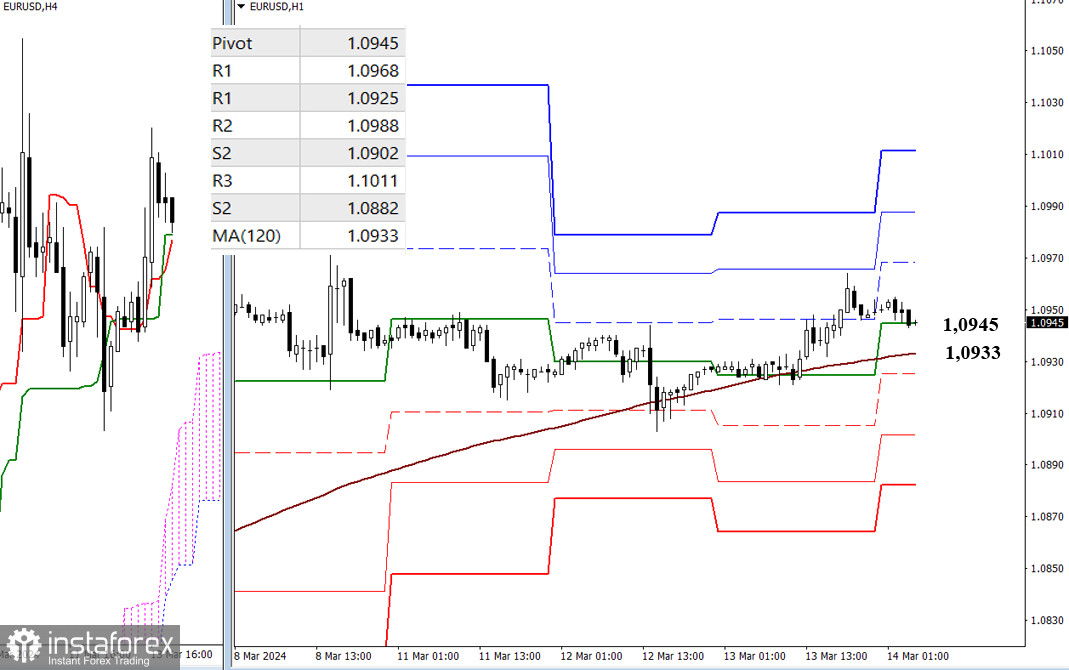

The weekly long-term trend is now at 1.0933, actively restraining the bearish offensive in recent days and helping to maintain bullish interests. The development of upward movement within the day under current conditions may pass through the testing of resistance at classic pivot points (1.0968 – 1.0988 – 1.1011). A breakthrough and reversal of the trend (1.0933) could alter the current balance of power. Bears' attention will then be directed toward the supports of classic pivot points (1.0925 – 1.0902 – 1.0882).

