On Tuesday, the GBP/USD currency pair continued to correct at a calm pace. The British currency has a short-term downward trend, but the technical picture is much more complicated than that of the EUR/USD. In the 24-hour timeframe, the price remains within a limited price range. It's not exactly a classic flat anymore, but it's still trading within a limited range. It was in the same range as 2-3 months ago when the pair was in a total flat. Therefore, the downward trend in the 4-hour timeframe is just a part of the movement within the flat on the daily chart. And that means it could end very quickly.

We still expect only declines in the British currency, even within the next downward movement inside the flat. The British currency has no reason to stay so high and expensive. Fundamental data in Great Britain was practically nonexistent for the first two days of the week. At least, we didn't see any significant reports. Nevertheless, a representative of the Bank of England's Monetary Policy Committee, Catherine Mann, made a rather interesting statement yesterday.

According to Ms. Mann, the market is pricing too much of a rate cut. She noted good inflation rate declines and observed that the market has somewhat lowered Bank of England rates without the Bank of England's knowledge. Mann also added that the size of the Federal Reserve and ECB rates influences the decisions of the British regulator.

We don't quite understand how exactly "the market is pricing in too sharp a rate cut." If the pound has been rising for half a year without any grounds for it, the market is not expecting any easing of the Bank of England's monetary policy. Or it is expecting, but much later than the Federal Reserve. Even now, when August can be considered a possible month for the first rate cut in Great Britain, the market continues to trade as if monetary policy easing concerns all banks except the Bank of England. And we'd like to remind you that inflation in Great Britain continues to decline, already standing at 3.4%, which is not much higher than in the USA. Thus, maybe the Federal Reserve is closer to the first step of policy easing, but it is approaching this step much faster than the Bank of England. The British regulator will be approaching the first easing step in another month or two.

Thus, the British pound should fall, not rise, against the US dollar, as the Federal Reserve's monetary policy may remain "hawkish" for longer. Based on this conclusion, we find Mann's words somewhat inconsistent with reality. In any case, whatever Ms. Mann says does not affect the overall conclusion about the pound. It still needs to be more expensive and overbought compared to the dollar. The macroeconomic background has long been worse in Great Britain than in the USA, so this source of support for the British currency is unnecessary. Just compare the GDP figures and the final estimates for the fourth quarter, which will be released this week, to understand which economy feels much better.

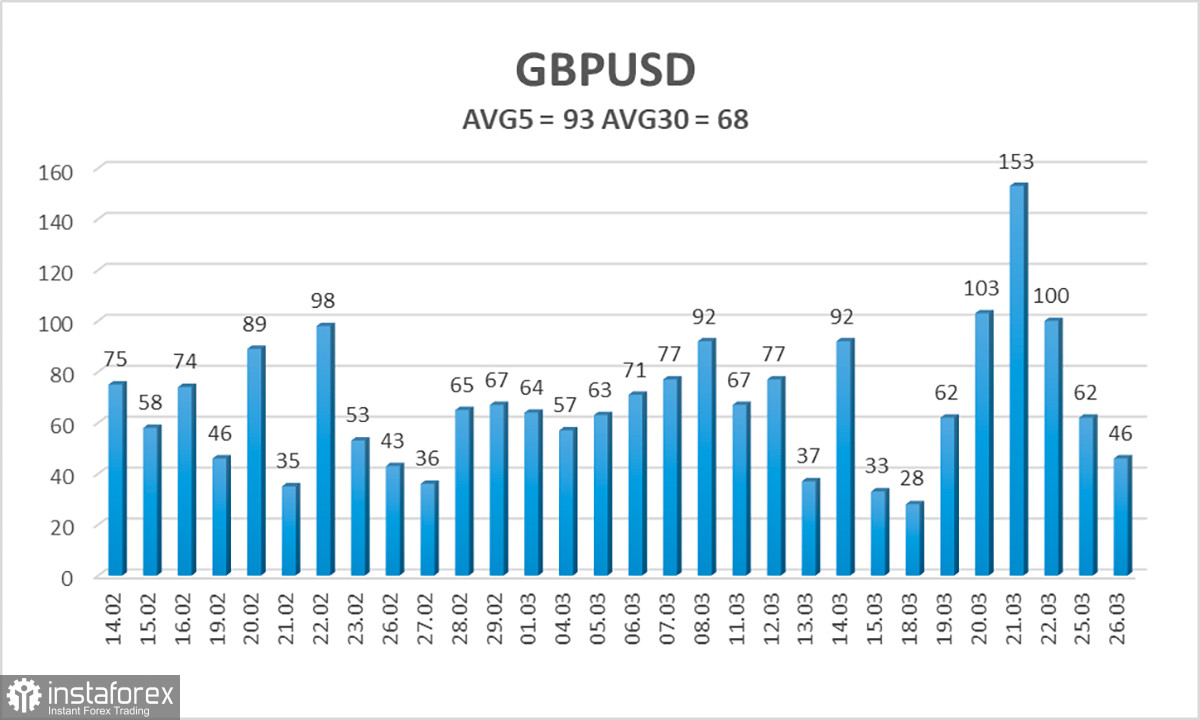

The average volatility of the GBP/USD pair over the last five trading days is 93 pips. For the pound/dollar pair, this value is "average." Therefore, on Wednesday, March 27, we expect movement within the range limited by the levels of 1.2536 and 1.2722. The senior linear regression channel is still sideways, so there are no questions about the current trend. The CCI indicator entered the oversold area last week, so a slight upward correction could be expected. The market is not trading too logically, but traders may expect a new significant downward movement.

Nearest support levels:

S1 – 1.2634

S2 – 1.2573

Nearest resistance levels:

R1 – 1.2695

R2 – 1.2756

R3 – 1.2817

Trading recommendations:

The GBP/USD currency pair has started forming a new downward movement. We still expect a move to the south, with targets at 1.2543 and 1.2512. The market still needs to work on buying the dollar and selling the pound, often ignoring fundamental and macroeconomic background. Long positions can be considered when the price is above the moving average. Still, such a direction of movement may be caused only by market makers' actions rather than common sense and logic.

Explanations for illustrations:

Linear regression channels – help to determine the current trend. If both are directed in the same direction, it means the trend is strong at the moment.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted.

Murray levels – target levels for movements and corrections.

Volatility levels (red lines) – the likely price channel the pair will spend the next day, based on current volatility indicators.

CCI indicator – its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal is approaching.