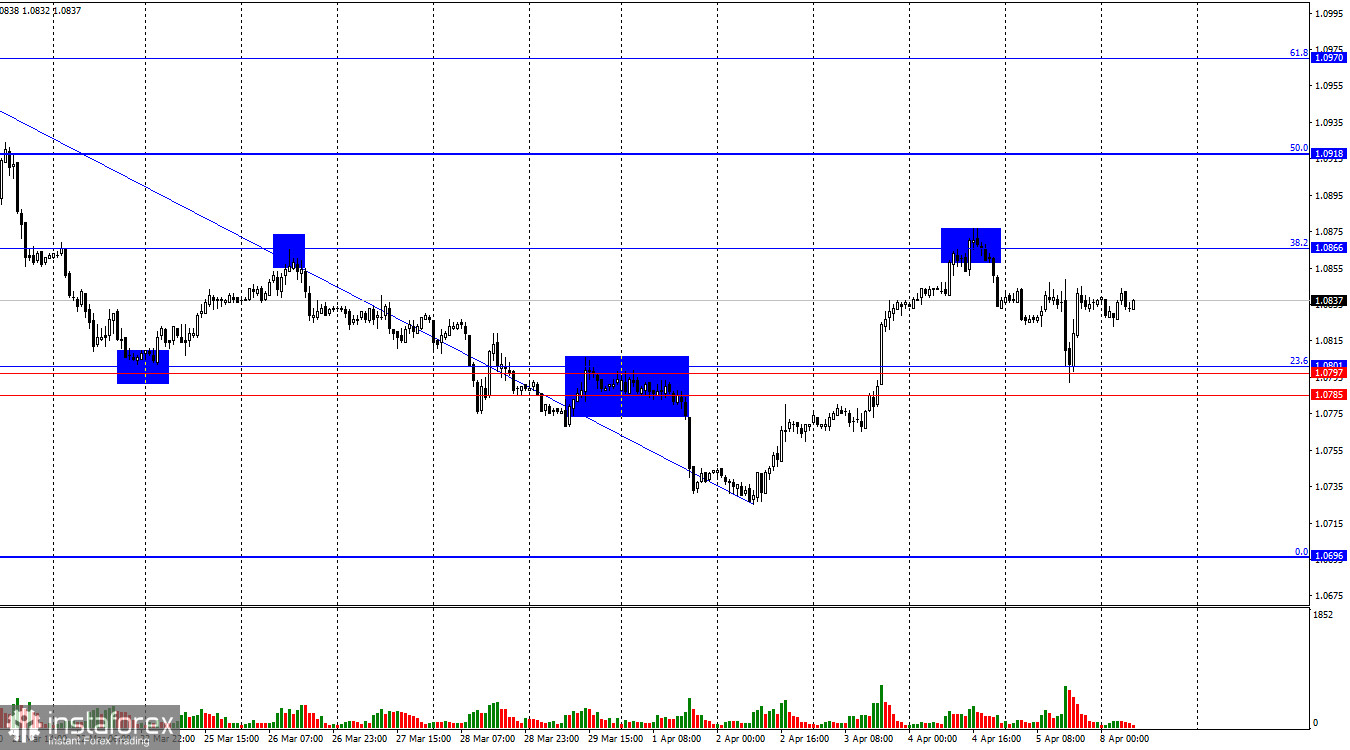

The EUR/USD pair dropped to the support zone of 1.0785–1.0801 on Friday, rebounded from it, and resumed the upward process towards the Fibonacci retracement level of 38.2%–1.0866. A new rebound from this level will again benefit the US dollar, as will a return to the zone of 1.0785–1.0801. Consolidation of the pair's rate below this zone will increase the probability of further decline towards the Fibonacci level of 0.0% at 1.0696. In my opinion, the option with a decline remains the most consistent.

The wave situation remains quite clear. The last completed downward wave broke the low of the previous wave (from March 19th), and the new upward wave has not yet approached the last peak (from March 21st). Thus, we are currently dealing with a "bearish" trend, and at the moment there is no sign of its completion. For such a sign to appear, the current upward wave must break the current last peak (from March 21st). If the new downward wave fails to break the low from April 2nd, this will also be a sign of the end of the "bearish" trend.

