Thursday marked the end of the second Bank of England meeting in 2024. As many analysts and economists have already pointed out, the results of this meeting are more likely dovish than hawkish or neutral. The main points that economists are paying attention to include the words of the BoE governor regarding the possibility of rate cuts in 2024 (although this was already understood), as well as the fact that the number of members who are supporting a rate hike has decreased among the central bank.

The first event is important simply because BoE Governor Andrew Bailey had previously avoided discussing the possibility of easing monetary policy, constantly reminding the market of high inflation and the central bank's ongoing fight against it. However, the inflation report for February, which was presented this week, indicated that the time for discussing rate cuts is approaching. Inflation in the UK has already decreased to 3.4%, which is only slightly higher than in the US. Based on this, if consumer prices continue to slow down at the same pace, Bailey may finally announce that discussions on policy easing have begun.

The timing of the first rate cut in the UK will be influenced by the European Central Bank. Let me remind you that ECB President Christine Lagarde first mentioned the possible date of a rate cut about a month and a half ago. At that time, inflation in the EU had dropped below 3%, so we can consider the 3% mark as a threshold below which the central bank deems it appropriate to discuss easing. Considering the fact that in February, inflation decreased from 4% to 3.4%, a drop of 0.6% annually, the March report could push the value below 3%. This means that in the next meeting, Bailey's rhetoric may soften, and the number of committee members supporting a rate cut may increase from one to two or three.

In this case, demand for the pound may weaken further. Despite the market's reluctance to get rid of the pound, under the pressure of the news background, demand may start to decline. The wave pattern suggests downward movement, and the Federal Reserve may delay the first rate cut for a very long time, which will support demand for the US dollar. I believe that the current news background is favorable for further decline in the GBP/USD instrument.

