It is a well-known fact that the market cannot stand still for a long time, and sooner or later, movement becomes inevitable. Moreover, the longer the stagnant phase, the more significant the subsequent leap. So, in general, it is not surprising that the dollar rallied on Monday. What is surprising is that it happened while Europe was still observing public holidays. Usually, if it's a holiday in Europe, or even more so in the United States, investors patiently wait for all the markets to open. What is equally interesting is that the market came into motion when the US ISM Manufacturing PMI data was released. The index itself shouldn't have been that significant to move the market. Furthermore, we're not talking about Markit data, but about ISM data, which is strictly an American matter. Moreover, Markit data were published fifteen minutes before this and it showed a decrease from 52.2 points to 51.9 points. In contrast, the ISM data showed an increase from 47.8 points to 50.3 points. Logically, if both indices move in different directions, they should offset each other, and the market should remain balanced. However, it turns out that the Markit data was simply ignored, while the ISM data was exaggerated. And there is also an assumption that such reports became a formal pretext, while the main focus is on inflation in the eurozone. Its preliminary assessment will be published tomorrow. Investors are becoming increasingly confident that the European Central Bank will be the first to lower its interest rates, and inflation data will confirm this assumption. So maybe the market is starting to prepare in advance. It is quite possible that the dollar will continue to strengthen its position.

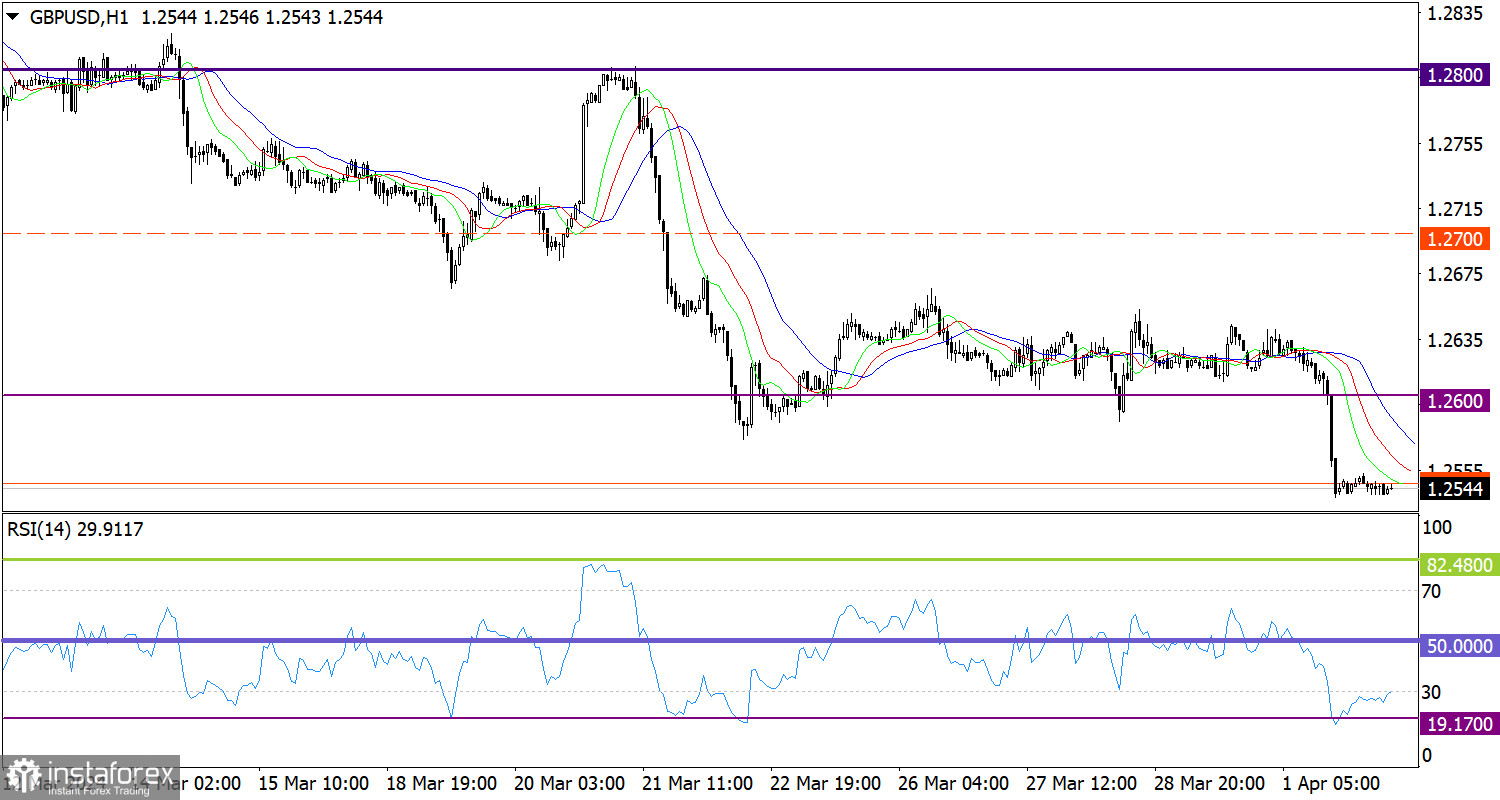

The GBP/USD pair not only surpassed the level of 1.2600 but also saw a sharp increase in selling volumes, which pushed the quote to drop below the value of 1.2550.

On the 30M and 1H charts, we observed signals of the pound's oversold conditions using the RSI technical indicator.

On the 4-hour chart, the Alligator's MAs are headed downwards, which corresponds to the current cycle.

Outlook

The pound's oversold condition became stagnant just below the value of 1.2550, but this could serve as a stage for changing the balance of trading forces. Therefore, the price may still reach the key level of 1.2500 while the dollar broadly strengthens.

In terms of complex indicator analysis, indicators signal a downward cycle in the short term and intraday periods.