The news background on Friday was very strong and extensive. It all started with the report on retail trade in the European Union. Volumes decreased by 0.5% m/m and by 0.7% y/y. Thus, from the very morning on, bears had reasons to counterattack. Next, in the United States, three reports on the labor market, unemployment, and wages were released, which also supported the bears, but the zone of 1.0785–1.0801 proved to be an insurmountable obstacle for them. This week will see the ECB's third meeting this year. I expect that interest rates will not be changed, but Christine Lagarde's statements will indicate that the regulator will be ready to lower rates at the next meeting. It's difficult to say whether the strengthening of the ECB's "dovish" sentiment will help the bears, as the market has long understood that the first easing of monetary policy awaits it in June. But once again, the news background will be on the side of sellers.

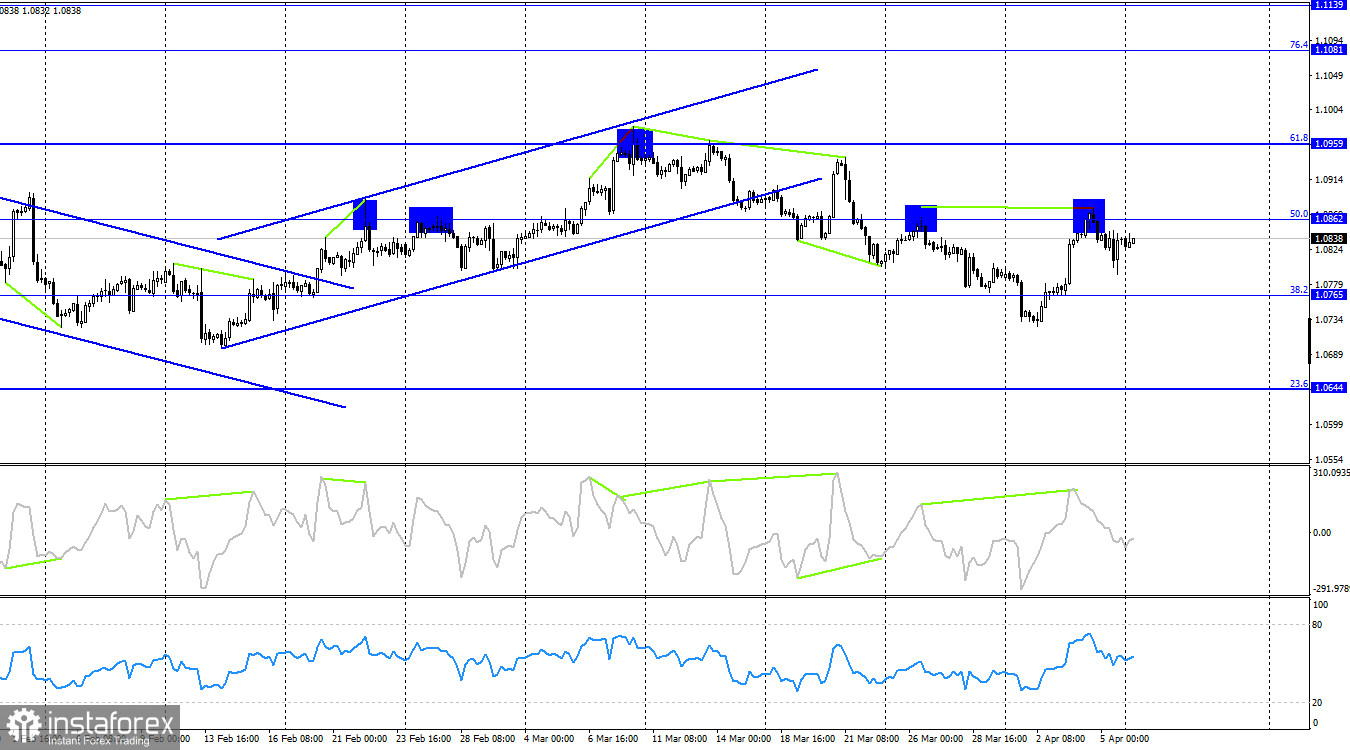

On the 4-hour chart, the pair rebounded from the corrective level of 50.0%-1.0862 and turned in favor of the US dollar. Thus, a new decline towards 1.0765 has begun. The "bearish" divergence on the CCI indicator also suggests a new rise in the dollar. Consolidation above the level of 1.0862 will benefit the EU currency and resume growth towards the next corrective level of 61.8% at 1.0959. The trend on the 4-hour chart is currently "bearish," as on the hourly chart.

