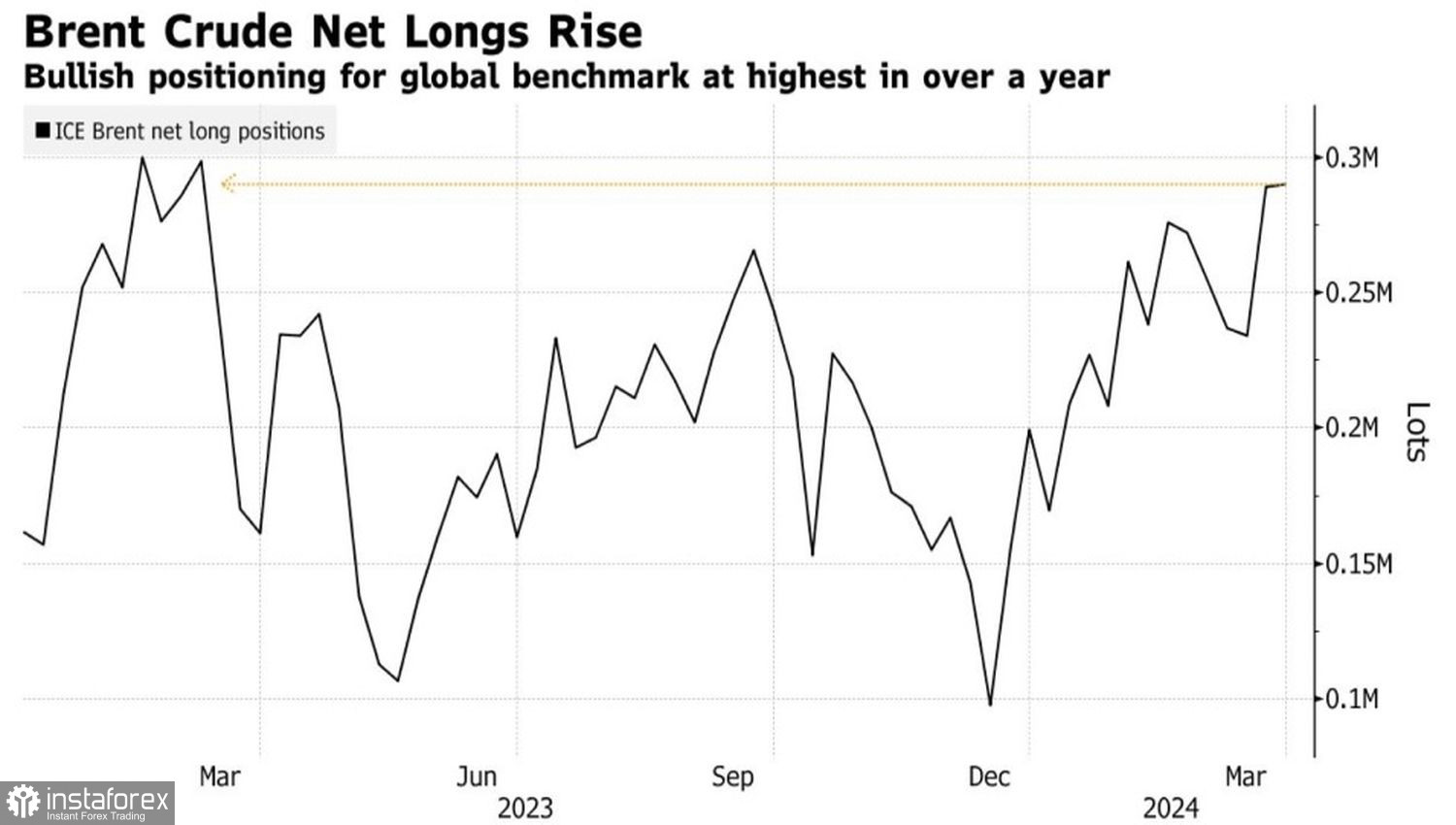

The dam has burst - and the elements can no longer be stopped. After breaking out of the consolidation range of $75-84 per barrel, Brent is growing like wildfire. Since the beginning of the year, the North Sea grade has already gained 14% thanks to increasing demand amid supply cuts. Speculators continue to build up long positions in oil. As a result, net longs have reached their highest levels since March of last year.

Speculative Position Dynamics for Brent

It seems that the demand for black gold is better than expected at the beginning of the year. Goldman Sachs claims that demand in Europe increased by 100,000 barrels per day just in February. Earlier, the bank forecasted that by the end of 2024, the indicator would decrease by 200,000 barrels per day.

