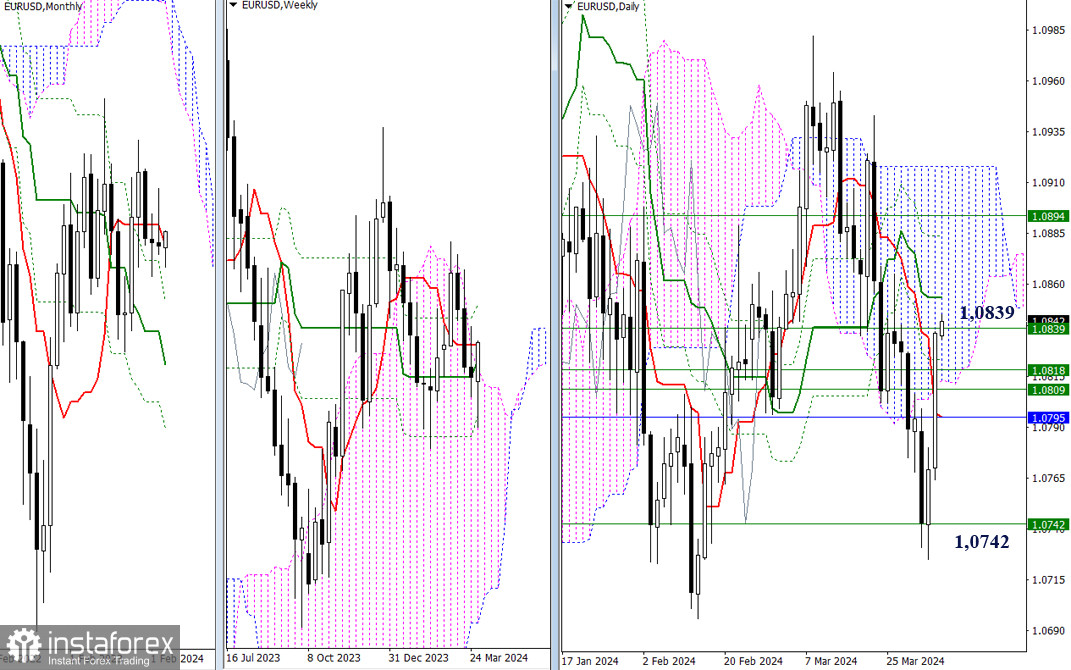

EUR/USD

Higher Timeframes

Bulls yesterday confirmed and developed a daily rebound from weekly support (1.0742). At the same time, the scale of the bullish movement allowed reaching the weekly short-term trend (1.0839). The passed resistance levels (1.0818 – 1.0809 – 1.0795) today on lower timeframes may provide support in case of a decline. The next tasks on the way to continuing the rise in the current conditions are the elimination of the daily death cross (1.0854 – 1.0884), reinforced by weekly resistance (1.0894), and reaching the upper boundary of the daily cloud (1.0918).

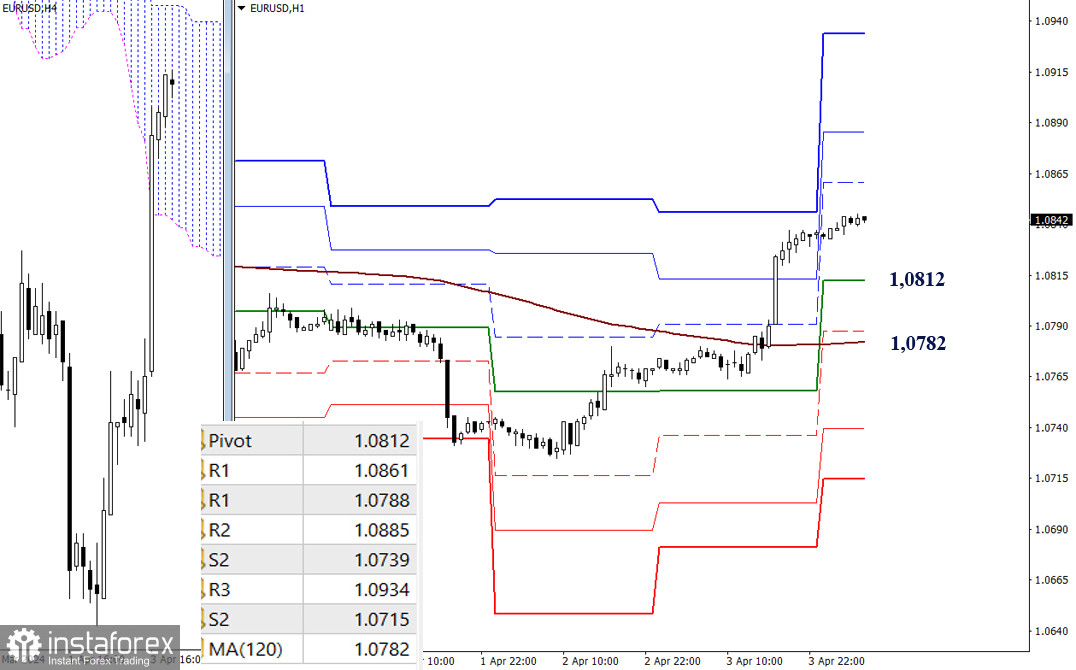

H4 – H1

On lower timeframes, bulls easily coped with the weekly long-term trend and, without stopping, continued the upward development. Bullish targets within the day are the resistances of classic pivot points, today located at 1.0861 – 1.0885 – 1.0934. Key levels 1.0812 (central pivot point of the day) – 1.0782 (weekly long-term trend) will meet the market during the development of a downward correction. In the case of their breakthrough and consolidation below, the current balance of power may again shift in favor of bears, who will be able to develop their sentiments by working out the support of classic pivot points (1.0739 – 1.0715).

