The dollar sharply weakened and continued its decline today after the Federal Reserve meeting concluded last Wednesday. Its outcomes indicated that the Fed officials seem inclined towards a rate cut. As expected, they kept the interest rate at 5.50% but also signaled the possibility of transitioning to a more accommodative policy, despite the need to wait for confirmation of inflation decline.

The latest FOMC forecast summary showed that its officials still anticipate three rate cuts in 2024.

Fed Chairman Jerome Powell noted that despite the rise in inflation figures in February, they did not affect the overall trend of its weakening. At the same time, despite the dovish tone of the statements, expectations regarding a rate cut at the June FOMC meeting also diminished. Additionally, markets now anticipate three rate cuts in 2025 instead of the previously expected four.

In short, the dollar weakened following this meeting, and many economists believe this is just the beginning of its more significant depreciation.

In the first half of today's trading day, the DXY index is near the 103.24 mark, up 37 points from today's low of 102.83. Meanwhile, the yield on 10-year U.S. Treasury bonds decreased to 4.226%, and major U.S. stock indices are updating record highs today, benefiting from the dollar weakness and the dovish rhetoric of the Fed statements.

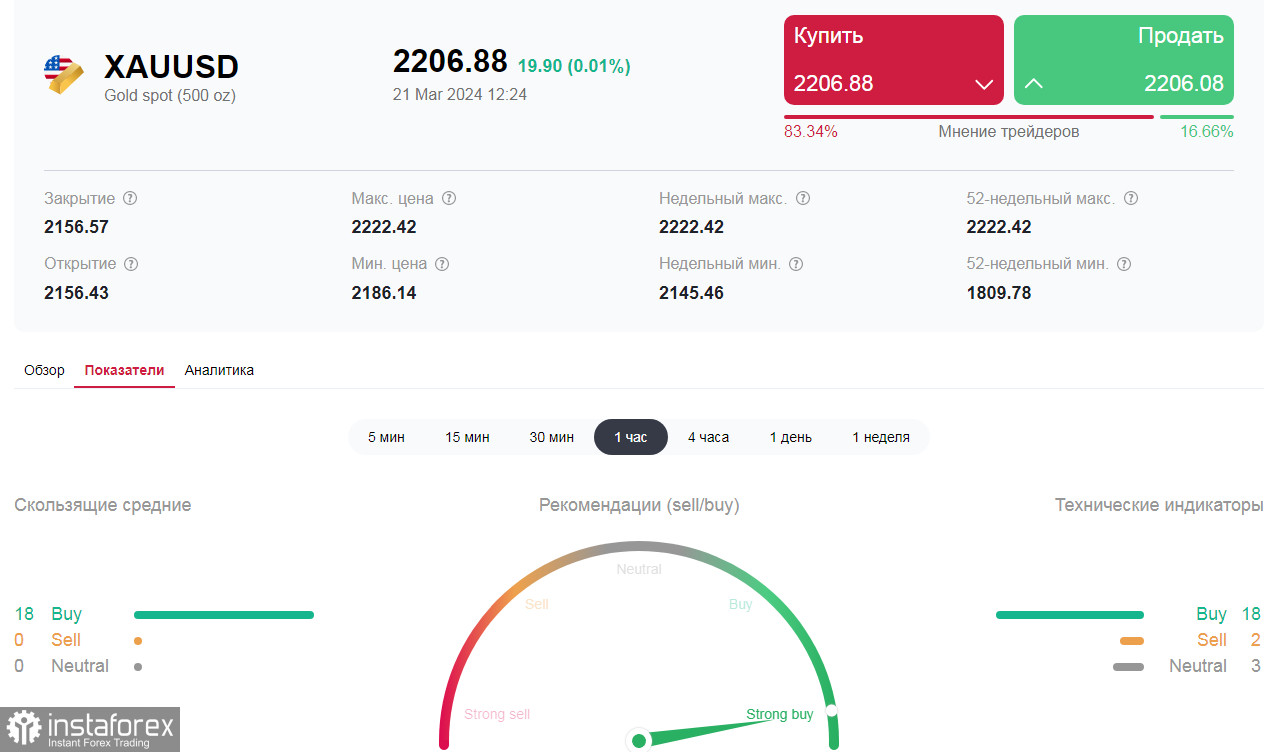

Notably, gold prices reached record highs today above the $2,220 per ounce mark.

The recent record price increase, with XAU/USD rising by 6.0% over a few trading days, caught many gold market analysts and experts by surprise. However, as we can see, the price of this precious metal shows no signs of decline.

The dovish stance of the Fed and other major central banks, market nervousness amid geopolitical tensions worldwide, and the upcoming U.S. presidential elections are prompting investors to increase their long positions in gold, seeking refuge from potential shocks.

Despite economists and gold market analysts considering the price increase to have gone too far, expecting any significant correction in the current situation is not likely. Moreover, further growth is not ruled out until the price "touches" new resistance levels.

Today, volatility in dollar quotes, and consequently in the XAU/USD pair, could increase again at 13:45 (GMT) when the U.S. business activity indices are published. Forecasts suggest a slowdown in manufacturing PMI in March from 52.2 to 51.7, and in services PMI from 52.3 to 52.0.

Most likely, the dollar will react to them with a decline. However, if the indicators fall below the 50 mark, which separates activity growth from slowdown, then a more significant dollar decline and a new impulse in the rise of XAU/USD should be expected.