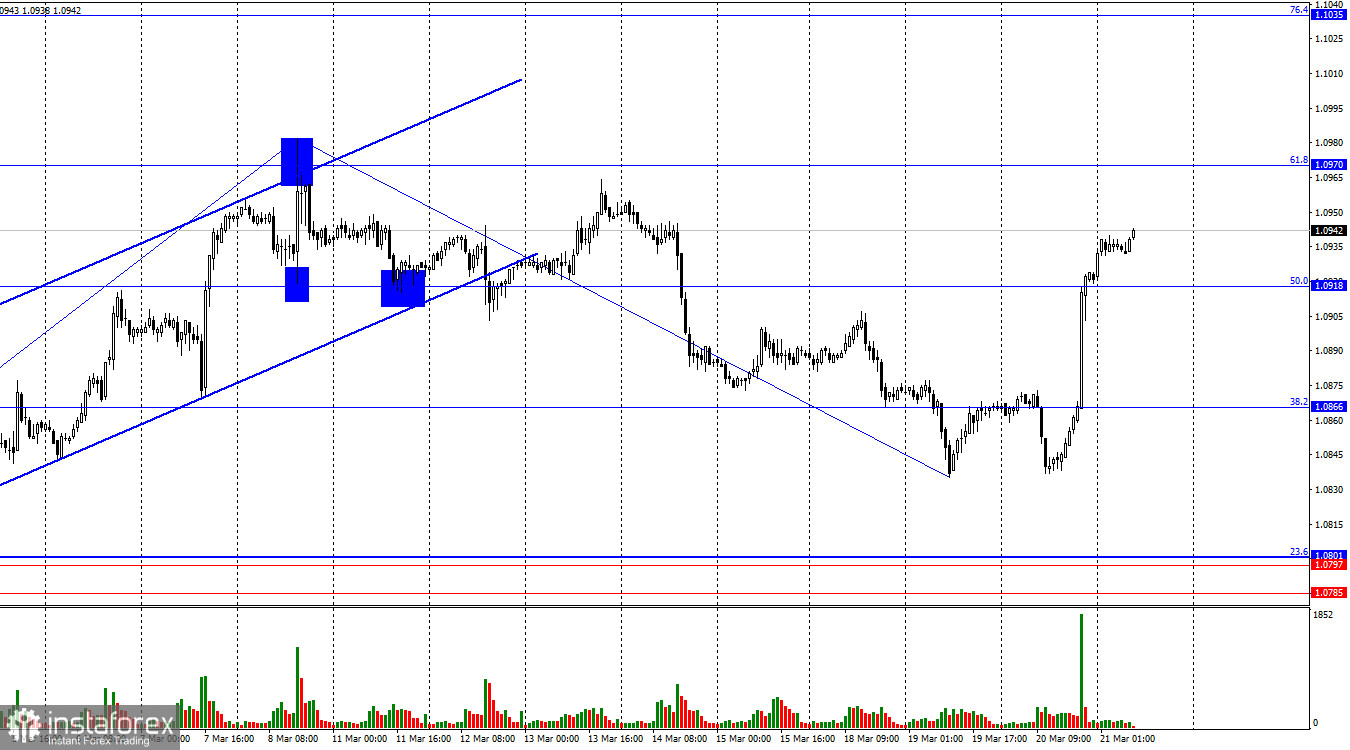

Hi, dear traders! On Wednesday, the EUR/USD pair made a reversal in favor of the European currency and consolidated above the correction levels of 38.2% and 50.0%. Thus, the instrument may extend its growth in the direction of the next Fibonacci level of 61.8% at 1.0970. However, in my opinion, the growth of the European currency this time will not last long. Already today, if the price settles below 1.0918, this will work in favor of the US dollar. So, EUR/USD will resume its fall in the direction of 1.0866 and 1.0801.

The situation with the waves remains quite clear. The last completed upward wave confidently broke through the peak of the previous wave from February 22. The last completed downward wave failed to break through the low of the previous wave from February 29. Therefore, at this time, EUR/USD has been following a bullish trend and there is not a single wave sign of its completion. A new upward wave has shown up. In order to determine the change in sentiment to bearish, it must be weaker than the previous wave (it must not break through the peak of March 8). I am counting on this scenario.

The information background on Wednesday was very strong. First, Christine Lagarde gave a speech. Later during the New York session, traders found out the outcome of the Fed's policy meeting. Lagarde said she expects inflation to ebb away further which will allow the ECB to consider easing monetary policy in early summer. Jerome Powell, in turn, announced that the current rate would remain at the same elevated level. Besides, the Federal Reserve maintained interest rate forecasts for 2024. Inflation forecasts for the current and next years were only slightly upgraded. To sum up, I would define the results of the Fed meeting as neutral, but traders seemed to be anticipating something more. Perhaps they thought the latest inflation report would prompt more hawkish messaging from Jerome Powell. In practice, the Fed Chairman did not sound too hawkish which was incredibly disappointing. But I don't think the US dollar will extend weakness now.

