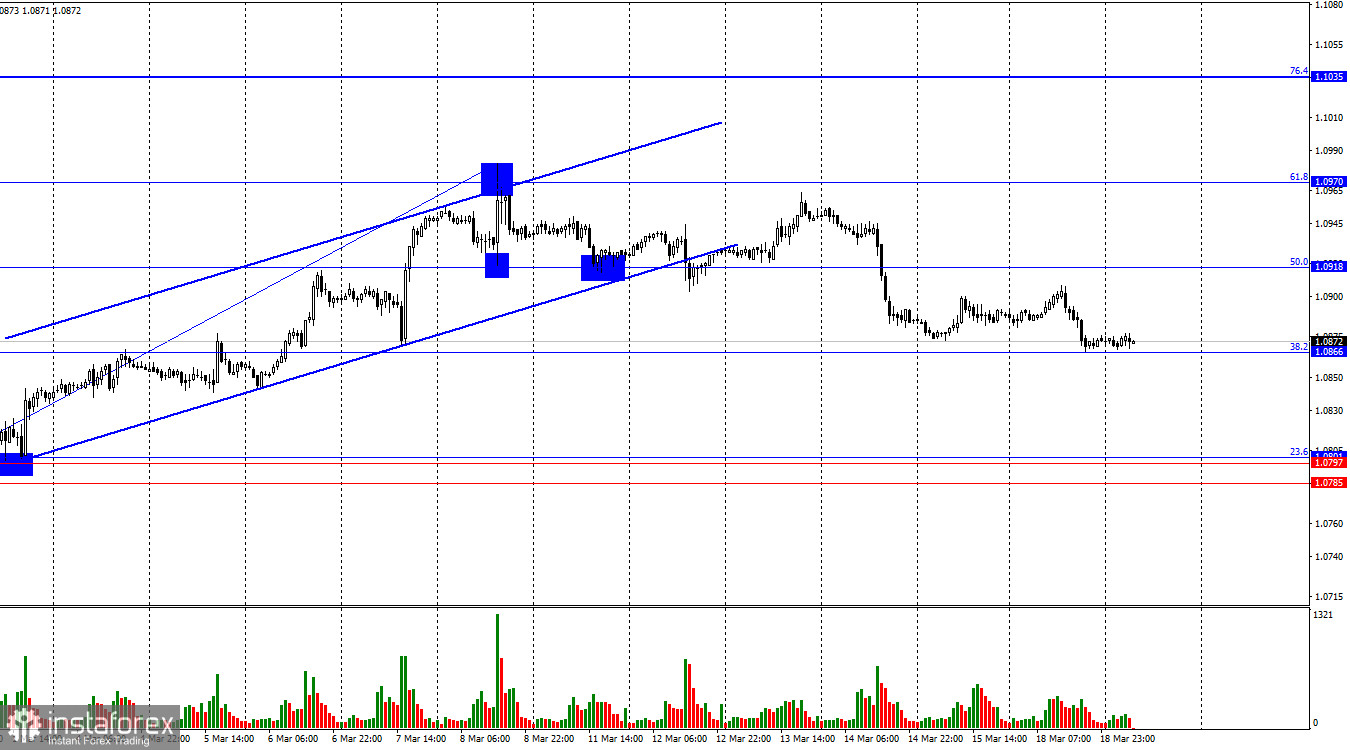

The EUR/USD pair continued its slow decline towards the corrective level of 38.2% (1.0866) on Monday. A rebound of quotes from this level will work in favor of the European currency and lead to some growth towards the Fibonacci level of 50.0% (1.0918). Consolidation of the pair's rate below the level of 1.0866 will increase the probability of further decline towards the Fibonacci level of 23.6% (1.0801). Traders' sentiment is currently characterized as "bearish" after consolidating below the upward trend channel.

The wave situation remains quite clear. The last completed upward wave confidently surpassed the peak of the previous wave (from February 22). Thus, we currently have a "bullish" trend and no signs of its completion. At the moment, a new downward wave is beginning to form but to determine a change in sentiment to "bearish," a breakthrough of zone 1.0785–1.0801 is required. Alternatively, a new upward wave should not surpass the peak from March 8. Until this moment, we observe only a corrective wave, after which the "bullish" trend may resume. The waves are currently quite large, but daily trading activity is low.

