Investors continue to scrutinize the February US consumer price index data, which came in above expectations and has already spurred a wave of statements from financial authorities. On Wednesday, Treasury Secretary Janet Yellen stated that her view of the future interest rate level had significantly changed since January due to persistent inflation that would not allow the regulator to return to the low interest rates of the pre-COVID period. She also added that high rates would negatively impact the country's debt servicing. Meanwhile, Fed Chairman Jerome Powell found a reason for the stabilization of high consumer inflation levels. He atttibued them to high interest rates on various types of insurance.

Another key reason is the structure of the American economy, which is significantly in the realm of various services, mostly financial. Instead of producing real products in the form of consumer goods and the like, the country prints unbacked money and exchanges it for commodity assets. The overall economic situation in the country shows that, under the current administration, it is unable to move away from this scheme.

Why, after reacting to inflation data, did the markets essentially return to the previous state of affairs?

As expected, after a volatile trading session following the release of inflation figures, stock market participants returned to the previous trend. They resumed selling treasuries, which push up the yield of these government securities, and buying company stocks on the wave of assessing their prospects. The dollar halted its slide, and the Forex market started to trade mixed. Thus, the ICE US dollar index has been consolidating around the 103.00 mark for the fifth day.

As expectations of an earlier start to cutting interest rates by the Fed wane, the dynamics of global markets return to uncertainty and high volatility.

Assessing all that is going on, we believe that the situation will persist until the end of this week.

Daily outlook:

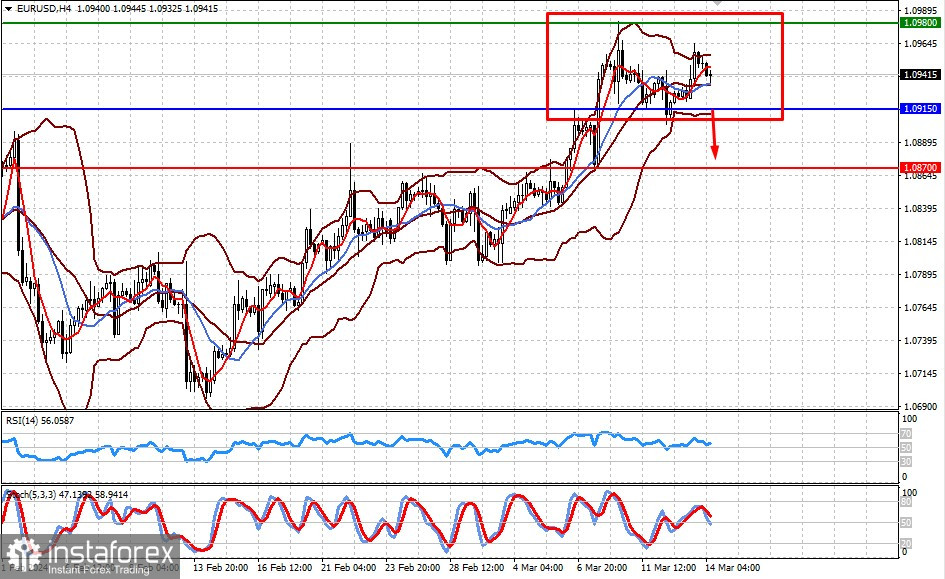

EUR/USD

The euro/dollar pair is trading in a sideways range amid uncertainty about the timing of a rate shift in the United States and possibly the euro area. However, the euro may lose value if today's data shows an increase in producer prices. Against this background, the euro/dollar pair could fall below the 1.0915 mark and head towards 1.0870.

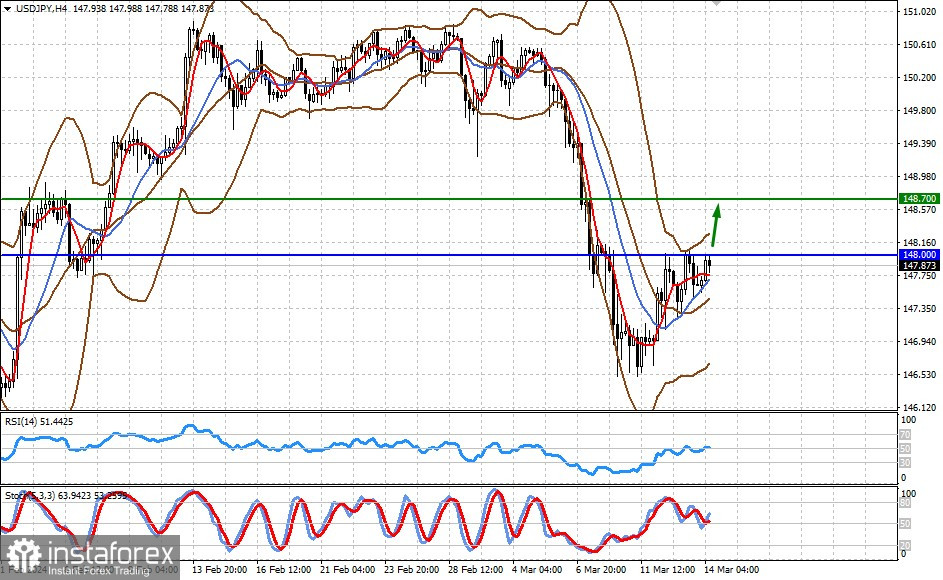

USD/JPY

The dollar/yen pair is drifting below the 148.00 mark. In case producer prices increase, the pair could rise above this mark and extend gains to the level of 148.70.