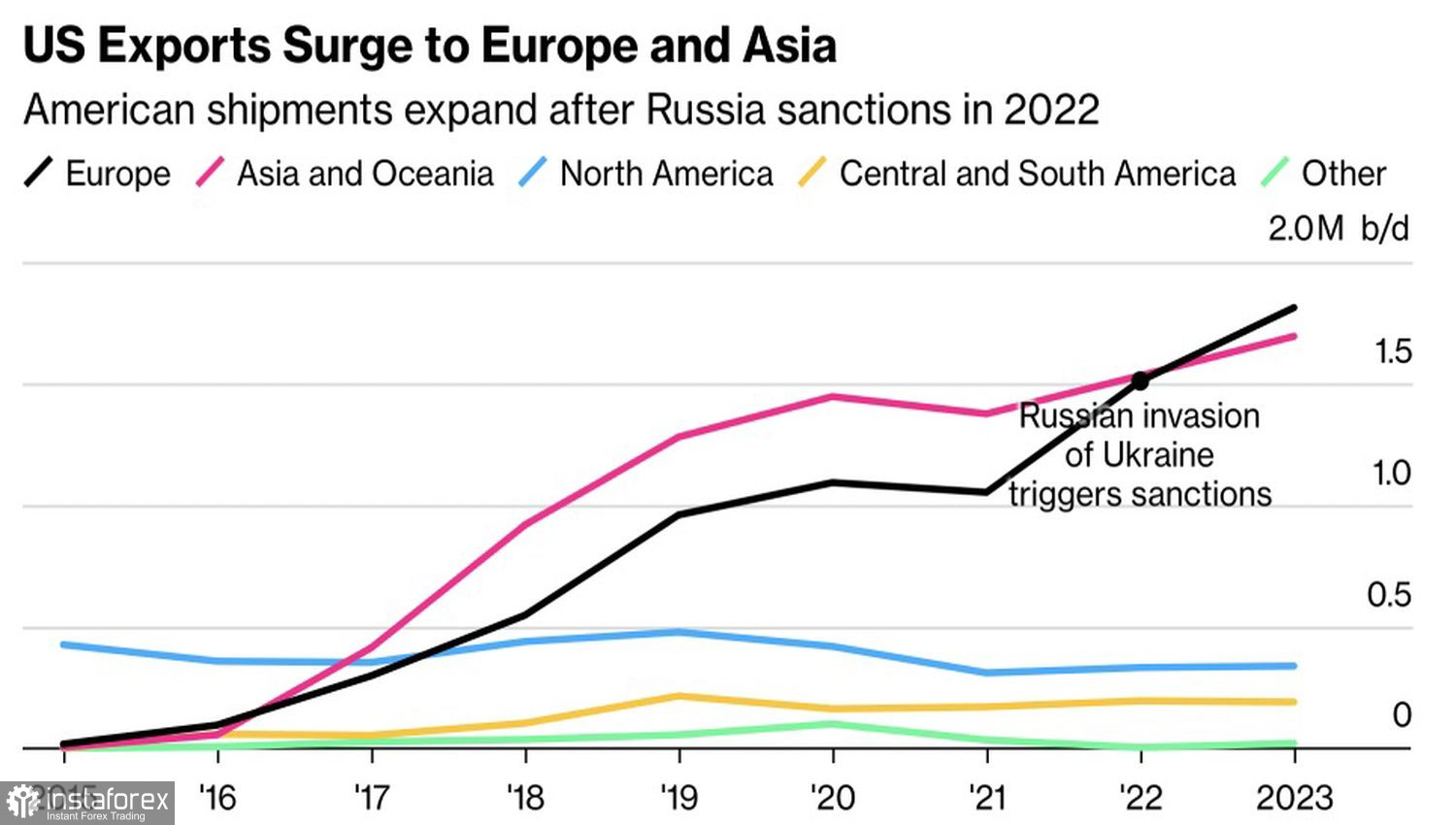

The increase in business activity in the manufacturing sectors of China and the USA to 6- and 16-month highs signals that even troubled industries are raising their heads. If so, then everything should be fine with the economies as a whole. The United States is the largest oil consumer, while China is the second-largest consumer and the world's largest importer. At the same time, Washington benefits the most from sanctions imposed against Russia and Venezuela. It is pushing these countries out of Europe and Asia.

U.S. Oil Export Dynamics

Thus, the demand for black gold pleases the eyes of the Brent bulls. The same can be said about supply. For a long time, investors were worried about disruptions in oil supplies due to Houthi attacks on ships in the Red Sea. Now, they have a new fear. Due to Israel's strikes on Iran's embassy in Syria, military commanders were killed. Tehran promised to react resolutely. Involvement in the conflict in the Middle East, according to JP Morgan, could quickly push the North Sea grade above $100 per barrel.

