EUR/USD

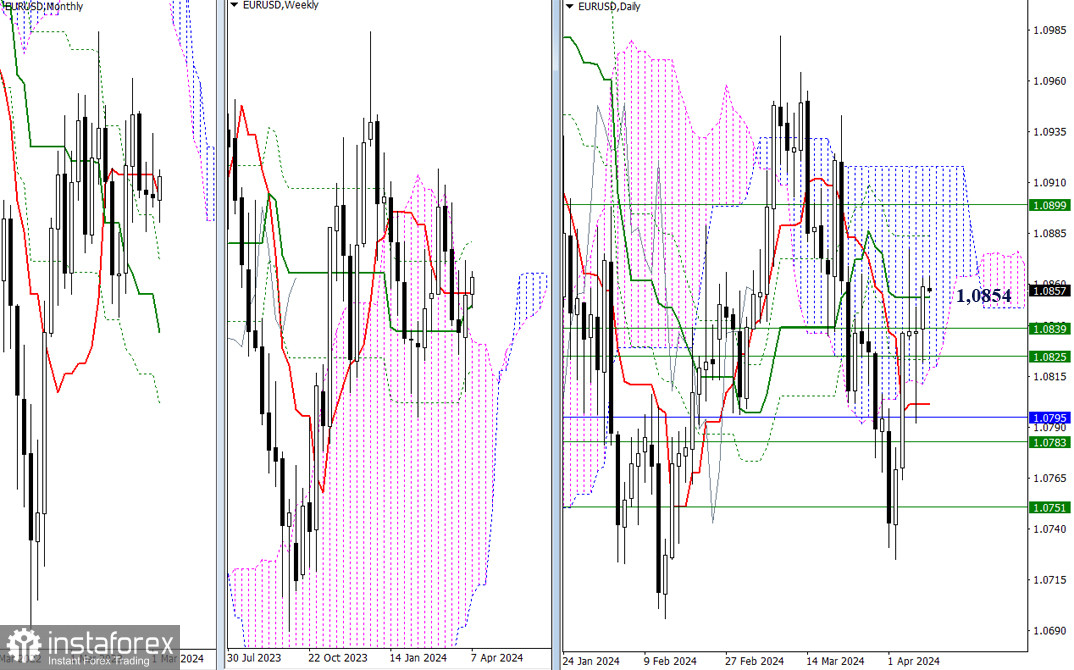

Higher Timeframes

On the first day of the new trading week, bullish players showed notable activity. They managed to close the day above the daily medium-term trend (1.0854). The following upside targets for today can be noted at 1.0884 – 1.0899 – 1.0918. Breaking through these daily and weekly resistances will allow for considering new prospects. In case of a return to weekly supports (1.0825-39), as well as breaking into the bearish zone relative to the daily cloud (1.0819), attention will be directed to the next important support zone, formed by short-term trends of the daily (1.0801), weekly (1.0795), and monthly (1.0783) timeframes.

