To predict the future, one must look into the past. Credit Agricole attempted to do so by analyzing how the Fed's easing monetary policy cycle and subsequent recessions affected the U.S. dollar over the past 50 years. The result turned out to be quite interesting: the beginning of the federal funds rate reduction is negative for bears on EUR/USD, however, the subsequent decline allowed them to recover some losses.

As a baseline scenario, Credit Agricole chose June as the month to start the Fed's monetary expansion, and the fourth quarter as the period of the recession's onset. The U.S. dollar risks a significant weakening in July-September, but it is expected to improve its position already in October-December. However, events may unfold differently. If the Fed manages to bring the economy to a soft landing, such a scenario will give a pronounced downward impulse to EUR/USD.

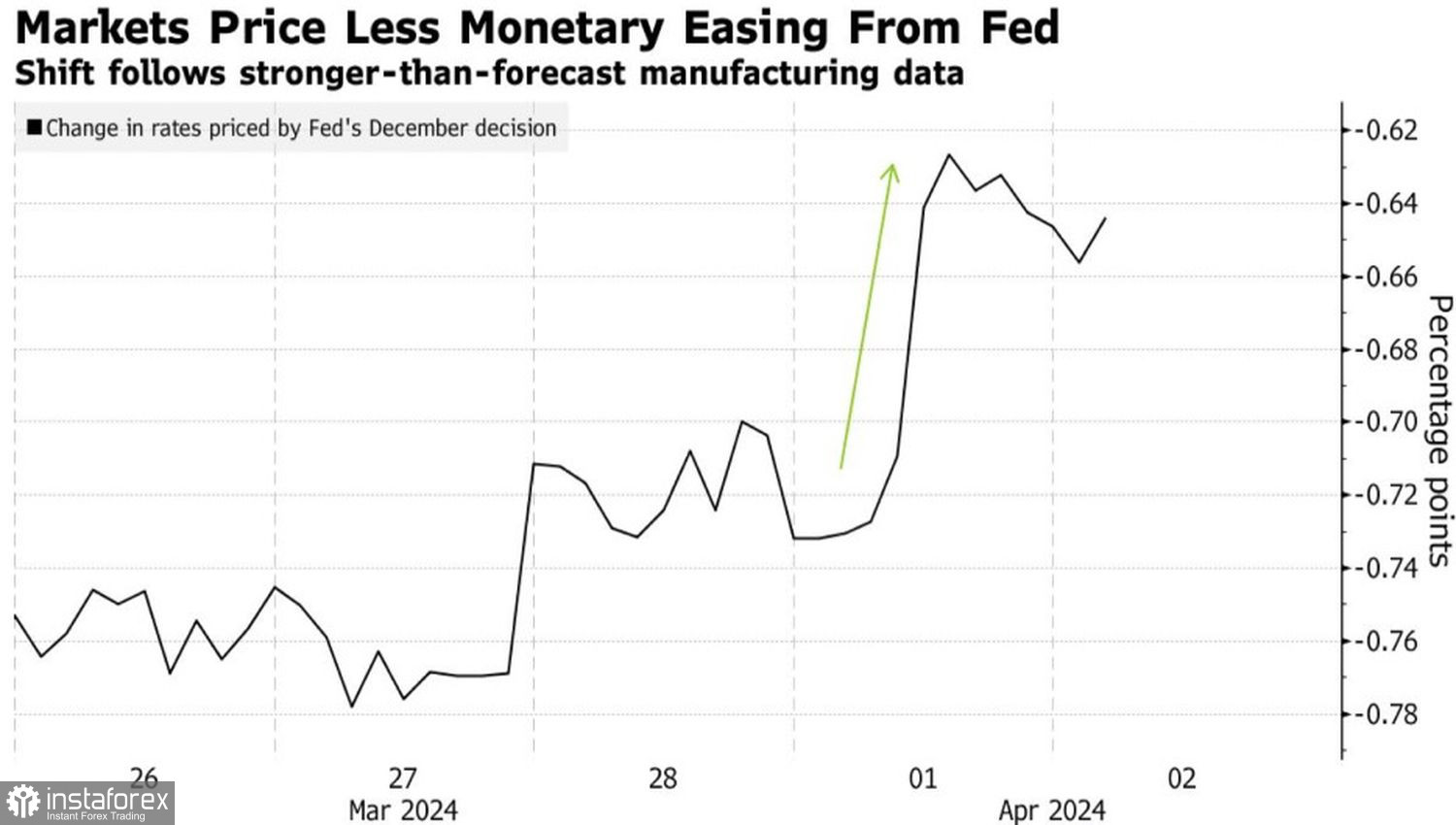

Even the modest increase in the PMI in the U.S. manufacturing sector above 50 prompted derivatives to reduce the expected scale of the Fed's monetary expansion in 2024 to 65 basis points. This is less than in the latest FOMC forecasts. If the figure decreases even further, no one will stop the bears on EUR/USD. However, for now, the main currency pair is trying to find its bottom, eagerly awaiting U.S. employment statistics.