On the 4-hour chart, EUR/USD made a reversal in favor of the euro currency. The price began growing towards the Fibonacci correction level of 61.8% at 1.0959. A bearish divergence is already brewing at the CCI indicator, which allows us to foresee a new bearish sequence after consolidating under the ascending trend channel. A rebound in the price from 1.0959 will also work in favor of the US currency. Only a consolidation above 1.0959 will ruin the bears' hopes and allow the bulls to push the price in the direction of the next Fibonacci level of 76.4% at 1.1081.

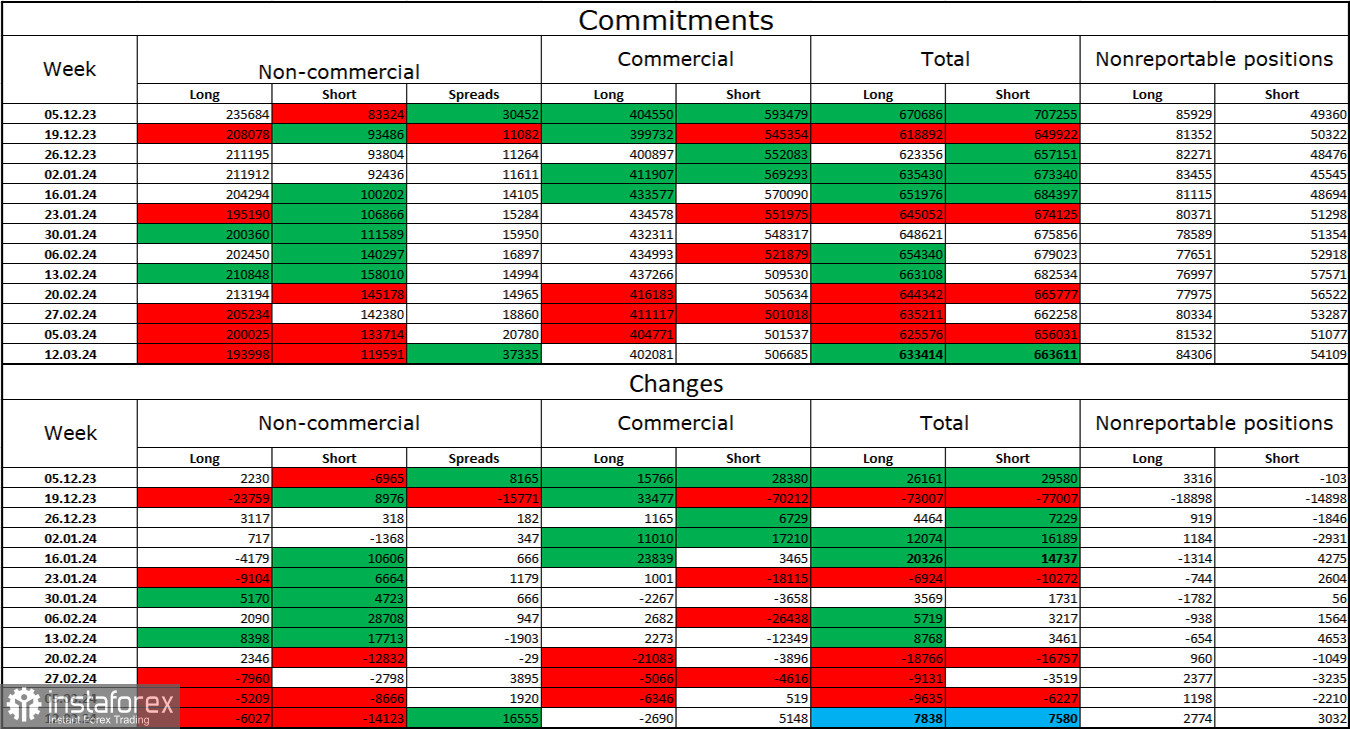

Commitments of Traders report (COT):

In the last reporting week, speculators closed 3,027 long contracts and 14,123 short contracts. The Non-commercial group's sentiment remains bullish but continues to weaken. The total number of long contracts is now 194K, and short contracts – 119K. I still believe that the situation will continue to change in favor of the bears. In the second column, we see that the number of short positions has increased from 83K to 119K over the past 2.5 months. Over the same period, the number of long positions decreased from 235K to 194K. The bulls have dominated the market for too long, and now they need a strong information background to maintain the bullish trend. I don't see that happening in the near future.

Economic calendar for US and EU

EU: Germany's manufacturing PMI due at 08-30 UTC

EU: Germany's services PMI due at 08-30 UTC

EU: manufacturing PMI due at 08-30 UTC

EU: services PMI due at 08-30 UTC

US: initial unemployment claims due at 12:30 UTC

US: S&P Global manufacturing PMI due at 13:45 UTC

US: S&P Global services PMI due at 13:45 UTC

US: existing home sales due at 14:00 UTC

The economic calendar contains a lot of reports both for the US and the EU. The information background is likely to exert a strong influence over market sentiment.

Intraday outlook and trading tips

We may sell EUR/USD today if the price rebounds from 1.0959 on the 4-hour chart with targets at 1.0918 and 1.0866. You can also go short when the instrument closes below 1.0918 on the 1-hour chart with targets at 1.0866 and 1.0801. Long positions are relevant if EUR/USD consolidates above 1.0866 on the 1-hour chart with targets at 1.0918 and 1.0959. The first target has been already accomplished. I think that long positions can be closed.