To open long positions on EUR/USD, the following is required:

The complete absence of US statistics affected the pair's volatility at the beginning of the week, so it's evident that the bearish market remains, and buying actions must be approached cautiously. Ahead of us are data on the US Manufacturing Purchasing Managers' Index and the ISM Manufacturing Purchasing Managers' Index. Strong indicators that exceed economists' forecasts will undoubtedly support the dollar in the second half of the day, so I will act on the downside and form a false breakout near the support level of 1.0769. This will be the appropriate scenario for long positions, targeting a correction towards 1.0798, which acts as resistance. There, the moving averages are also aligned in favor of sellers. A breakthrough and renewed downward movement from this range will strengthen the pair with a chance to surge towards 1.0826. The ultimate target will be the high of 1.0863, where I will take profits. In the scenario of further EUR/USD decline and lack of activity around 1.0769 in the second half of the day, pressure on the euro will only intensify, leading to a further decline towards 1.0735. I plan to enter the market there only after the formation of a false breakout. I intend to open long positions immediately on a rebound from 1.0698 with a target of a 30-35 point upward correction intraday.

To open short positions on EUR/USD, the following is required:

Euro buyers failed to show anything significant in the first half of the day, and so far, there have been no significant attempts to regain control. In the event of an attempt to rise after weak US data, the formation of a false breakout around 1.0799 will demonstrate the presence of major sellers in the market and provide another entry point for short positions with the prospect of a new support level at 1.0769. A breakthrough and consolidation below this range and a reverse test from below will provide another selling opportunity with a pair slump towards 1.0735, where buyers will become more active. The ultimate target will be the low of 1.0698, where I will take profits. In the event of upward movement in EUR/USD in the second half of the day and the absence of bears at 1.0798, buyers will have a chance for a small upward correction early in the week. In this case, I will postpone selling until testing the next resistance at 1.0826. I will sell there as well, but only after an unsuccessful consolidation. I plan to open short positions immediately on a rebound from 1.0863 with a 30-35 point downward correction target.

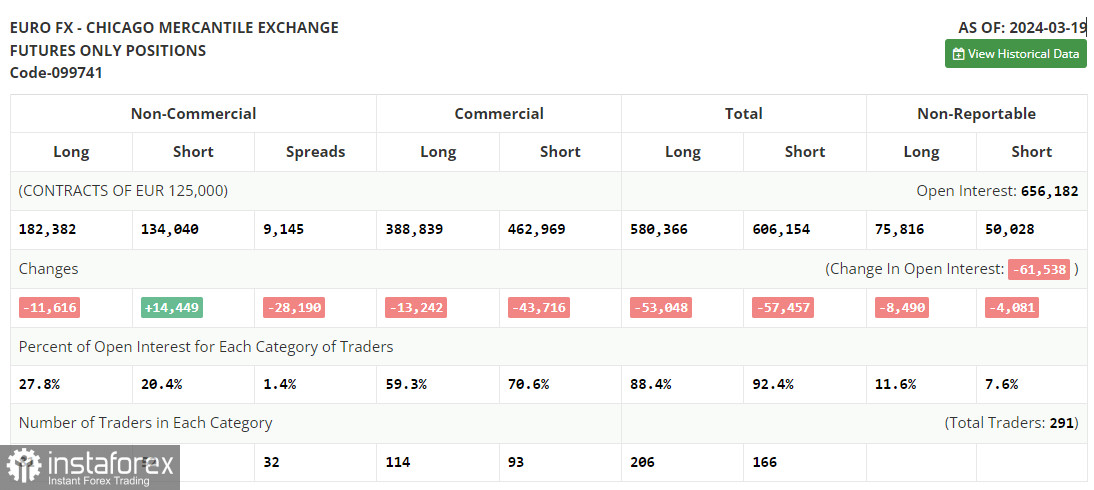

In the COT report (Commitment of Traders) for March 19th, there was a reduction in long positions and an increase in short positions. Such results are unsurprising given the recent Federal Reserve meeting and the unchanged policy. Meanwhile, representatives of the European Central Bank increasingly hint at active inflation decline in the eurozone, allowing the regulator to approach monetary policy easing by summer. For this reason, I am betting on further development of the bullish trend for the US dollar and a decline in the euro. The COT report indicates that long non-commercial positions decreased by 11,616 to 182,382, while short non-commercial positions jumped by 14,449 to 134,040. As a result, the spread between long and short positions decreased by 28,190.

Indicator Signals:

Moving Averages

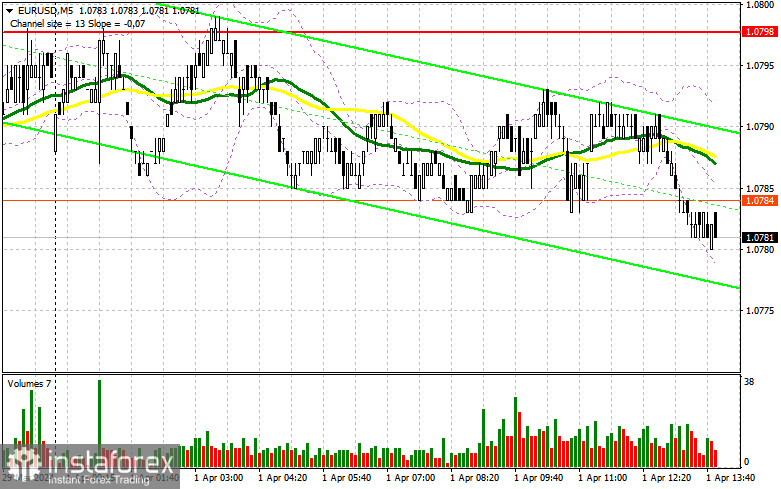

Trading is conducted below the 30 and 50-day moving averages, indicating a decline in the euro.

Note: The period and prices of moving averages considered by the author are on the hourly chart H1 and differ from the general definition of classic daily moving averages on the daily chart D1.

Bollinger Bands

In case of a decline, the lower boundary of the indicator, around 1.0780, will act as support.

Description of Indicators:

• Moving Average (MA) - determines the current trend by smoothing volatility and noise. Period 50. Marked on the chart in yellow.

• Moving Average (MA) - determines the current trend by smoothing volatility and noise. Period 30. Marked on the chart in green.

• MACD Indicator (Moving Average Convergence/Divergence) - Fast EMA period 12. Slow EMA period 26. SMA period 9.

• Bollinger Bands - Period 20.

• Non-commercial traders - speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• The net non-commercial position is the difference between non-commercial traders' short and long positions.