The GBP/USD currency pair continued to trade fairly weakly. Throughout the week, we observed a decent movement of the pair on Monday, and that's about it. We warned that the price came close to the level of 1.2500, which can be considered the lower boundary of the sideways channel on the 24-hour timeframe, which has been maintained for four months now. Thus, the probability of the flat remaining this time is indeed high.

It is worth noting that macroeconomic and fundamental factors have only had an indirect influence on the pound in recent months. There is no doubt that over the past four months, the market has had enough reasons to exit the sideways channel. However, this has not happened, so there is no certainty that a whole series of important reports in the US this week will prompt the market to massive sales of the pair. And massive purchases of the British currency will not change the current technical picture. The upper boundary of the sideways channel is at the level of 1.2800, so even a rise of 200 points by the end of the week will leave the pair within the sideways channel.

Meanwhile, it became known that members of the Federal Reserve's monetary committee, Mary Daly and Loretta Mester, support three rate cuts in 2024. Recall that earlier, Raphael Bostic stated that he sees only one cut of 0.25% in the current circumstances. As we can see, not everyone in the FOMC takes such a "dovish" position, but at present, even three rate cuts are a "dovish" position.

It is worth reminding you that at the beginning of the year, the Fed was expected to have 5–6 rate cuts in the current year alone. And the monetary policy easing was supposed to start in March. Now, there are no guarantees that it will start even in June because Loretta Mester and Mary Daly also clarified that "a smaller number of rate cuts may be needed." As before, everything will depend on macroeconomic statistics. If there are no questions about the state of the American economy, there are still many questions about inflation. Accordingly, if inflation does not slow down, as it has not slowed down in the last 8–9 months, then even the heads of the Federal Reserve Bank of San Francisco and Cleveland will change their positions to a more "dovish" one.

Based on the speeches of Mester and Daly, we cannot conclude that the overall sentiment of the Fed has changed. We have only realized that there is no unanimous opinion on rates at the moment. But there is a clear understanding that no matter what the forecasts of individual officials are, everything, as before, depends on inflation. Therefore, if there is no decrease in inflation, there will be no easing of policy. For the US dollar, this information is just excellent news, but the market still refuses to buy it when approaching the 25th level. The flat continues.

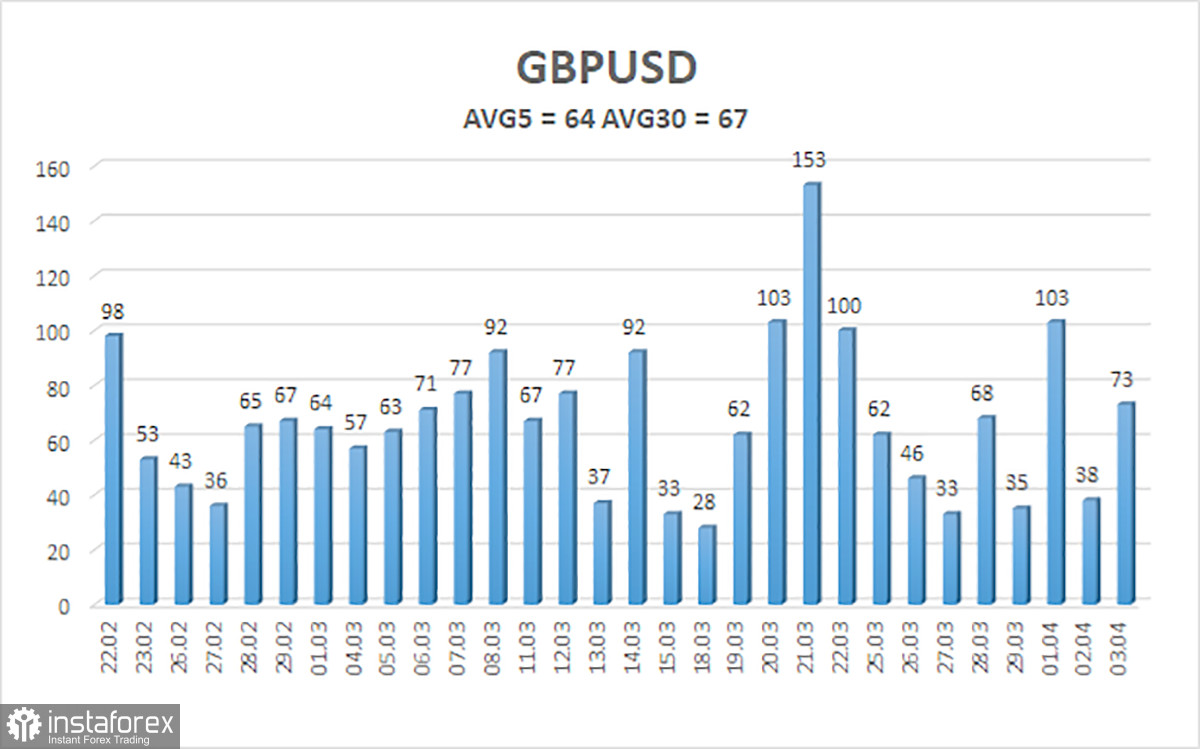

The average volatility of the GBP/USD pair over the last five trading days is 64 points. For the pound/dollar pair, this value is "low." Thus, on Thursday, April 4th, we expect movement within the range bounded by levels 1.2566 and 1.2694. The senior linear regression channel still points sideways, so there are no questions about the current trend. The CCI indicator entered oversold territory on Monday, prompting the pair's rise. However, the market continues to trade not too logically, which is not surprising given the ongoing sideways movement in the 24-hour timeframe.

Nearest support levels:

S1 – 1.2573

S2 – 1.2512

S3 – 1.2451

Nearest resistance levels:

R1 – 1.2634

R2 – 1.2695

R3 – 1.2756

Trading Recommendations:

The GBP/USD pair continues to trade in a sideways pattern in the 24-hour timeframe. We still expect movement to the south, now with targets at 1.2512 and 1.2489, and the market still extremely reluctantly buys the dollar and sells the pound, often ignoring fundamental and macroeconomic factors. Thus, we first need the flat to end, and only then analyze the technical picture for trading signals. Monday should not mislead traders with a drop in the British pound - the pair is still in a flat. Tuesday and Wednesday showed that there would be no continuation.

Explanations for Illustrations:

Linear regression channels - help determine the current trend. If both are pointing in the same direction, it means the trend is strong right now.

Moving average line (settings 20.0, smoothed) - determines short-term trend and direction for trading.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - probable price channel where the pair will trade in the next day, based on current volatility indicators.

CCI indicator - its entry into oversold territory (below -250) or overbought territory (above +250) indicates a trend reversal approaching in the opposite direction.