While OPEC+ is ready to prolong production cuts by 2.2 million barrels per day, the decrease in black gold supplies from Mexico adds fuel to the Brent rally. The country's president is nearing the end of his term in office, and as a parting gift, he decided to add fuel to the fire—increase gasoline and diesel production. The oil produced in Mexico goes there, and its export beyond the country's borders has been decided to be suspended. The reduction in supply pushes prices up.

Thus, global demand for black gold has exceeded expectations, the degree of geopolitical tension in the Middle East is increasing, OPEC+ continues to cut production, and the decrease in shipments from Mexico becomes a catalyst for the upward movement of the North Sea grade. Not even a strong U.S. dollar is saving the bears.

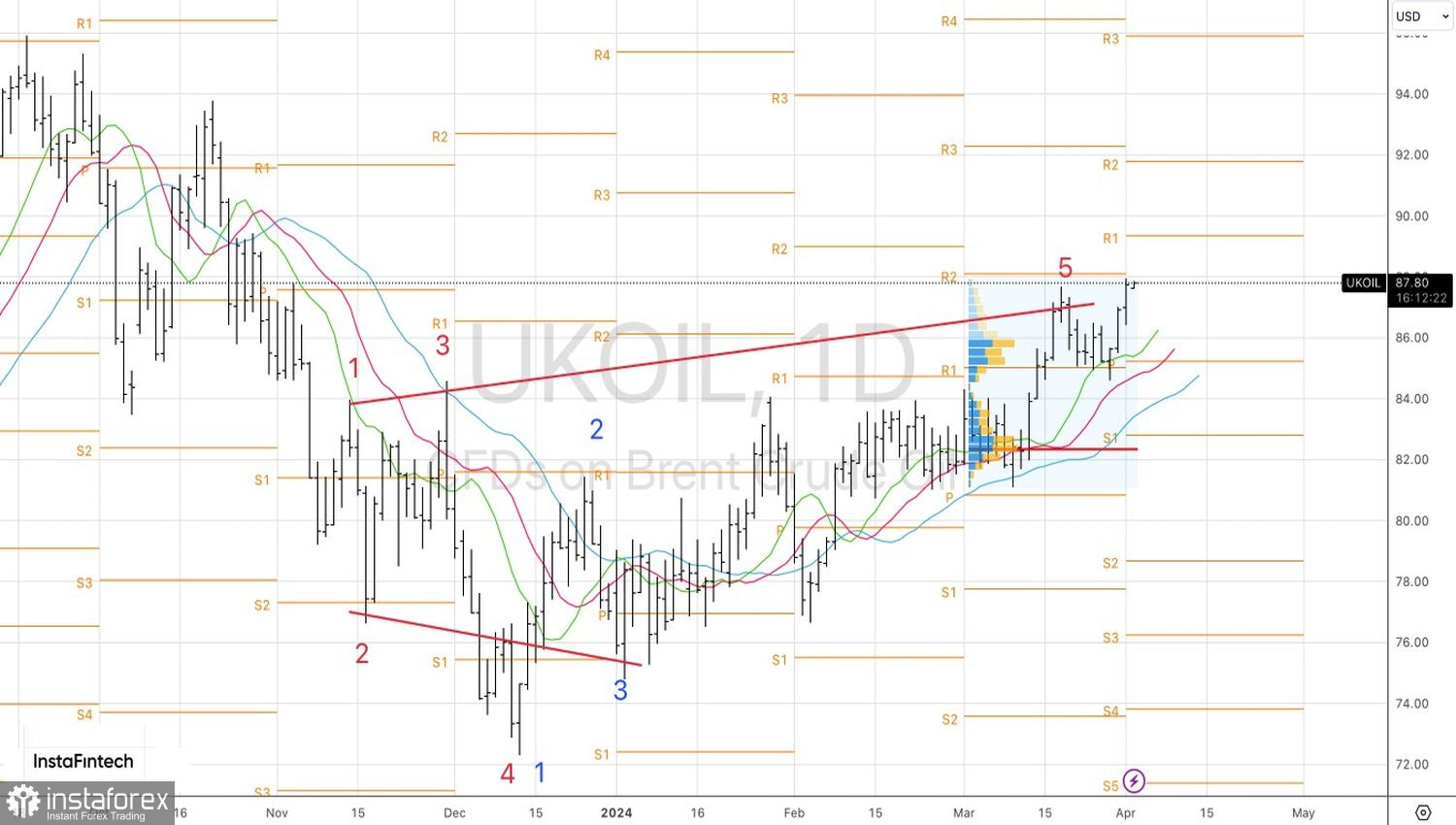

Technically, on the daily chart, Brent continues the implementation of the Broadening Wedge pattern. Recommendations for adding to previously formed long positions from the level of $82.65 per barrel on the rebound from support at $85.20 have worked like clockwork. We continue to use pullbacks to buy the North Sea grade. The initial target levels are the pivot levels of $92 and $96 per barrel.