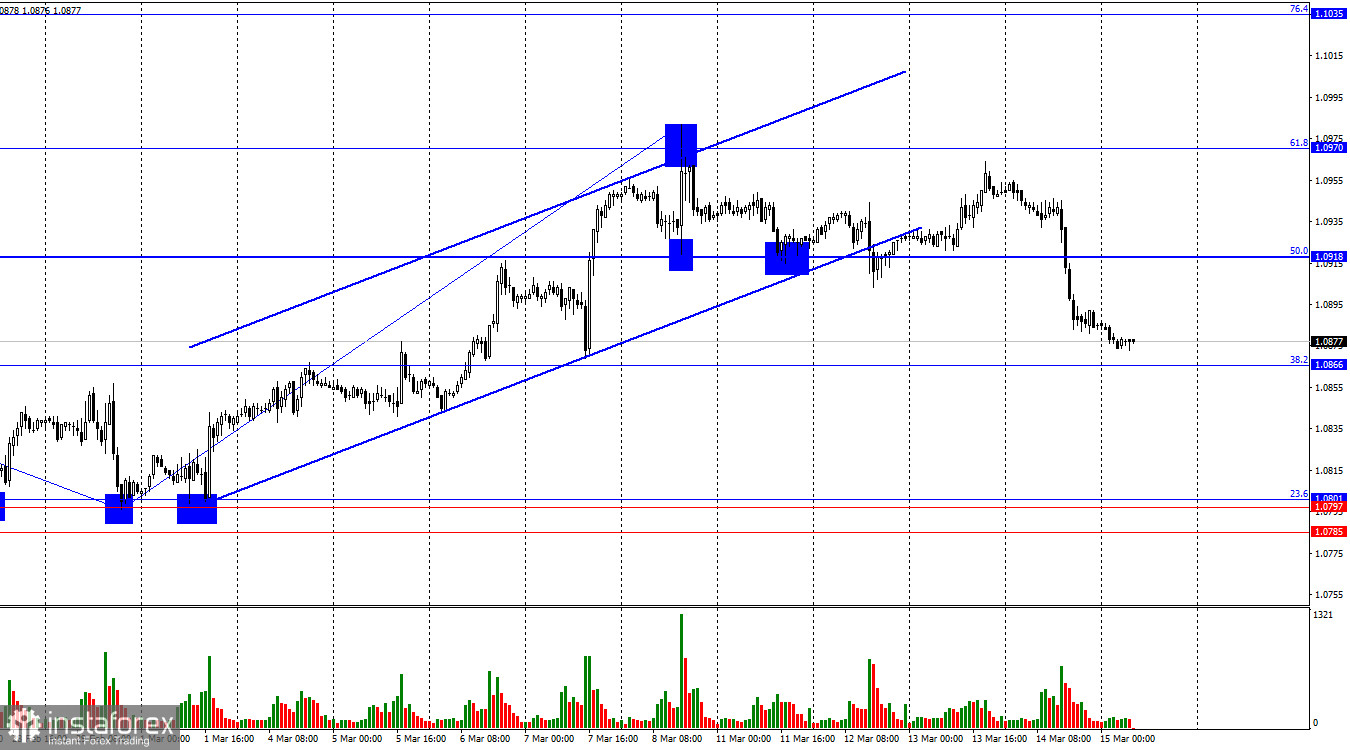

The EUR/USD pair made a new reversal in favor of the American currency on Thursday and resumed its downward movement after closing below the ascending trend channel. Thus, the decline in quotes may continue down to the Fibonacci level of 38.2%–1.0866. A rebound of the pair's rate from this level will benefit the European currency and may lead to some growth towards the corrective level of 50.0%–1.0918. Consolidation of quotes below 1.0866 will increase the pair's chances of further decline towards the next corrective level of 23.6%–1.0801.

The wave situation remains quite clear. The last completed upward wave confidently broke the peak of the previous wave (from February 22). Thus, we currently have a "bullish" trend, and there are no signs of its completion. Currently, a new downward wave is beginning to form but to determine a shift in sentiment to "bearish," a breakthrough of zone 1.0785–1.0801 is required. Until this moment, we observe only a corrective wave, after which the "bullish" trend may resume. The waves are currently quite large, but daily trader activity is not at its highest level. I believe that the support zone of 1.0785–1.0801 is a good target for traders.