***

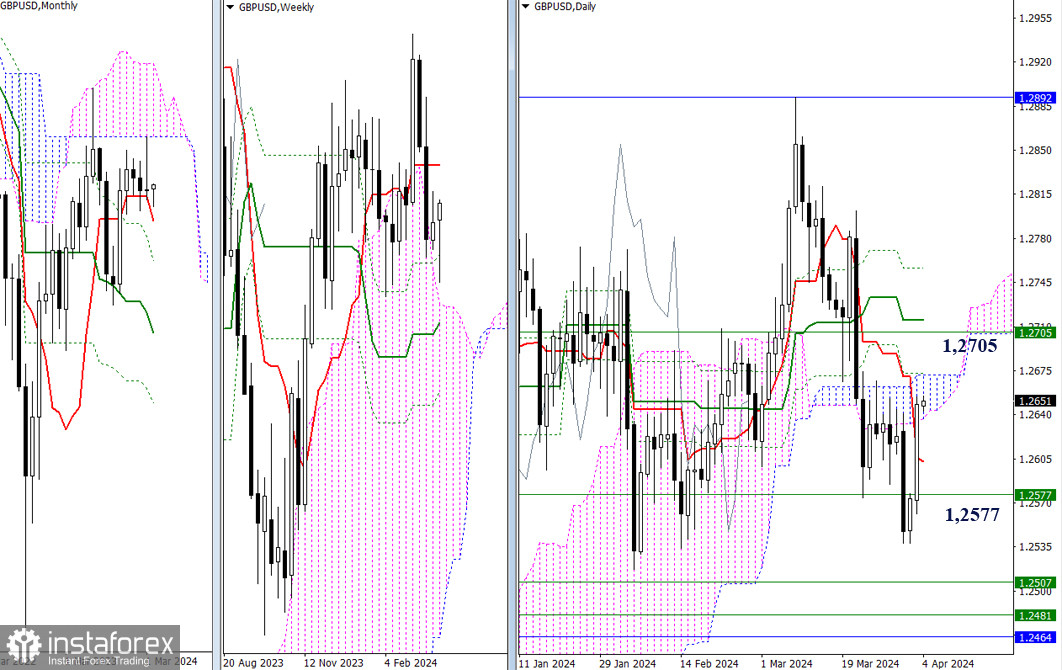

GBP/USD

Higher Timeframes

Over the past trading day, bulls successfully restored their positions; they seized the support of the daily short-term trend (1.2603) and entered the daily cloud (1.2637). Now, bulls' further tasks consist of entering the bullish zone relative to the daily cloud (1.2671); they need a return to the weekly short-term trend (1.2705) and the daily medium-term trend (1.2715). The levels passed yesterday (1.2637 – 1.2603), and the weekly support (1.2577), in the current conditions, may again provoke a slowdown and serve as the basis for another rebound.

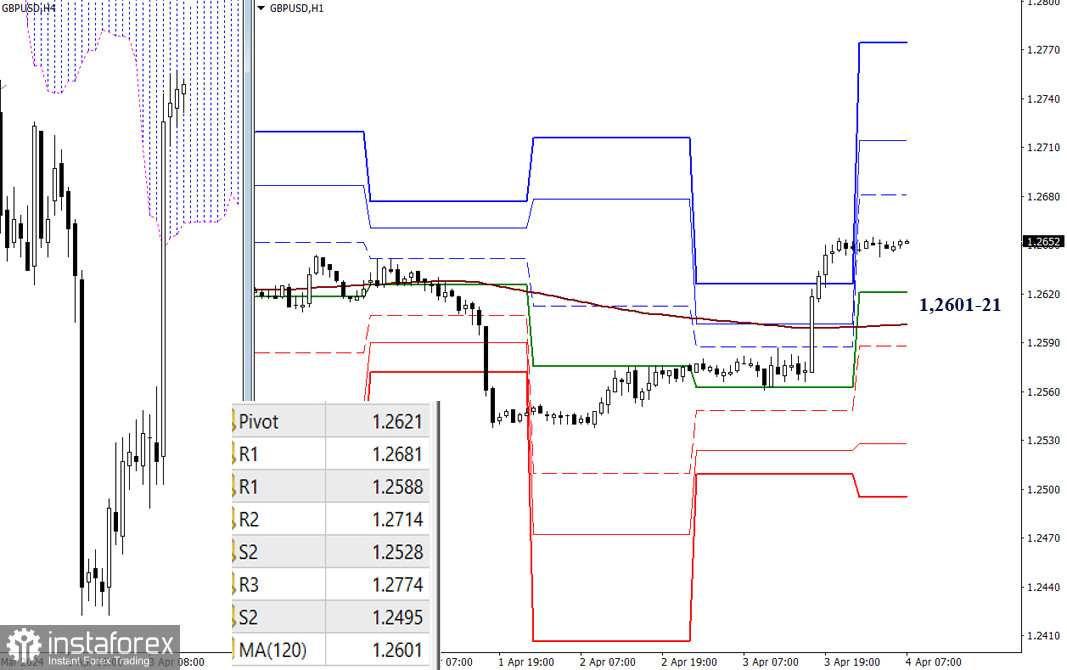

H4 – H1

The bulls have gained an advantage. Today, further development of the rise within the day is possible through overcoming the resistances of classic pivot points (1.2681 – 1.2714 – 1.2774). During corrective declines, the pair will encounter key levels 1.2621 (central pivot point of the day) – 1.2601 (weekly long-term trend), which, on lower timeframes, determine the current balance of power. Overcoming key levels and reversing the trend will contribute to the strengthening of bearish sentiments. Support levels of classic pivot points (1.2588 – 1.2528 – 1.2495) can serve as targets for decline within the day today.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)