Market participants continue to assess the prospects of the global economy as a whole and specific situations in individual countries, paying particular attention to the United States.

All major global stock indices ended the first quarter of this year with steady gains on expectations that the Fed would be the first to cut interest rates, followed by other global central banks.

But is this really the case?

The US regulator finds itself in a rather difficult situation. On one hand, the unique national economy cannot withstand a prolonged period of high interest rates and, in theory, they need to be lowered. On the other hand, the monetary model of a 2% inflation rate or around that mark does not allow the Fed to start cutting rates. That's why we observe regular promises from Fed Chair Jerome Powell to start cutting interest rates as soon as possible, yet the central bank does nothing.

What is the danger of a prolonged period of uncertainty in the Federal Reserve's actions?

Last week, Larry Fink, the co-founder of one of the largest investment companies, BlackRock, stated that the American economy is facing serious shocks, with the local financial market experiencing widespread problems. In his opinion, the uncontrolled US national debt could lead to another "lost decade." Currently, it amounts to over $34 trillion, which equals 124% of the national GDP. Fink believes that in this situation, it will be very difficult to combat inflation, so high interest rates will not only increase America's debt but also lead to the risk of being unable to service it. Essentially, he points out that the Fed's sole use of monetary measures will not help reduce inflation. If the regulator continues to just watch and do nothing, promising markets what it might not be able to do, this could result in a stock market crash and sell-offs in the government bond market. By the way, there are already concerns in the States about the endlessly inflating local stock market bubble.

Observing all that is unfolding, it's safe to say that the American economy indeed faces serious issues. We have pointed this out before. The complete absence of a real sector in the economy and the dominance of the financial or service sector lead to the destruction of the country's infrastructure, further confirming our thesis. Why would the country need repaired bridges and railways if there's practically nothing to transport? The manufacturing sector is very small and weak.

What threatens markets in the current situation in the United States?

We believe that unrestrained demand for company shares, which owners themselves actively purchase, artificially raising their value and capitalization, increases the risk of a total collapse in asset values, burying the financial market and investors buying shares at sky-high prices of shell firms, companies that produce nothing.

What awaits the dollar in such a situation?

Uncertainty around the Fed's monetary policy as well as other global central banks will continue to stimulate an overall sideways trend in the foreign exchange market that involves the dollar.

As for gold and other real assets such as oil, there are reasons to believe that demand for them will remain strong. The risks of a financial bubble in the US stock market, a number of conflicts around the world, serious contradictions within the United States amid presidential elections, and overall geopolitical tension will support demand for real assets, even though many investors continue to hope for the best, which is about to come.

Daily forecast:

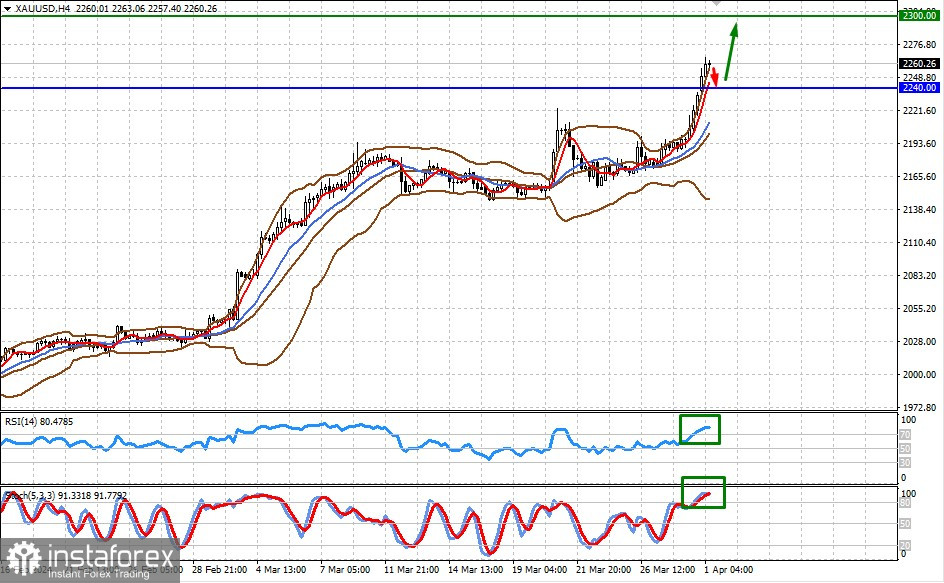

XAU/USD

Spot gold has reached our previous target level of 2,250.00. With local overbought conditions, the market may dip to 2,240.00 as part of a correction before resuming gains to the 2,300.00 mark.

WTI

The price of American crude oil has also reached the first target level of 83.50. There is a likelihood that the benchmark will correct to 82.85 but then bounce back to the level of 84.70.