Dynamics of expected Fed rate cuts

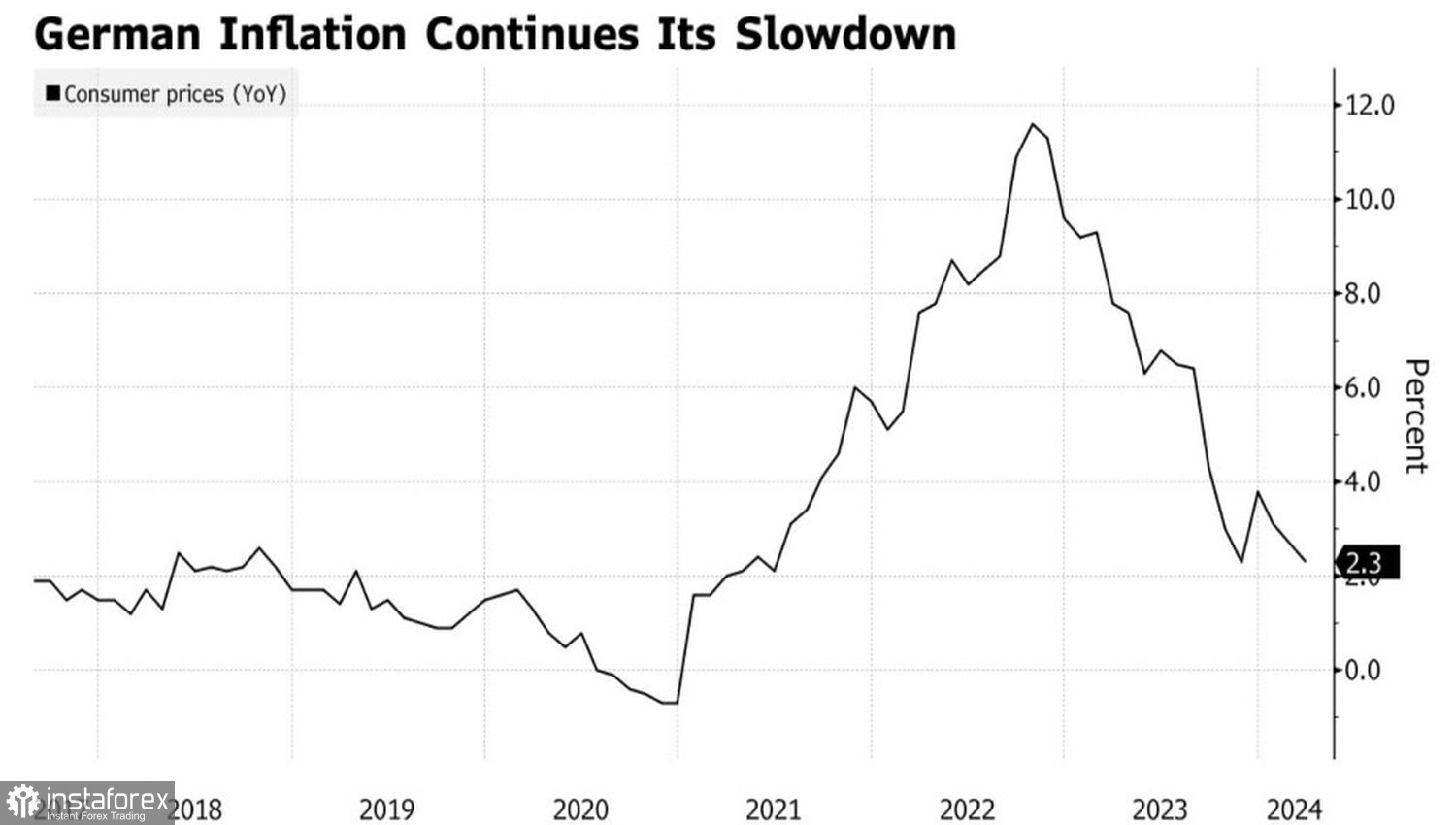

Fans of the euro are not pleased with the news from Germany. In March, German consumer prices slowed from 2.7% to 2.3%, more than Bloomberg experts had predicted. A similar process is taking place in France, which allows us to expect a slowdown in the growth rates of the eurozone's CPI and brings the date of the ECB's monetary policy easing cycle closer.

According to Deutsche Bank, the cancellation of government support measures will lead to short-term spikes in inflation, but the trend remains the same—downward, which allows the European Central Bank to start cutting deposit rates in June. The question is how significant the scale of monetary expansion will be. If there are four or more steps in 2024, EUR/USD will continue to fall towards 1.02-1.03.

German inflation dynamics

Thus, the fate of the main currency pair depends on whether the U.S. economy experiences a soft or hard landing, the ability of U.S. inflation to reach a new peak, and the magnitude of the ECB's deposit rate cuts in 2024. The euro may dive towards parity, but it is unlikely to find the strength to close the year at $1.12 or higher.

In the short term, U.S. labor market statistics will influence the dynamics of EUR/USD. According to Bloomberg experts' forecasts, employment will increase for the fourth consecutive month by 200,000 or more, which is good news for the U.S. dollar.

Technically, on the daily chart of EUR/USD, bulls are trying to find a bottom by playing out the 20-80 pattern. If buyers manage to form a pin bar, the euro's pullback may continue. However, as long as the pair is trading below 1.08, bulls dominate the market, and it is advisable to stick to a strategy of selling on rallies.