The background information on Monday was very weak. One inflation report in the European Union, the second estimate of which matched the first. In the second half of the day, bears became more active, but their activity was still very low. Tomorrow evening, the results of the FOMC meeting will be known, so traders are not rushing to open trading deals ahead of this important event. There is a high probability that the Fed will maintain a "hawkish" stance on monetary policy, allowing bears to launch new attacks after a month-long hiatus. I believe that the dollar has a good chance to break through the level of 1.0866 and continue rising.

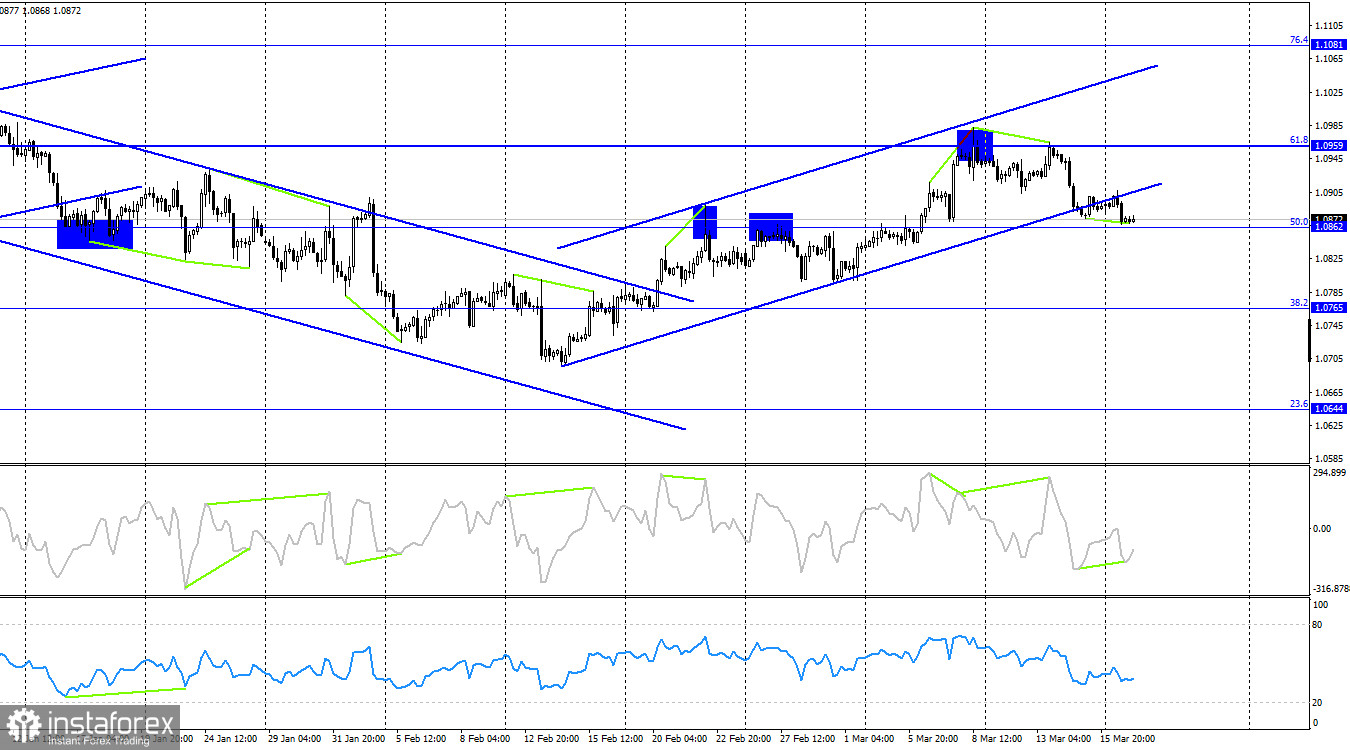

On the 4-hour chart, the pair experienced a decline to the lower line of the upward trend channel and consolidated below it. Thus, the process of quote decline may continue towards the Fibonacci level of 38.2%–1.0765 if a close below the corrective level of 50.0% (1.0862) is achieved. The imminent "bullish" divergence on the CCI indicator is unlikely to stop the bears. Traders' sentiment has changed to "bearish" after exiting the corridor.

