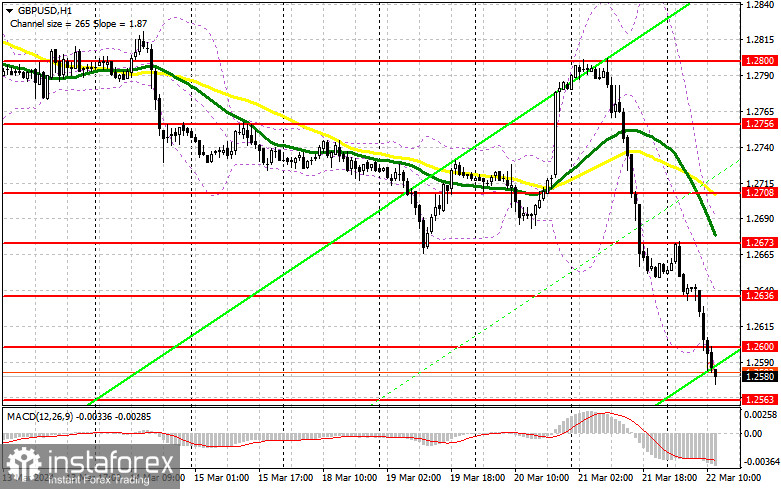

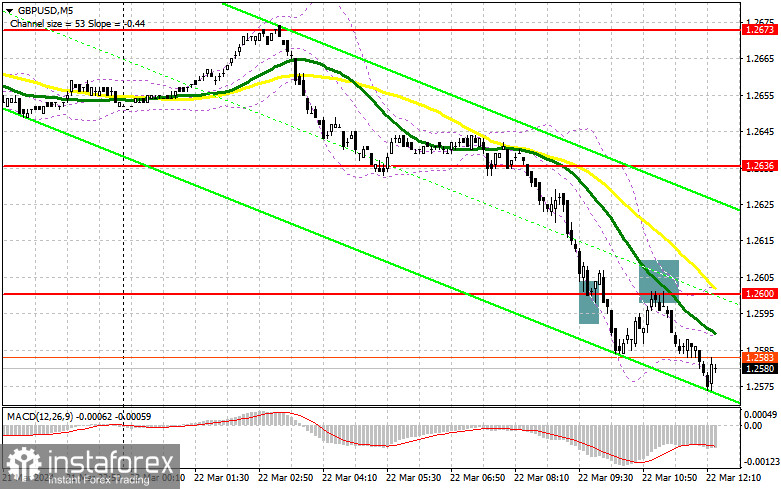

In my morning forecast, I paid attention to the 1.2600 level and planned to make decisions on entering the market from it. Let's look at the 5-minute chart and figure out what happened there. The decline and the formation of a false breakdown there led to the formation of an entry point for the purchase, but it never reached a major increase. The breakthrough and the reverse test of this range allowed us to enter the market in short positions, which resulted in a drop of more than 40 points. In the afternoon, the technical picture was revised.

To open long positions on GBP/USD, it is required:

There are no statistics in the afternoon, so there will still be chances of a slight correction at the end of the week, but I would not count on it much. In the event of a further decline in the pair, only the formation of a false breakdown in the area of the nearest support of 1.2563, by analogy with what I discussed above, will give a suitable entry point into long positions based on the return of demand for the pound with the prospect of updating 1.2600 – a new resistance formed following the results of the first half of the day. A breakout and consolidation above this range will strengthen the position of the bulls and open the way to 1.2636. The farthest goal will be a maximum of 1.2673, where I'm going to fix the profit. In the scenario of a decline in the pair and a lack of activity on the part of the bulls at 1.2563, sellers will continue to control the market. In this case, only a false breakout in the area of the next support at 1.2535 will confirm the correct entry point into the market. I plan to buy GBP/USD immediately for a rebound from the minimum of 1.2507 in order to correct 30-35 points within the day.

To open short positions on GBP/USD, you need:

Bears control the market. In the case of an attempt to grow the pair, only a false breakdown in the area of the new resistance of 1.2600 will confirm the correct entry point for sale in the continuation of the trend, which will lead to a downward movement to the area of 1.2563 – support, which plays a fairly important role in the current trend. A breakout and a reverse test from the bottom up of this range will deal the mother-in-law one blow to the positions of buyers, leading to the demolition of stop orders and opening the way to 1.2535. The farthest target will be the area of 1.2507, where profits will be fixed. With the option of GBP/USD growth and lack of activity at 1.2600 in the afternoon, buyers will have a chance to build an upward correction at the end of the week. In this case, I will postpone sales until a false breakdown at 1.2636. In the absence of a downward movement there, I will sell GBP/USD immediately for a rebound immediately from 1.2673, but only counting on a correction of the pair down by 30-35 points within the day.

In the COT report (Commitment of Traders) for March 12, there was an increase in long and short positions. Despite expectations that rates in the UK may be lowered even if inflation does not reach the target of 2.0%, demand for the British pound continues to be observed. The current correction for the pair is entirely due to the sharp demand for the US dollar throughout the market, which is due to the release of inflation data in the United States last week. Rising prices for the third month in a row will certainly force the Federal Reserve to stick to a tough policy for as long as possible, which is what the market is reacting to now. The latest COT report says that long non-profit positions increased by 21,006 to the level of 123,285, while short non-profit positions jumped by 8,940 to the level of 52,834. As a result, the spread between long and short positions increased by 4,760.

Indicator signals:

Moving averages

Trading is conducted below the 30 and 50-day moving averages, indicating further decline in the pair.

Note: The period and prices of moving averages considered by the author are on the hourly chart H1 and differ from the general definition of classical daily moving averages on the daily chart D1.

Bollinger Bands

In case of decline, the lower boundary of the indicator, around 1.2580, will act as support.

Description of indicators:

• Moving average (determines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

• Moving average (determines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

• MACD indicator (Moving Average Convergence/Divergence). Fast EMA period 12. Slow EMA period 26. SMA period 9.

• Bollinger Bands. Period 20.

• Non-commercial traders - speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between the short and long positions of non-commercial traders.