The Federal Reserve meeting, and that's all that needs to be said. The US central bank meeting has been, is, and will be the key event for the dollar and the entire currency market. Of course, not every Fed meeting leads to changes in monetary policy that the market simply cannot ignore. However, every meeting is an opportunity to see and hear important information that will determine the dollar's fate for the next few weeks.

I would like to remind you that the US currency has not been in demand on the market for quite some time. If the US dollar is somewhat rising against the euro, then we haven't seen it rise when it comes to the GBP/USD for half a year now. The latest inflation report showed that prices in America have accelerated again, and the 2% target remains at the same distance as it was half a year ago. Accordingly, the Fed may only maintain a hawkish stance following the March meeting.

A firm hawkish stance will support the greenback. The market expected a much faster rate cut cycle but did not get it. And with such inflation figures, it won't get it anytime soon. The Bank of England is not in a rush to lower rates as well, but the market did not expect it to immediately lower rates anyway. The question lies precisely with the Fed, which may transition to a more accommodative policy much later than the market expects. If there are no dovish signals from Fed Chair Jerome Powell, I will expect the dollar to strengthen.

Also, in the US, business activity indices in the manufacturing and services sectors will be released. All three indices (including the composite) are likely to remain above the 50.0 mark, but all three may slightly fall. I don't think the market will focus on these reports on Thursday. We have the UK inflation report on Wednesday afternoon, the FOMC meeting in the evening, and on Thursday afternoon, the Bank of England meeting will be the highlight. Market participants will have more important data to react to in the first place.

Although I expect the dollar to strengthen, there's still a good chance that the BoE, the Fed, and inflation may surprise us. Therefore, it would be wise not to blindly sell both instruments, ignoring official data.

