In January, industrial production dropped sharply by 3.2% in the euro area, while production fell 6.7% year-on-year, with both indicators significantly worse than forecasts. Europe's largest economy may have already slid into a recession, with industrial production falling by more than 5%. Germany's decline is pulling down the entire euro area, meaning that if it previously pulled the bloc upwards, now its the opposite.

The euro area economy, which was booming on stable, and most importantly, cheap supplies of energy resources from Russia, is now dealing with a situation that has become too much to handle. The ban on imports of high value-added goods to Russia undermined exports, and restrictions on purchases of Russian raw materials led to a noticeable decrease in production profitability, as compensating for the lost volumes of energy resources had to be done at significantly higher prices.

In fact, it is the deindustrialization of Germany, as German companies are starting to relocate against the backdrop of rising gas prices in the US and China. Germany's chemical industry has lost about a quarter of its production volumes over the past two years, while other industries that relied on access to cheap energy resources - such as steelmaking, mechanical engineering, etc. - are experiencing immense difficulties, and the process of closure or relocation of production is gaining momentum.

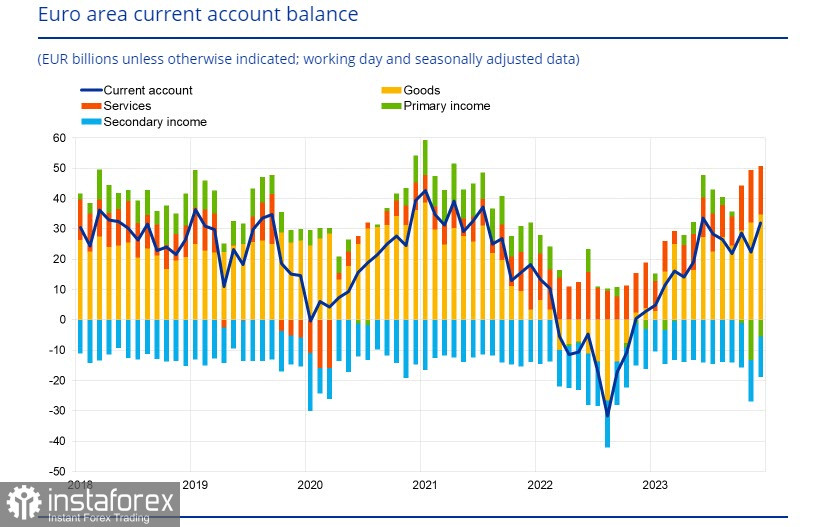

For now, the euro looks convincing, as its quotes depend on profitability rather than the state of affairs in the economy, but the economic crisis will inevitably have its impact on the direction of financial flows. In 2023, the current account surplus hit €260 billion or 1.8% of euro area GDP in 2023, shifting from the €82 billion deficit in 2022.

At the same time, non-residents disinvested €208 billion in net terms from euro area assets in 2023, while euro area residents recorded net acquisitions of non-euro area assets amounting to €159 billion in 2023. If the European Central Bank starts to lower rates, which is necessary to support the European industry, the yield on eurozone country bonds will go down, leading to a change in financial flows that will not work in favor of the euro. Recession in the industrial sector dictates that this is necessary, which mounts pressure on the euro; however, in the short term, there are no reasons to be alarmed yet, and the euro benefits from favorable market conditions.

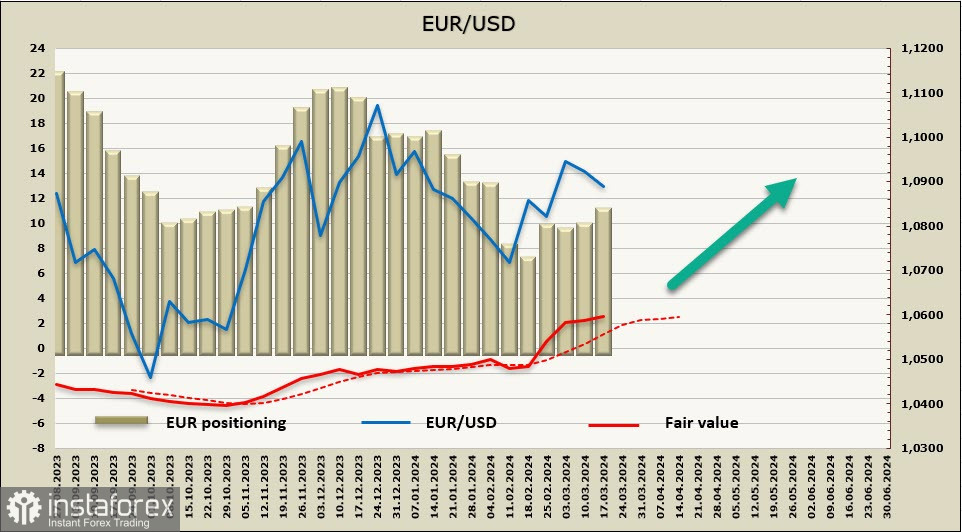

Positioning on the euro continues to improve, with the net long position growing by 1.1 billion to 10.2 billion. Speculators are reacting to the increasing probability of a recession in the US amid signs of rising inflation, which influences rate expectations. The price is above the long-term average and is headed upwards, but the momentum is quite weak.

Last week, the euro corrected to the support zone of 1.0890/0900, and we anticipated this possibility, with a high chance that the pair will rise again. We expect an attempt to break above the local high of 1.0982 and a test of the psychological level of 1.1000, with the long-term target still at 1.1140, but in order to guarantee that rise, the market must be able to confirm the fundamental changes in the US economy.