Monday, Tuesday, and Wednesday were only memorable for a few events. Although, to be more accurate, these days were not memorable for anything specific, but they could have been. Speeches by Christine Lagarde and Philip Lane did not provide any new information. Speeches by Madis Muller and Piero Cipollone only confirmed the European Central Bank's intentions to start the rate cut process in the foreseeable future, namely in June. Based on this, the news background did not affect the euro. Market participants pushed the pair a bit higher in the first half of the week, which is a typical corrective wave within a larger-scale wave.

In the UK, Catherine Mann, a member of the Bank of England's Monetary Policy Committee, spoke, but her comments did not yield any important information. Mann only said that the markets are pricing in 'too many' cuts, expecting the central bank to take active actions to lower the rate. Buyers could have used these words as a reason to open new long positions, but fortunately, it did not happen. I say "fortunately" because the corrective wave 2 or b on GBP/USD has become too complicated, and we certainly don't need a new extension. However, at the same time, sellers are still not in a rush to build wave 3 or c. The pound sterling remains in a suspended state, and the scales could tip in either direction.

In America, Raphael Bostic said that he expects just one rate cut in 2024, while Austan Goolsbee expects three. However, Goolsbee will not participate in the Federal Reserve's voting until the end of the year. Therefore, Bostic's opinion is more valuable. And his statement could have increased demand for the US dollar, but if it did, it was not significant. In addition, the US released a report on durable goods orders, the value of which turned out to be better than market expectations, but at the same time, the January value was revised downward.

For the last two days of the week, we have GDP reports for the fourth quarter in the UK and the US, as well as Fed Chair Jerome Powell's speech in the evening on Friday. In America, several minor reports will be released, which the market will likely ignore. Even GDP reports may be ignored, as the final estimates may coincide with the initial and revised ones. Based on all of the above, I expect the week to end as boringly as its first half.