The news background on Thursday was interesting. We learned that retail sales volumes in the US turned out to be slightly below market expectations, but at the same time, the Producer Price Index surged by 0.6% in February, which does not bode well for the US economy as inflation may continue to rise, as it did in February. However, such a value is positive for the American currency, as the Fed may now adhere to a hawkish policy longer than traders expect. At the same time, the ECB may start easing monetary policy as early as June.

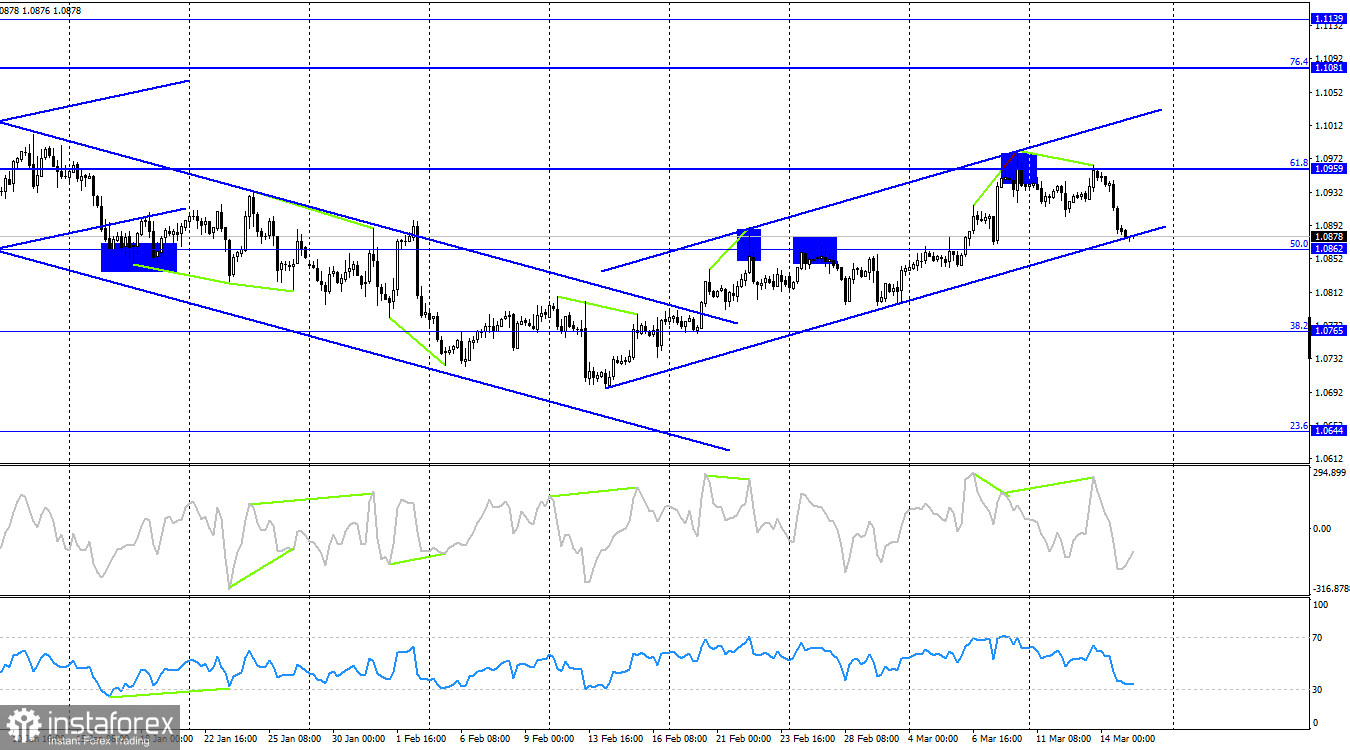

On the 4-hour chart, the pair declined to the lower line of the ascending trend channel after a double rebound from the corrective level of 61.8%–1.0959 and the formation of a "bearish" divergence on the CCI indicator. A rebound of quotes from this line will lead to a resumption of growth back to the level of 1.0959. Consolidation of the pair's rate below the channel will increase the probability of further decline towards the Fibonacci level of 38.2%–1.0765. The "bullish" sentiment of traders is still preserved.

