Reports released separately revealed that producer prices have surged, nearly doubling economists' predictions, and the count of initial jobless claims fell below expectations. Coupled with recent data showing a quicker pace in the rise of core consumer prices in the US last month, the reasons behind the dollar's appreciation become clearer.

The robust data on inflation and employment bolster the stance of policymakers who argue that further progress towards their objectives is necessary before lowering borrowing costs. With a commitment to both price stability and maximizing employment, Fed officials are likely to maintain the current rate levels unchanged for the fifth straight session in their upcoming meeting.

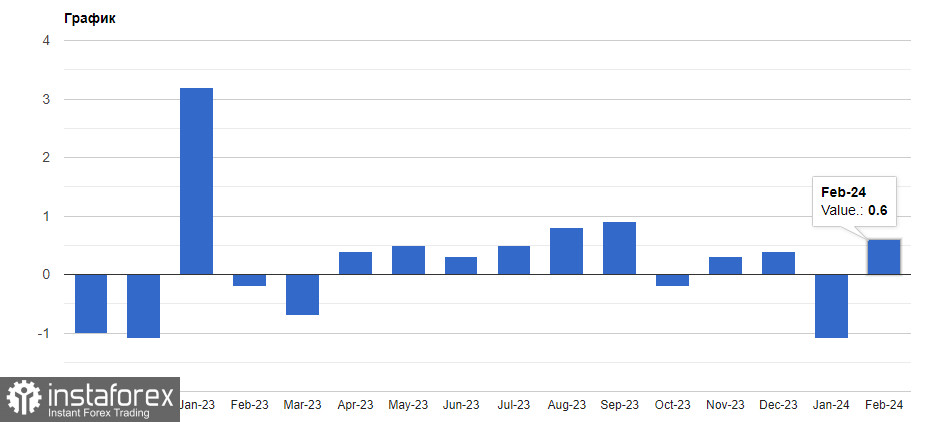

Even though inflation has seen a general decline over the last year, primarily attributed to lower commodity and energy prices, the latest figures on consumer and producer prices suggest that this trend might be stalling or even reversing. Notably, a spike in electricity costs has significantly influenced the surge in both consumer and producer price indexes.

Given the labor market's resilience, it is probable that the Fed will maintain elevated interest rates for a longer period than initially anticipated.

The increase in retail sales for February, albeit lower than what economists projected, indicates that consumer spending isn't decelerating as much as some had forecasted. While it may not reach last year's levels, it's still expected to considerably affect pricing.

The report also highlighted that sales within the so-called control group, which are crucial for calculating the GDP, remained steady in February after a drop the previous month. This group excludes sales from several sectors, including food services and car dealerships, hinting at a potential slowdown in economic activity in Q1.

As previously mentioned, this scenario has negatively impacted risk assets, leading to their notable devaluation against the US dollar.

Focusing on the euro/dollar pair's technical outlook, there's been a marked decline in demand for the euro. To reverse this trend, buyers must aim to recapture the 1.0900 mark, setting the stage for potential tests of 1.0930 and possibly 1.0965. However, reaching these targets without significant backing will be difficult, with 1.1000 being the ultimate goal. Should the currency pair drop to the 1.0870 range, a strong response from key buyers is anticipated. Absent such support, a new low at 1.0840 might be expected, or long positions could be considered at 1.0800.

As for the pound/dollar pair, for the upward trend to continue, bulls must overcome the immediate resistance at 1.2755, paving the way for targets at 1.2790 and beyond, though breaking through these levels will prove challenging. The next target is the 1.2820 area, beyond which a significant upward trajectory of the pound to 1.2855 could become a topic of discussion. If the currency pair sees a downturn, bears will likely aim for control over the 1.2715 level, which, if breached, could severely undermine the bulls' standing and drive the pair towards a low of 1.2690, with a potential further slide to 1.2660.