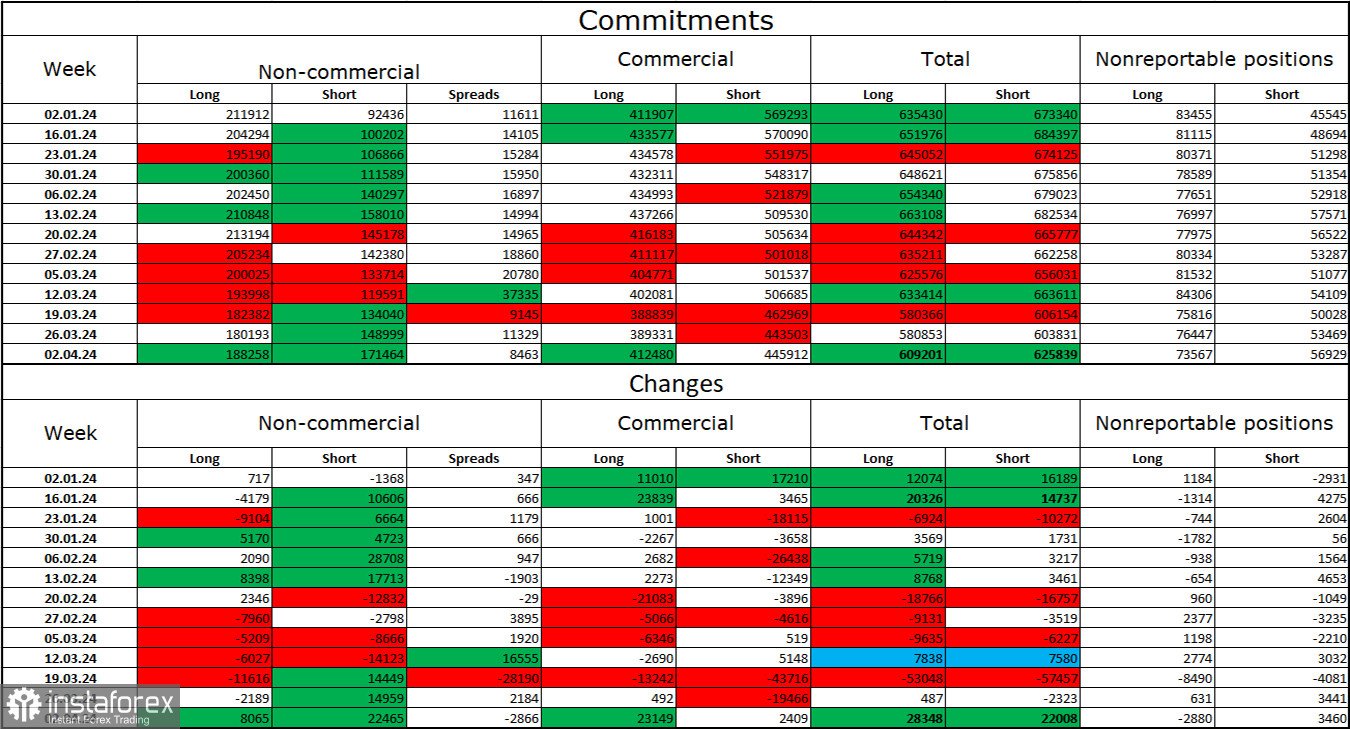

Commitments of Traders (COT) report:

During the last reporting week, speculators opened 8065 long contracts and 22465 short contracts. The sentiment of the "non-commercial" group remains "bullish" but continues to weaken rapidly. The total number of long contracts held by speculators now stands at 188 thousand, while short contracts amount to 171 thousand. I still believe that the situation will continue to change in favor of the bears. In the second column, we see that the number of short positions has increased from 92 thousand to 171 thousand over the past 3 months. Over the same period, the number of long positions decreased from 211 thousand to 188 thousand. Bulls have dominated the market for too long, and now they need a strong news background to resume the "bullish" trend. In the near future, I don't see such a background.

News Calendar for the US and the European Union:

European Union – Industrial Production Change (06:00 UTC).

On April 8th, the economic events calendar contains only one entry. The influence of the news background on traders' sentiment today will be very weak.

Forecast for EUR/USD and trading advice:

Sales of the pair were possible upon rebound from the level of 1.0862 on the 4-hour chart, with targets at 1.0785–1.0801. This target has been achieved. Upon closing below 1.0785, new sales can be opened with a target of 1.0696. Purchases of the pair were possible upon rebound from the zone of 1.0785–1.0801 with a target of 1.0866. Today, these trades can be kept open.