Today, the focus of the markets is the publication of data on the number of new jobs for March in the US economy. The labor market is expected to create 212,000 new jobs in March following 275,000 in February. Unemployment could have remained at the same level of 3.9%.

Of course, the dynamics of the gold price depends not only on the growth or depreciation of the US dollar, but also on geopolitical tensions in the world. From a technical point of view, the yellow metal is currently overbought. Even though the nonfarm payrolls show employment growth, this may still stimulate higher prices. Only an unexpected decline can lead to a local weakening of the gold price.

Technical picture and trading idea

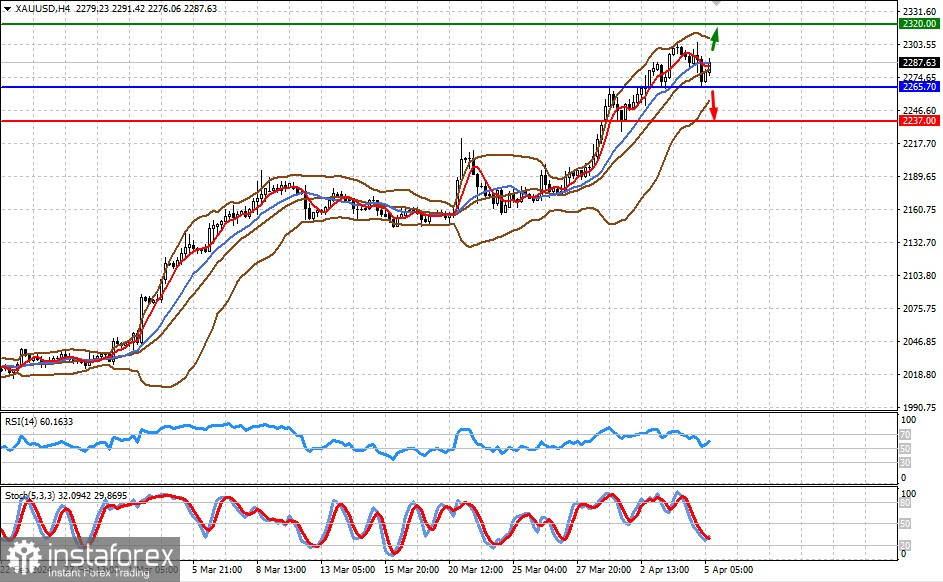

At present, the price is above the middle line of the Bollinger Bands, above the SMA 5, but below the SMA 14. The RSI is above the 50% level and growing. Stochastic crosses are generating a buy signal.

A breakout of the support level at 2,265.70 strengthens the downtrend, which may lead to a corrective fall in price to 2,237.00. Only the weakening of the US dollar on the back of geopolitical tensions will be able to push the gold price to the level of 2,320.00.