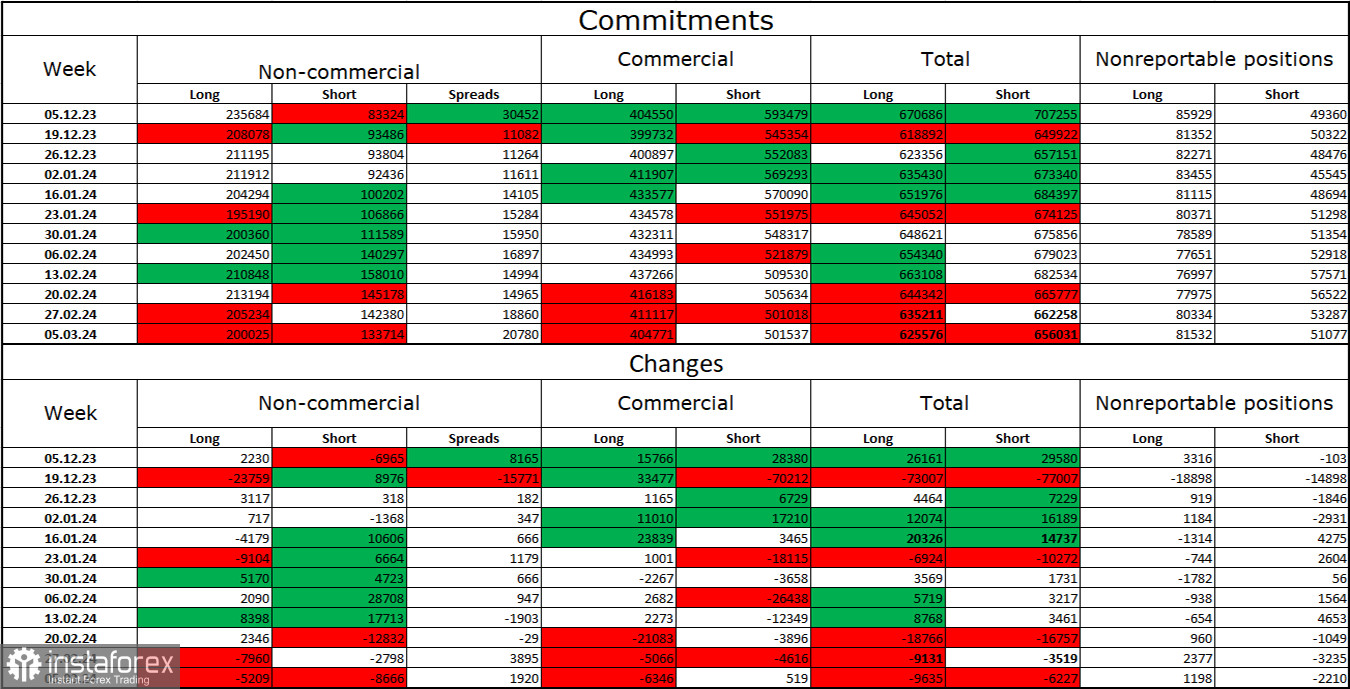

Commitments of Traders (COT) report:

During the last reporting week, speculators closed 5209 long contracts and 8666 short contracts. The sentiment of the "non-commercial" group remains "bullish" but continues to weaken. The total number of long contracts held by speculators now stands at 200 thousand, while short contracts amount to 133 thousand. I still believe that the situation will continue to change in favor of bears. Bulls have dominated the market for too long, and now they need a strong news background to maintain the "bullish" trend. I don't see such a background at the moment. At the same time, the total number of open long positions is less than the number of short positions (625K versus 656K). However, this balance of power has been observed for quite some time.

News Calendar for the US and the Eurozone:

US – Industrial Production Change (15:15 UTC).

US – University of Michigan Consumer Sentiment Index (16:00 UTC).

On March 15, the economic events calendar contains two equally important entries in the US. The impact of the news background on trader sentiment today may be moderate in strength.

Forecast for EUR/USD and trader recommendations:

Sales of the pair were possible upon a rebound from the level of 1.0959 on the 4-hour chart, with targets at 1.0918 and 1.0866. The first target has been hit, and the second one may be hit today. New sales are possible upon closing below the level of 1.0866 with a target of 1.0801. Buying the pair is possible upon a rebound from the level of 1.0866 on the hourly chart with targets at 1.0918 and 1.0959. Or upon a rebound from the lower line of the channel on the 4-hour chart.