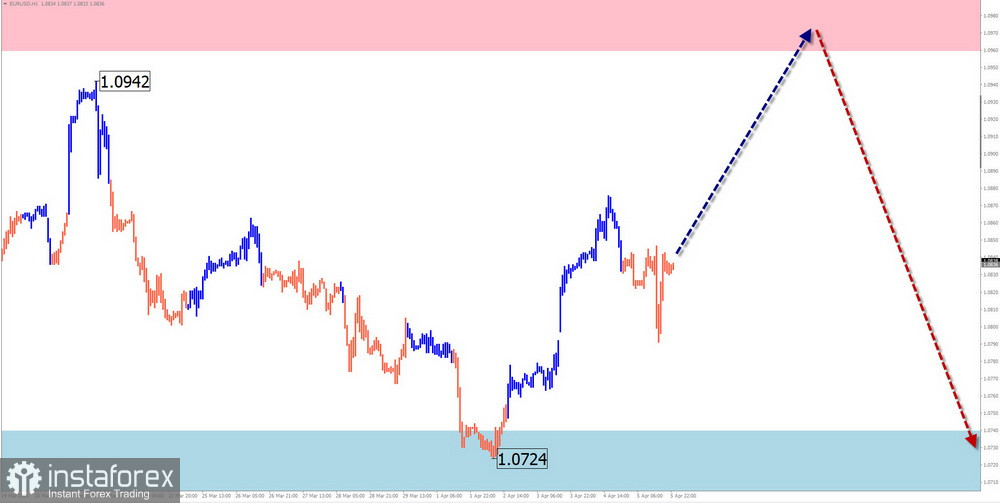

EUR/USD

Analysis:

On the chart of the European currency, the direction of price fluctuations since September of last year sets a descending wave algorithm. The wave structure forms a horizontal corrective plane. Extremes on the chart create a "pennant" pattern. The wave structure is nearing completion, but there are no signals of an imminent reversal on the chart.

Forecast:

Next week is expected to see movement in the euro's price within a sideways range, bounded by calculated reversal zones. At the beginning of the week, there is a high probability of an upward movement vector, possibly reaching the upper boundary of the price channel. The resumption of the price decline is expected closer to the weekend.

Potential Reversal Zones

Resistance:

- 1.0960/1.1010

Support:

- 1.0740/1.0790

Recommendations:

Buying: may be profitable with reduced trading volume and within the time frame of intraday trading.

Selling: premature until corresponding reversal signals appear near the resistance zone.

USD/JPY

Analysis:

Since July of last year, the leading ascending wave of the major pair of the Japanese yen has been forming its final part (C). Within its structure, a corrective counterwave has been developing since March 20th. It takes the form of a stretched plane and, at the time of analysis, does not show completion.

Forecast:

In the coming days, a continuation of sideways movement can be expected. A brief decline is not excluded, possibly down to the support zone. Then, there is a high probability of the pair's movement shifting into a sideways plane and conditions forming for a change in direction. The resumption of the exchange rate's rise may be expected no earlier than the end of the week.

Potential Reversal Zones

Resistance:

- 152.80/153.30

Support:

- 150.00/149.50

Recommendations:

Selling: may be profitable for short-term trades within individual sessions. It's safer to reduce the trading volume.

Buying: will become relevant after confirmed reversal signals appear around the resistance zone.

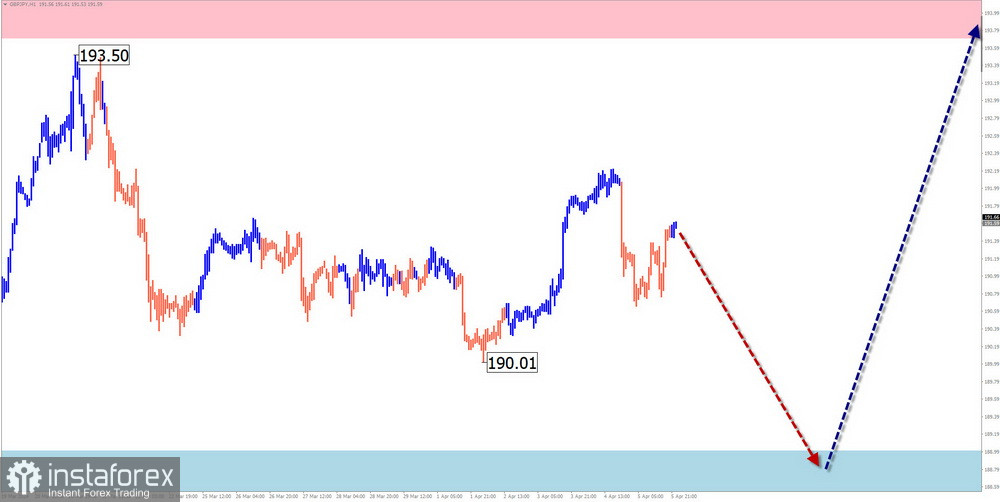

GBP/JPY

Analysis:

The main direction of movement for the British pound/Japanese yen pair since December of last year is set by the algorithm of an ascending wave. Within the structure of this wave zigzag, an intermediate correction has been developing in a sideways flat for the past one and a half months. The structure of this wave segment does not appear to be complete.