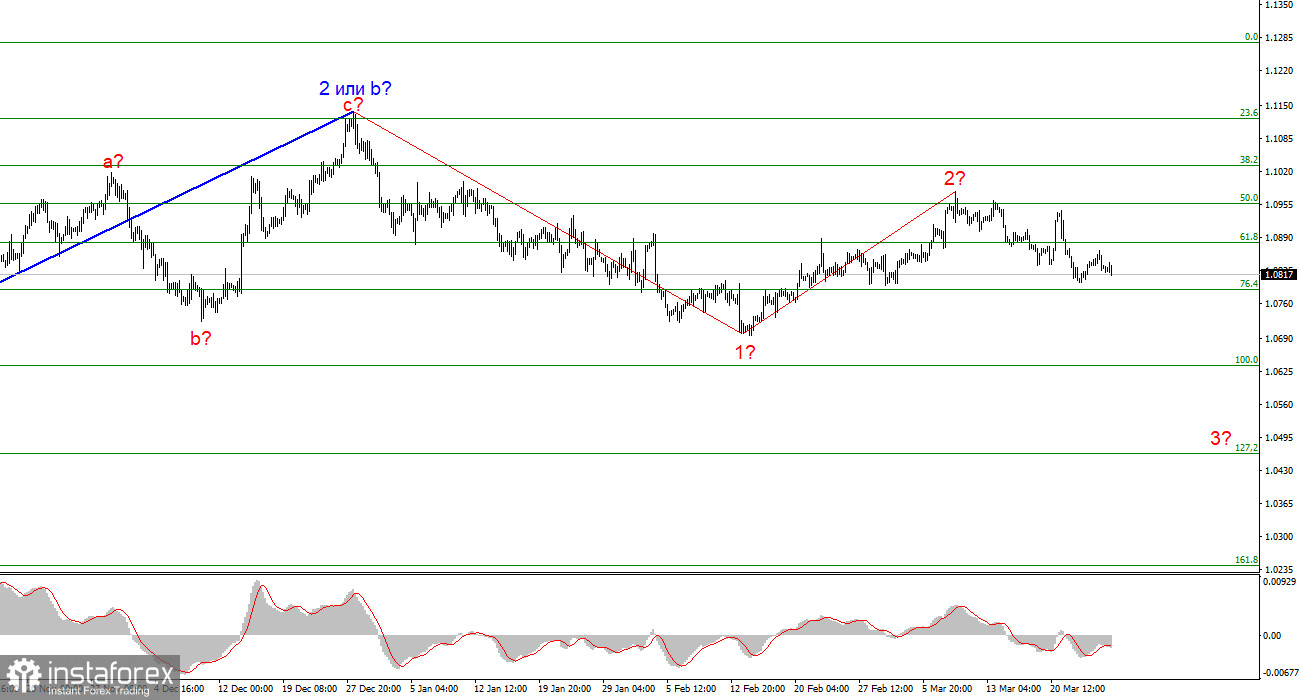

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Wave 2 or b is complete, so in the near future, I expect an impulsive downward wave 3 or c to form with a significant decline in the instrument. An internal corrective wave is currently being formed, which could have already ended. I am considering short positions with targets near the 1.0462 mark, which corresponds to 127.2% according to Fibonacci.

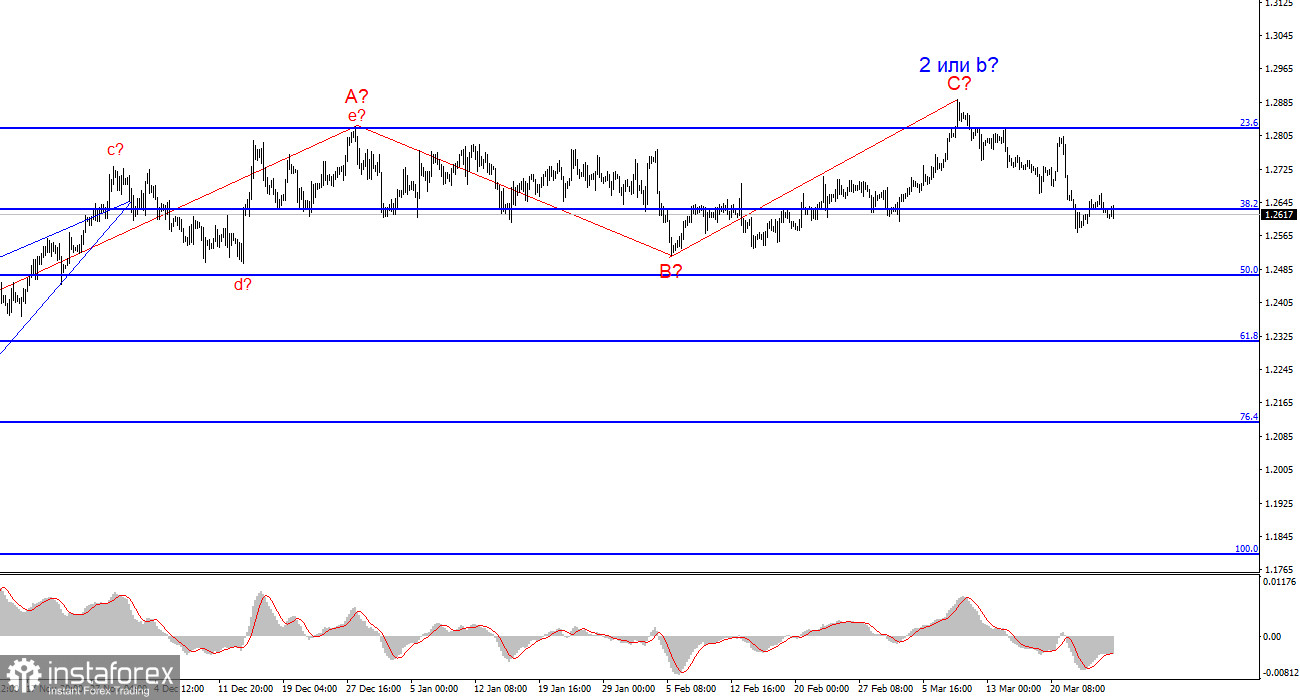

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c will start sooner or later. However, unless wave 2 or b ends, the instrument can still rise to the level of 1.3140, which corresponds to 100.0% Fibonacci. The construction of wave 3 or c may have already started, but the quotes haven't moved far away from the peaks, so we cannot confirm this.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.