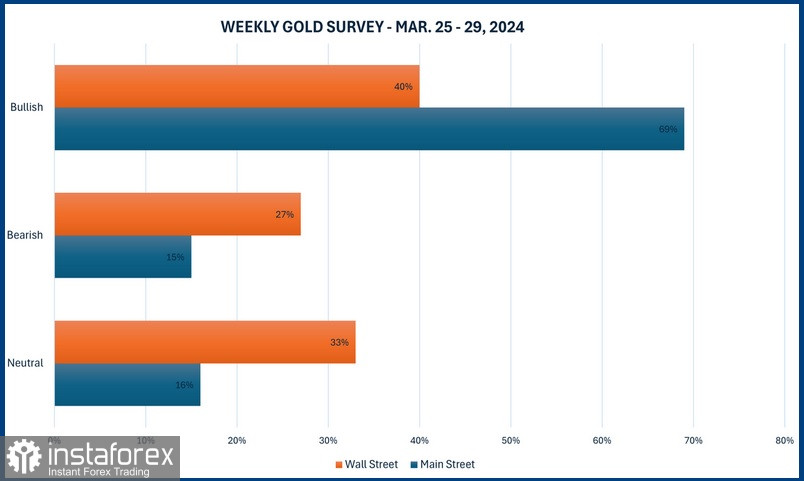

According to the latest weekly gold survey, it is evident that market experts are divided in their opinions, showing caution regarding price direction analysis. Meanwhile, investors have returned to the bullish trend.

Colin Cieszynski, Chief Market Strategist at SIA Wealth Management, remains neutral on gold this week due to the strengthening of the U.S. dollar, further compounded by month-end and a shortened trading week.

Darin Newsom, Senior Market Analyst at Barchart.com, maintains his downward bias for the third consecutive week. However, he expressed some doubts about it last Thursday.

Sean Lusk, co-director of commercial hedging at Walsh Trading, was surprised by Fed Chairman Jerome Powell's and the market's positive sentiments, and he doesn't believe the Fed will be able to cut rates by 75 basis points this year.

Mark Leibovit, publisher of the VR Metals/Resource Letter, asserts that the strengthening dollar will lead to a decline in gold, thus he anticipates a pullback.

15 Wall Street analysts participated in the gold survey, and their opinions were fairly evenly distributed. Six of them, or 40%, expect an increase in the price of the precious metal this week, while four analysts, or 27%, forecast a decline. Five, comprising 33%, anticipate sideways trading.

In an online poll, 170 votes were cast, with the vast majority of Main Street investors expecting further price increases. 117 retail investors, constituting 69%, expect the price to rise this week. Another 25, or 15%, predict a fall, and 28, or 16%, were neutral on the short-term prospects of the precious metal.

This week, data on new home sales will be published on Monday; durable goods data, consumer confidence index, and the Richmond Fed report on Tuesday; and MBA mortgage applications on Wednesday. Thursday will be the busiest day due to the long Easter weekend, when fourth-quarter GDP results, initial jobless claims, pending home sales, and the University of Michigan's consumer sentiment survey will be released.