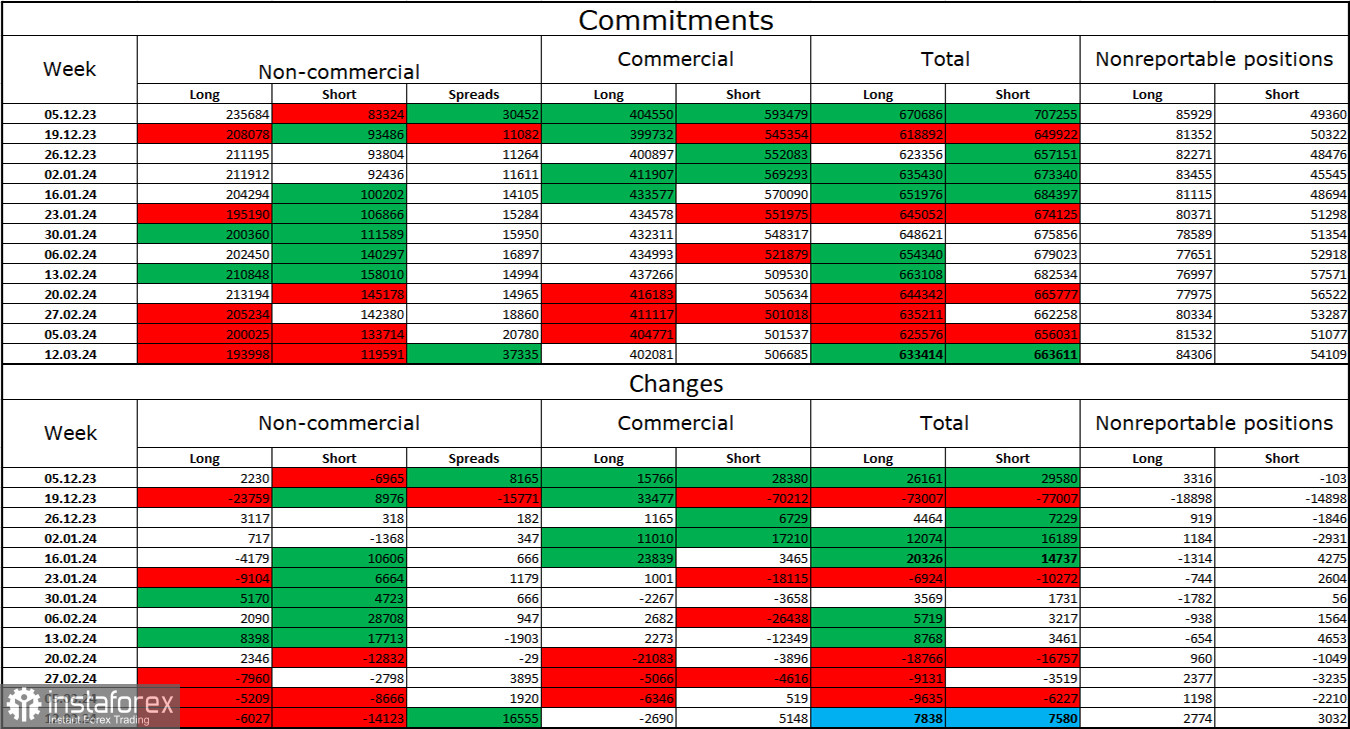

Commitments of Traders (COT) report:

During the last reporting week, speculators closed 3,027 long contracts and 14,123 short contracts. The sentiment of the "non-commercial" group remains "bullish" but continues to weaken. The total number of long contracts held by speculators now stands at 194,000, and short contracts - 119,000. I still believe that the situation will continue to favor bears. In the second column, we can see that the number of short positions increased from 83,000 to 119,000 over the past 2.5 months. During the same period, the number of long positions decreased from 235,000 to 194,000. Bulls have dominated the market for too long, and now they need a strong information background to maintain the "bullish" trend. I don't see such a perspective soon.

News calendar for the US and the European Union:

European Union - Ifo Business Climate Index in Germany (10:00 UTC).

European Union - Economic Sentiment Index (10:00 UTC).

US - Building Permits (12:30 UTC).

On March 19, the economic events calendar contains several entries, none of which are significant. The impact of the information background on traders' sentiment today may be weak.

Forecast for EUR/USD and trader advice:

Selling the pair was possible upon a rebound from the level of 1.0959 on the 4-hour chart, with targets at 1.0918 and 1.0866. Both targets have been reached. New sales are possible upon closing below the level of 1.0866 on the hourly chart, with a target of 1.0801. Buying the pair is possible upon a rebound from the level of 1.0866 on the hourly chart, with targets at 1.0918 and 1.0959.