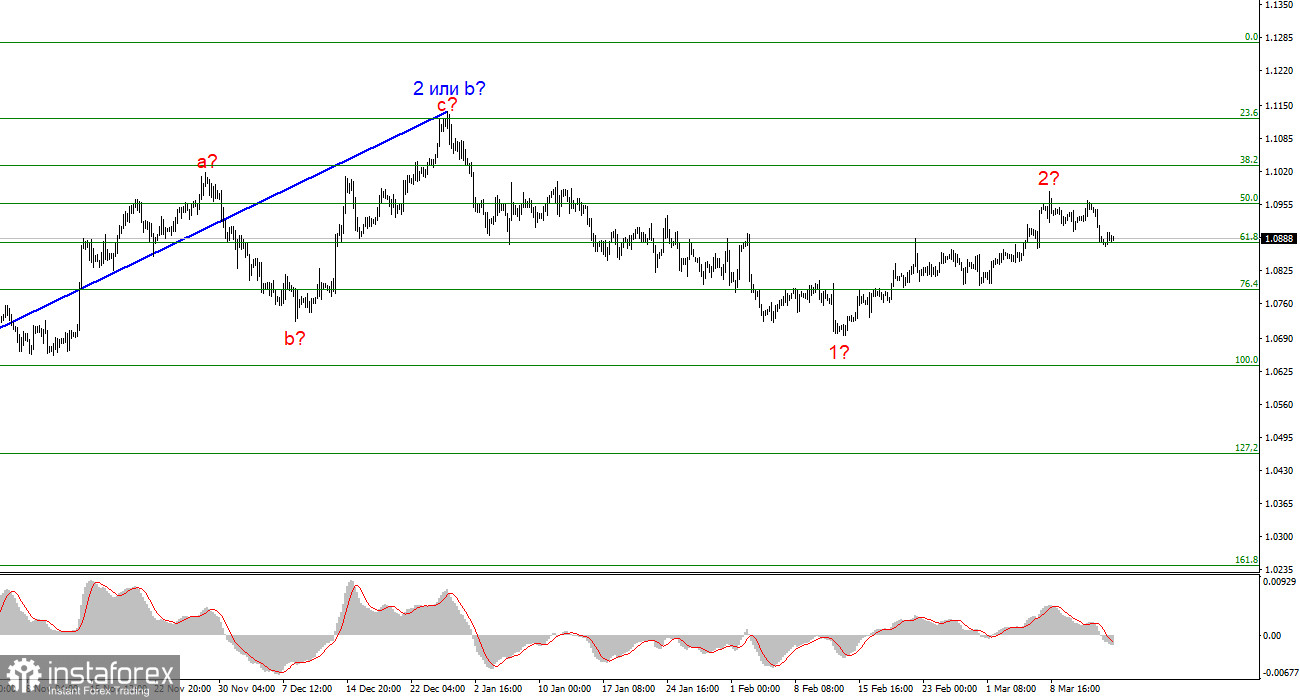

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Wave 2 or b is complete, so in the near future, I expect an impulsive downward wave 3 or c to form with a significant decline in the instrument. An internal corrective wave is currently being formed, which could have already ended. I am considering short positions with targets around the level of 1.0462, which corresponds to 127.2% according to Fibonacci.

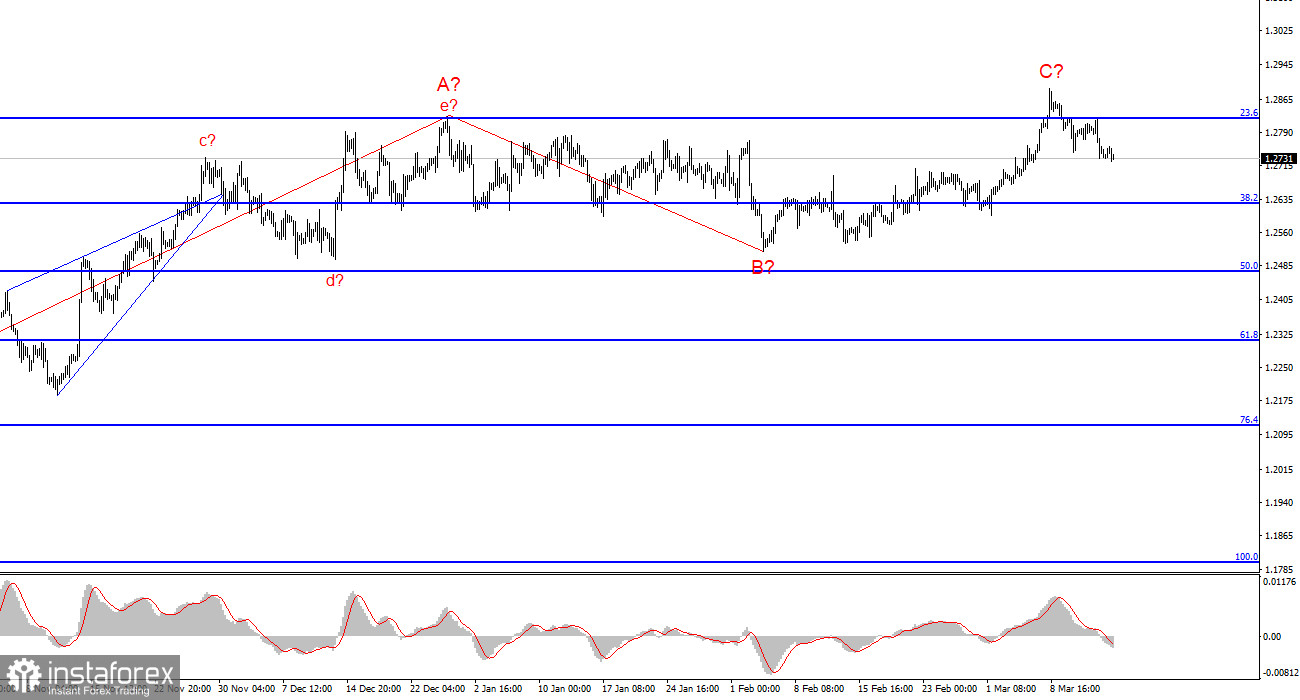

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c will start sooner or later. However, unless wave 2 or b ends, the instrument can still rise to the level of 1.3140, which corresponds to 100.0% according to Fibonacci. A successful attempt to break through the level of 1.2877, which is equivalent to 76.4% Fibonacci retracement, will indicate that the market is ready to increase the demand for the instrument. However, at this time it is futile, so the construction of wave 3 or c may have already started.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.