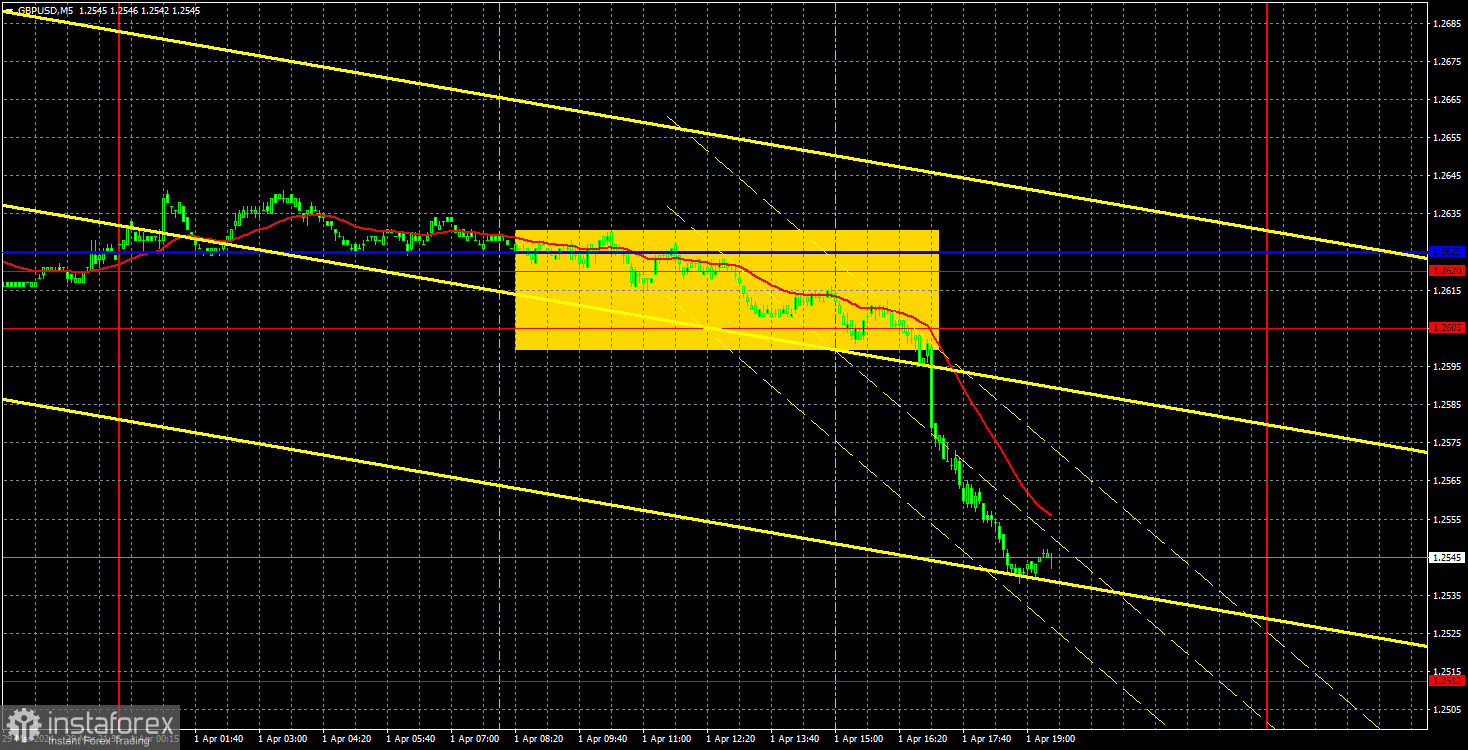

Analysis of GBP/USD 5M

GBP/USD fell by almost 100 pips on Monday. Bear in mind that the pair started a significant downward movement almost in the evening when a resonant report on ISM business activity was published in the United States, the value of which turned out to be above forecasts and above the "waterline" of 50.0. This particular report triggered the dollar rally. If it had not been for this report or if its value had been weaker, it is quite likely that we would not have seen the dollar's rise. However, the dollar still strengthened, but in the global scheme of things, nothing has changed. The pair continues to move horizontally on the 24-hour timeframe, so we may see a new upswing on lower time frames. Especially since the US will release many important reports this week, and there is no guarantee that all of them will support the dollar. Furthermore, the market is still reluctant to buy the dollar and sell the pound...

From a technical perspective, the pair has once again settled below the critical line, which allows us to expect further downward movement. If the pair continues to fall for at least a few more days, then the pair may exit the range of 1.25-1.28 on the daily chart, which could signal the end of the flat phase. In this case, we can only expect the start of a new downward trend, as we have been saying for the past few months. The pound doesn't have any reason to rise at the moment.

Speaking of trading signals, a sell signal was formed after the price settled below the area of 1.2605-1.2620. Even if traders did not enter the trade on time, it was still possible to earn at least 35 pips on it, which is not bad at all.

COT report:

COT reports on the British pound show that the sentiment of commercial traders has frequently changed in recent months. The red and blue lines, which represent the net positions of commercial and non-commercial traders, constantly intersect and, in most cases, remain close to the zero mark. According to the latest report on the British pound, the non-commercial group closed 11,300 buy contracts and opened 6,700 short ones. As a result, the net position of non-commercial traders decreased by 18,000 contracts in a week. It is quite interesting that even such changes do not lead to a significant decline in the pound. The fundamental background still does not provide a basis for long-term purchases of the pound sterling.

The non-commercial group currently has a total of 91,300 buy contracts and 56,100 sell contracts. The bulls no longer have a significant advantage. And yet, the pound refuses to fall, but such a thing cannot persist forever. The technical analysis also suggests that the pound should fall further (descending trend line), but we still have a total flat on the 24-hour timeframe.

Analysis of GBP/USD 1H

On the 1H chart, GBP/USD resumed its downward movement due to yesterday's US report. The economic reports and the fundamental background do not support the British pound at all, and yet it is reluctant to fall. We expect a firm downward movement; however, globally, the flat trend persists, and within the flat, the price either rises or falls, unrelated to news and reports. Therefore, it is still too early to celebrate the end of the flat.

As of April 2, we highlight the following important levels: 1.2215, 1.2269, 1.2349, 1.2429-1.2445, 1.2516, 1.2605-1.2620, 1.2691-1.2701, 1.2786, 1.2863, 1.2981-1.2987. Senkou Span B (1.2697) and Kijun-sen (1.2602) can also serve as sources of signals. Don't forget to set a Stop Loss to breakeven if the price has moved in the intended direction by 20 pips. The Ichimoku indicator lines may move during the day, so this should be taken into account when determining trading signals.

Today, the UK will release the second estimate of its Manufacturing PMI. Market participants will particularly focus on the US JOLTs figures. But then again the market may also ignore these reports altogether. So there's a chance that we might see weak movements and no trends on Tuesday.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;