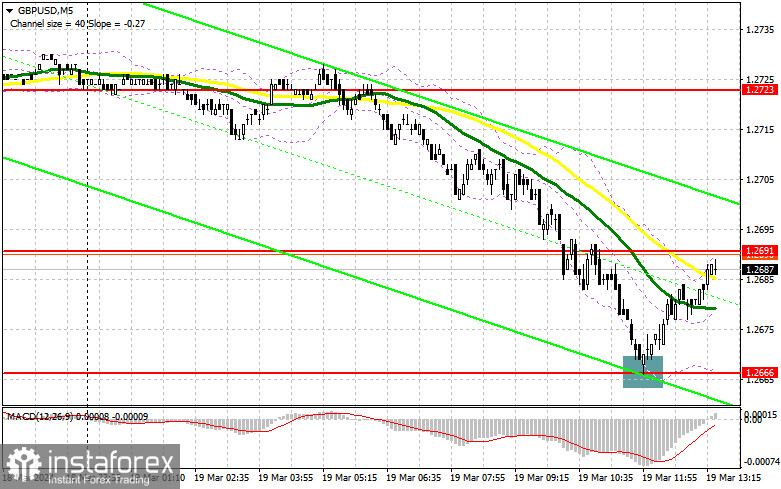

In my morning forecast, I paid attention to the 1.2666 level and planned to make decisions on entering the market from it. Let's look at the 5-minute chart and figure out what happened there. The decline and the formation of a false breakdown there led to an excellent entry point for the purchase, which resulted in an increase in the pair by almost 30 points. In the afternoon, the technical picture was revised.

To open long positions on GBP/USD, you need:

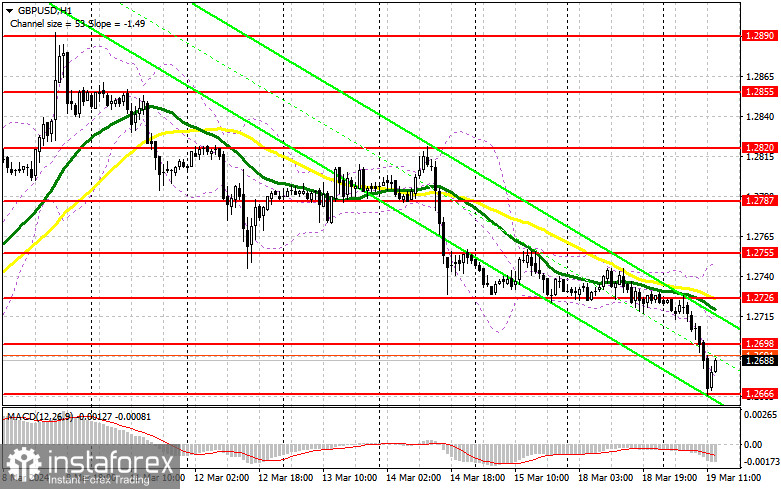

Given the lack of statistics on the UK, the pound continued to decline as part of a new trend. Figures are expected ahead in terms of the volume of construction permits issued and the number of new foundations laid in the United States. Real estate market data is very important and strong discrepancies with expectations can affect the foreign exchange market, and good data will certainly increase pressure on the GBP/USD pair, which I'm going to take advantage of. The formation of a false breakdown in the area of the nearest support of 1.2666, by analogy with what I discussed above, will give a suitable entry point into long positions based on the return of demand for the pound with the prospect of updating 1.2698 – a new resistance formed at the end of the first half of the day. A breakout and consolidation above this range will strengthen the position of the bulls and open the way to 1.2726, where the moving averages are playing on the side of the bears. The farthest goal will be a maximum of 1.2755, where I'm going to fix the profit. In the scenario of a decline in the pair and a lack of activity on the part of the bulls at 1.2666, and all this will be possible in the case of strong US data, the pair will continue its decline. In this case, only a false breakout in the area of the next support at 1.2636 will confirm the correct entry point into the market. I plan to buy GBP/USD immediately for a rebound from the 1.2600 minimum in order to correct by 30-35 points within the day.

To open short positions on GBP/USD, you need:

Bears control the market. In case of weak data, a false breakdown in the area of the new resistance of 1.2698 will confirm the correct entry point for sale in the continuation of the trend, which will lead to a downward movement to the area of 1.2666 – the support tested today during the European session, so it is quite difficult to count on active bull actions there. A breakout and a reverse test from the bottom up of this range will deal the mother-in-law one blow to the positions of buyers, leading to the demolition of stop orders and opening the way to 1.2636. The farthest target will be the 1.2600 area, where profits will be fixed. With the option of GBP/USD growth and lack of activity at 1.2698 in the afternoon, buyers will have a chance to compensate for the morning drop. In this case, I will postpone sales until a false breakdown at the level of 1.2726, where the moving averages are located. In the absence of a downward movement there, I will sell GBP/USD immediately for a rebound immediately from 1.2755, but only counting on a correction of the pair down by 30-35 points within the day.

Indicator signals:

Moving Averages

Trading is conducted below the 30 and 50-day moving averages, indicating further decline of the pair.

Note: The period and prices of moving averages considered by the author are on the hourly chart H1 and differ from the general definition of classic daily moving averages on the daily chart D1.

Bollinger Bands

In case of decline, the lower boundary of the indicator around 1.2670 will serve as support.

Description of Indicators:

- Moving average (determines the current trend by smoothing out volatility and noise). Period 50. Marked in yellow on the chart.

- Moving average (determines the current trend by smoothing out volatility and noise). Period 30. Marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence). Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands. Period 20.

- Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between the short and long positions of non-commercial traders.