***

GBP/USD

Higher Timeframes

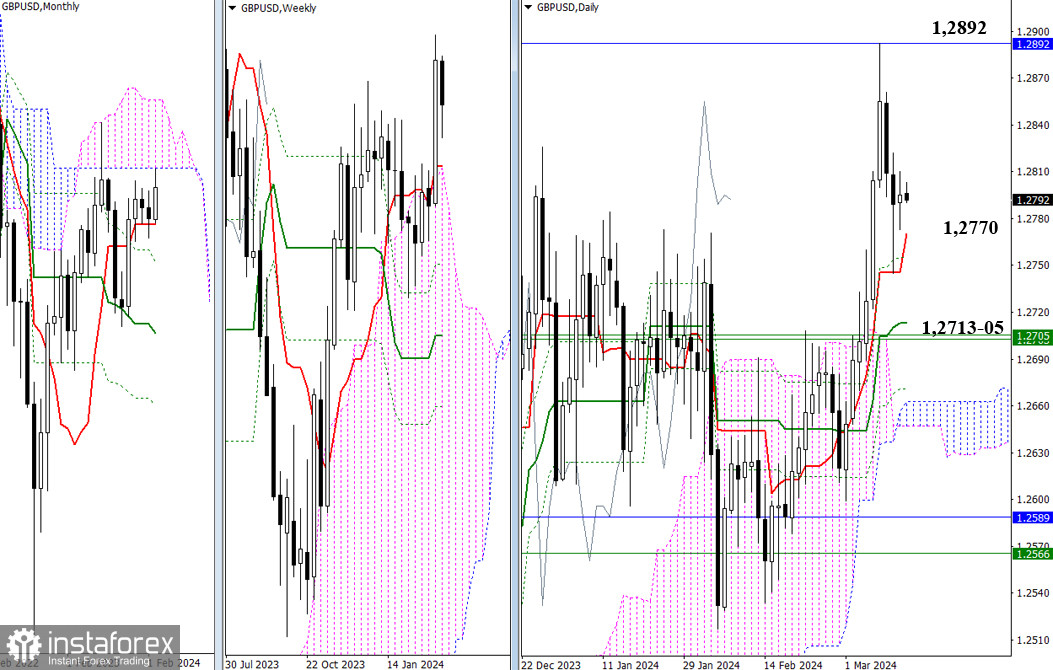

Nothing significant happened during yesterday's trading. Correction to the daily short-term trend has been completed, so the question now is whether bulls can overcome the depth of the corrective decline and restore positions, or if the correction will continue. In the first case, the outcome will involve a new test of the lower boundary of the monthly cloud (1.2892), aiming to break through this level to restore the upward trend on daily and weekly timeframes. In the second case, a breakthrough of the daily short-term trend is needed, currently at 1.2770, followed by a deepening correction to the daily medium-term trend (1.2713), reinforced by weekly supports around 1.2705–02.

H4 – H1

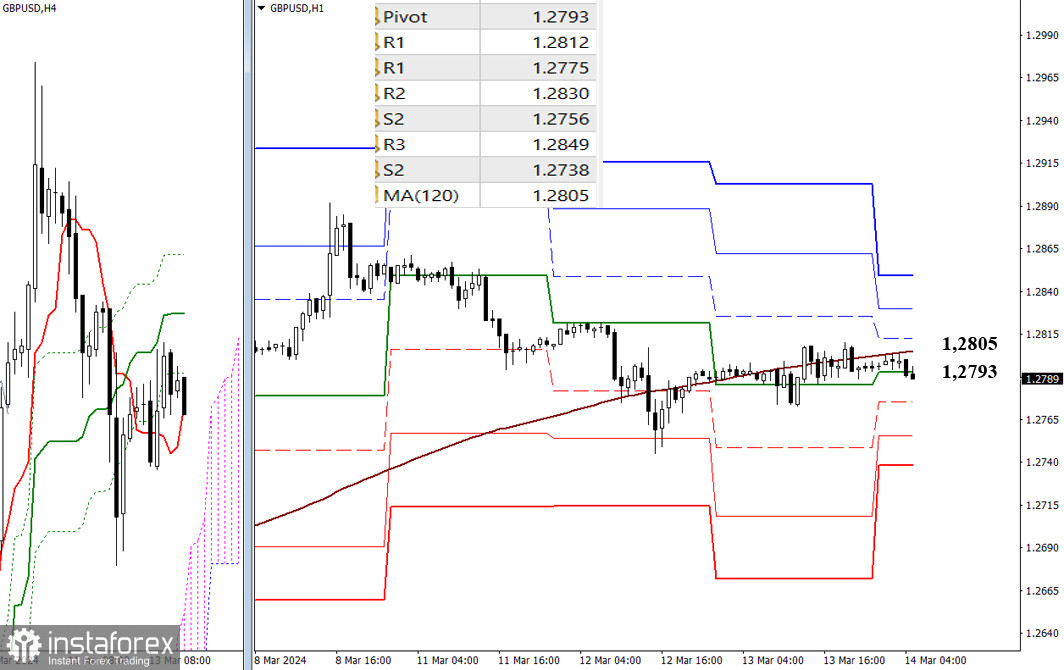

The struggle for possession of the most important level has led to the market currently trading below the weekly long-term trend (1.2805). The development of bearish sentiments within the day today will involve passing through the supports of classic pivot points (1.2775 – 1.2756 – 1.2738). However, if bulls manage to reclaim the weekly long-term trend (1.2805), then the market's focus will shift to testing the resistances of classic pivot points (1.2812 – 1.2830 – 1.2849).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)