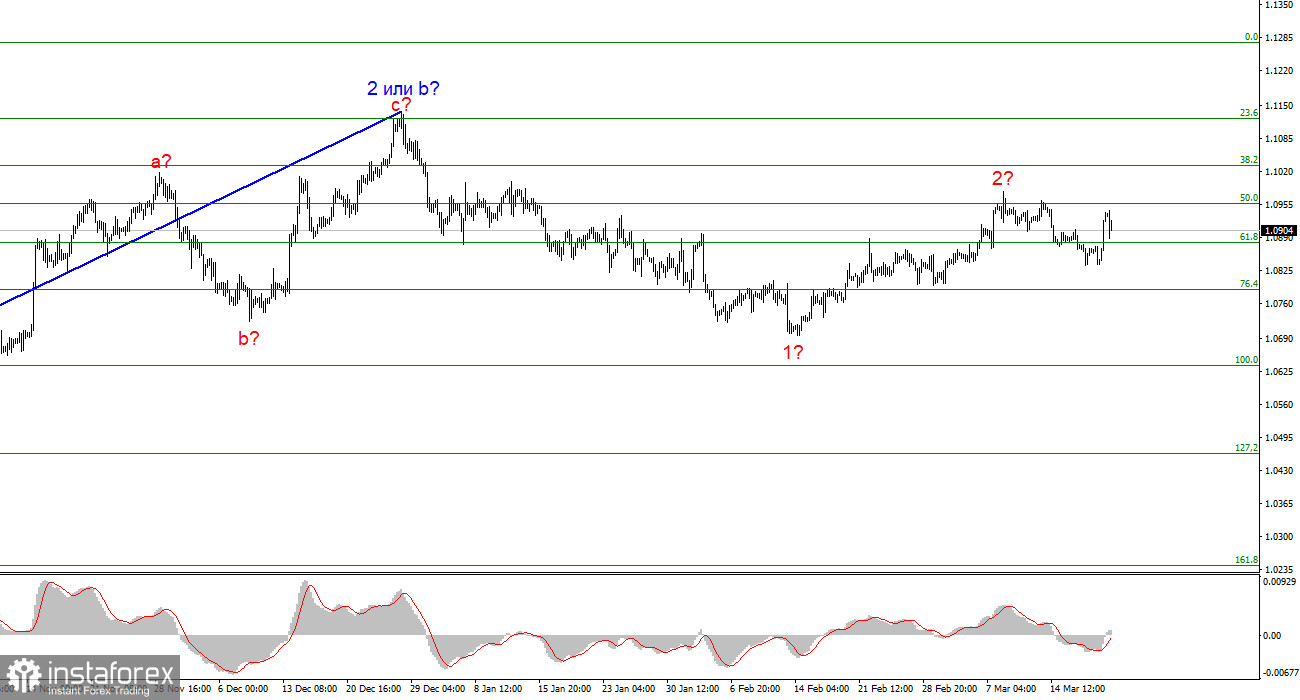

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Wave 2 or b is complete, so in the near future, I expect an impulsive downward wave 3 or c to form with a significant decline in the instrument. An internal corrective wave is currently being formed, which could have already ended. I am considering short positions with targets near the 1.0462 mark, which corresponds to 127.2% according to Fibonacci.

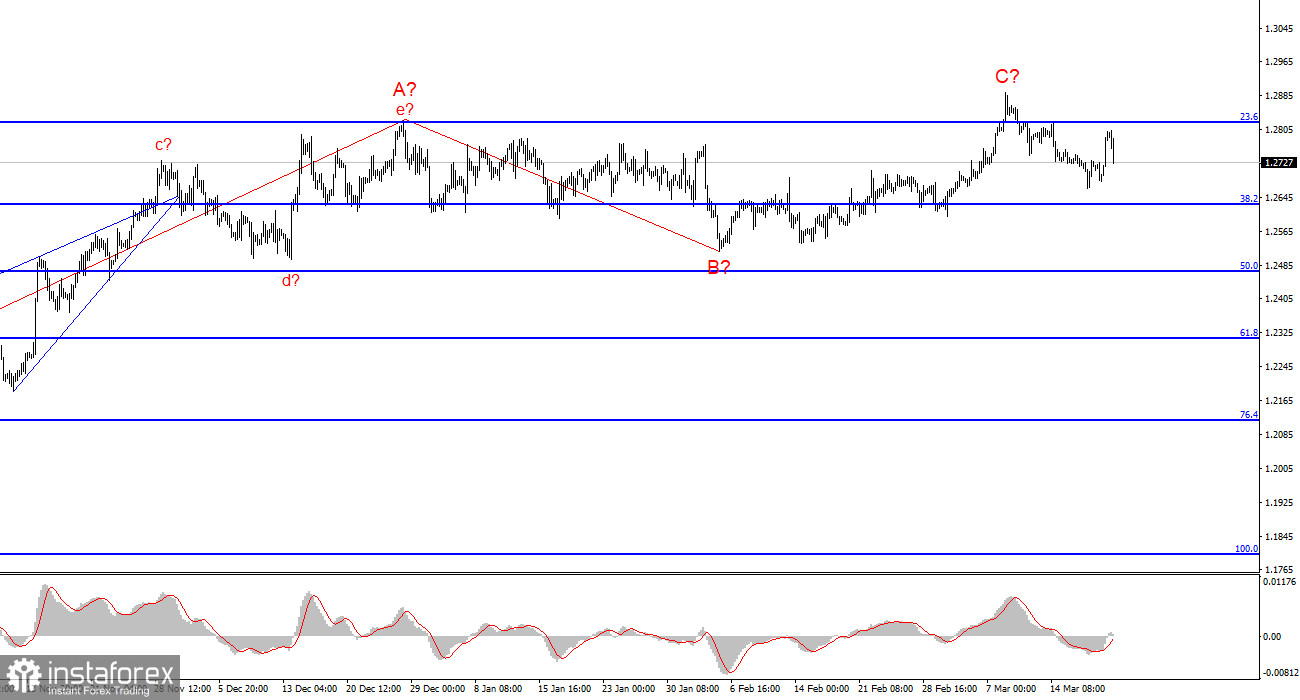

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c will start sooner or later. However, unless wave 2 or b ends, the instrument can still rise to the level of 1.3140, which corresponds to 100.0% Fibonacci. The construction of wave 3 or c may have already started, but the quotes haven't moved far away from the peaks, so we cannot confirm this. A breakthrough of 1.2715 will encourage those who are bearish.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.