To be honest, there's no point in highlighting the recently published economic reports. As a matter of fact, the market moved after Neel Kashkari took the stage, surprising everyone by saying that the central bank may not cut interest rates at all in 2024 if inflation continues to move sideways. Federal Reserve Chief Jerome Powell said something similar, but in a much milder form, the other day. He said that the Fed has the time to assess data before cutting interest rates. Overall, this suggests that the market should not expect rate cuts at the upcoming meeting. In fact, another representative of the Fed said that it may happen even later. And naturally, the dollar immediately started to actively rise in value.

In light of such statements, market participants will focus on today's report from the United States Department of Labor. After all, outside of agriculture, 275,000 new jobs may be created, which is enough to keep the labor market in a stable condition. It even creates the conditions for a possible decrease in the unemployment rate, which is already at an unusually low level for the American economy. In this case, lower interest rates threaten both overheating the labor market and a sharp escalation of the inflationary spiral. So, if we consider the labor market, rate cuts wouldn't be reasonable. Most likely, this is exactly what Powell and Kashkari had in mind. And most importantly, all of this will support the dollar's strength.

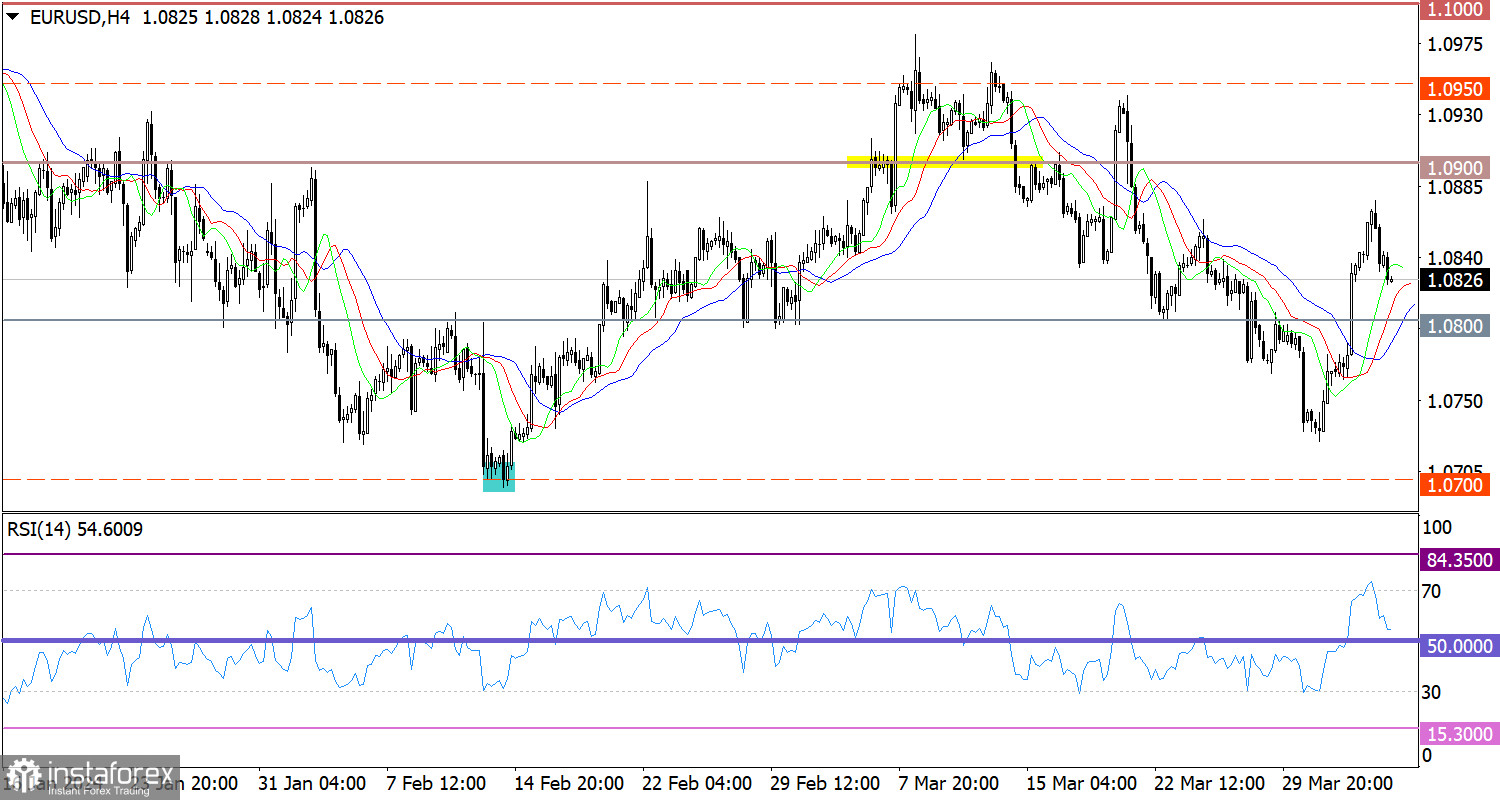

The cycle of the speculative movement stopped around the value of 1.0875, where the volume of long positions rapidly decreased. This is due to the Fed's information flow. From a technical perspective, we can only add that the euro has been overbought recently.

The RSI has left the overbought zone on the 4-hour chart.

On the 4-hour chart, the Alligator's MAs are headed upwards. This is a residual background from the recent upward movement.

Outlook

In case the bearish bias persists, the quote may fall to the level of 1.0800. The price must settle below this mark at the end of the week in order for the volume of short positions to increase. As for the upward movement, traders will consider this when one of the possible scenarios is fulfilled: The first scenario involves a price rebound from the level of 1.0800, which will lead to a slowdown in the downward cycle and buying volumes will increase. The second scenario considers the possibility of a slowdown in the downward cycle relative to current values, and if the price climbs above 1.0850, the volume of long positions may increase.

In terms of complex indicator analysis, indicators point to the downward cycle in the short-term and intraday periods.