Forecast:

In the next couple of days, a flat mood of price fluctuations can be expected, predominantly with a downward vector. A reversal is expected to form near the support zone. The resumption of the price increase is likely in the second half of the week.

Potential Reversal Zones

Resistance:

- 193.70/194.20

Support:

- 189.00/188.50

Recommendations:

Selling: highly risky and may lead to a loss of deposit.

Buying: will become attractive for trading deals after corresponding reversal signals appear around the support zone as per your trading system.

USD/CAD

Analysis:

The four-hour chart of the major Canadian dollar pair demonstrates the formation of an ascending wave. The wave has been counting since the end of December of last year. Since March 10th, the beginning of the final part (C) has been forming, with a movement character close to impulse.

Forecast:

Throughout the upcoming week, a continuation of upward price movement is expected, possibly up to touching the resistance zone. It runs along the lower boundary of a powerful potential reversal zone in the higher timeframe. After this, conditions for reversal and the beginning of decline may be expected.

Potential Reversal Zones

Resistance:

- 1.3670/1.3720

Support:

- 1.3490/1.3440

Recommendations:

Selling: there won't be conditions for such deals in the upcoming week.

Buying: can be used to generate profit. The potential for increase is limited by calculated resistance.

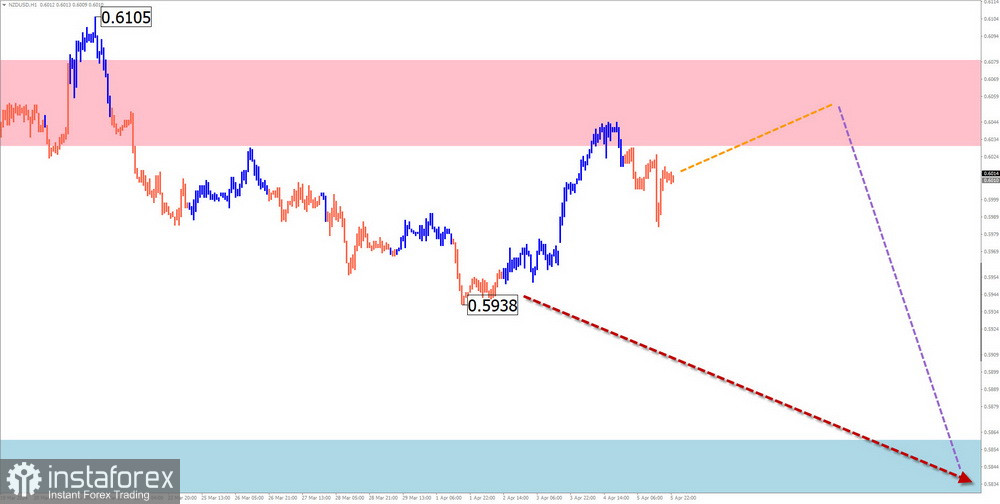

NZD/USD

Analysis:

The unfinished wave construction on the chart of the major New Zealand dollar is directed downward, counting from the end of December of last year. Within the wave structure of the final part (C), an intermediate correction has been developing over the past two weeks. The downward segment since April 4th has reversal potential.

Forecast:

At the beginning of the upcoming week, a continuation of the general sideways mood with attempts to pressure the resistance zone is expected. Further, a change in course and resumption of downward movement can be expected. The calculated support demonstrates the lower boundary of the expected weekly movement of the pair.

Potential Reversal Zones

Resistance:

- 0.6030/0.6080

Support:

- 0.5860/0.5810

Recommendations:

Buying: lacks potential and is high-risk.

Selling: may become the primary trading direction after confirmed reversal signals appear around the resistance zone.

Gold

Analysis:

The price of gold is breaking records. Quotes pushed through the upper boundary of the reversal zone, turning it into support and entering the operative space. The level of $2500 per ounce stands as a significant threshold. Before reaching this threshold, the calculated resistance level will act as an obstacle to the course's growth.

Forecast:

In the next couple of days, a flat mood of gold price fluctuations along the support boundaries is most likely. In the second half, the probability of increased volatility, reversal, and resumption of growth increases.

Potential Reversal Zones

Resistance:

- 2420.0/2435.0

Support:

- 2305.0/2290.0

Recommendations:

Selling: has low potential and may lead to losses.

Buying: will become relevant after confirmed signals appear around the support zone using your trading system.

Explanations: In simplified wave analysis (SWA), all waves consist of 3 parts (A, B, and C). On each timeframe, the latest, unfinished wave is analyzed. Dotted lines indicate expected movements.

Attention: The wave algorithm does not consider the duration of instrument movements over time!