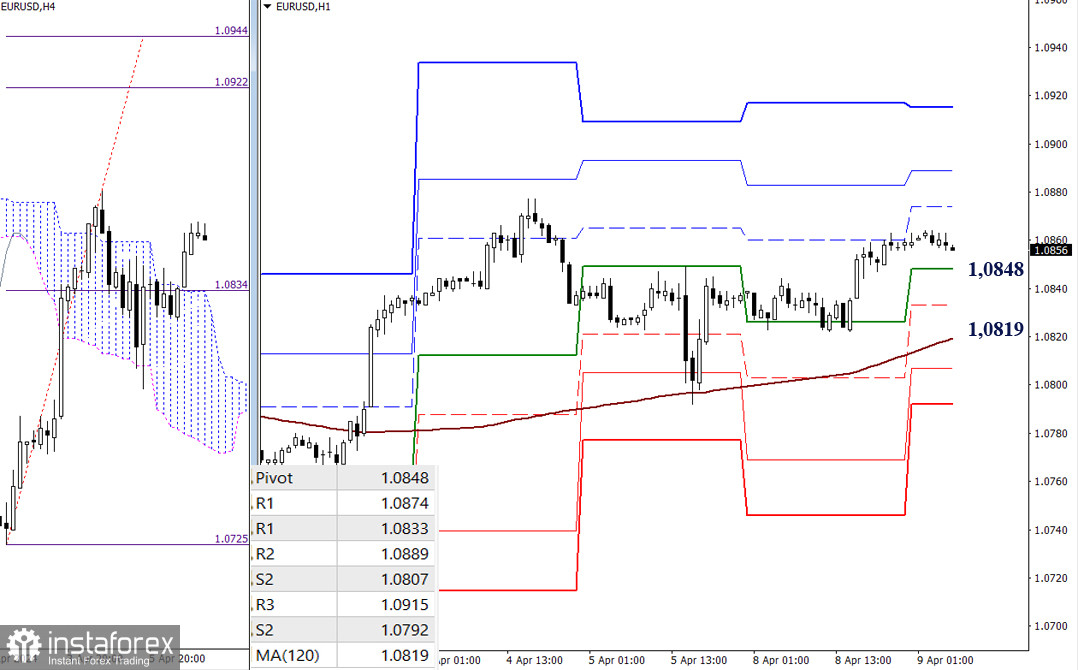

H4 – H1

Bulls continue to trade in the correction zone, maintaining their position above key levels, which are now at 1.0848 (central pivot point) and 1.0819 (weekly long-term trend). Intermediate support during correction development may also be provided by S1 (1.0833). When continuing the ascent, the intraday targets will be the resistances of classic pivot points, currently located at 1.0874 – 1.0889 – 1.0915.

***

GBP/USD

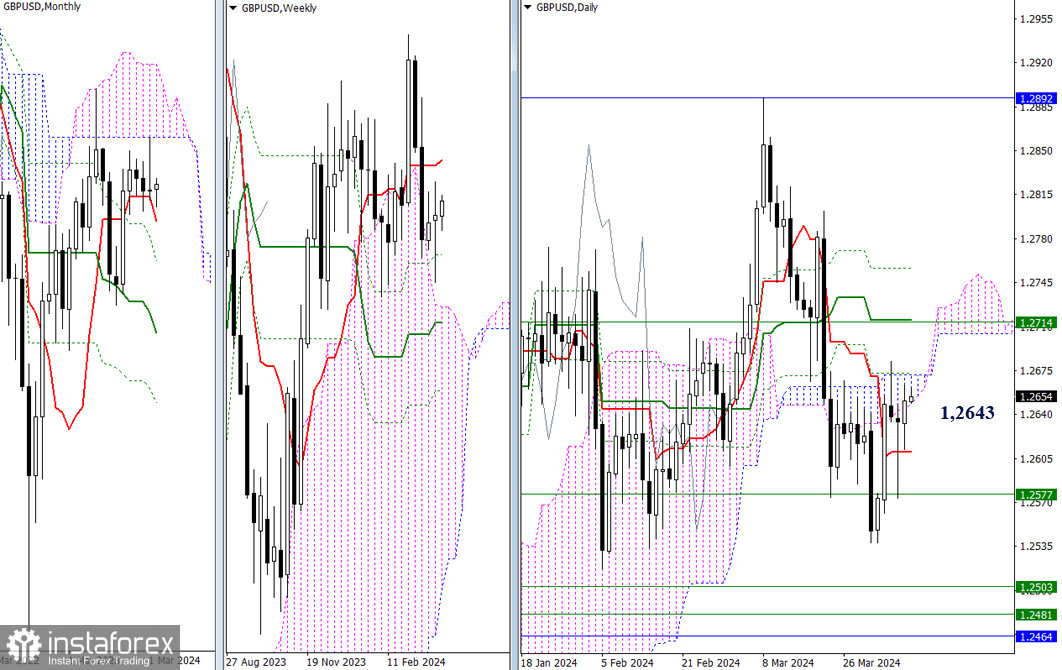

Higher Timeframes

The daily cloud (1.2643) continues to influence developments, so the situation has not undergone significant changes; the conclusions and expectations voiced earlier remain relevant. The main upward targets today are still at 1.2671 – 1.2714 – 1.2757, while the downward targets are still awaited by the market at the levels of 1.2610 – 1.2577 – 1.2538.

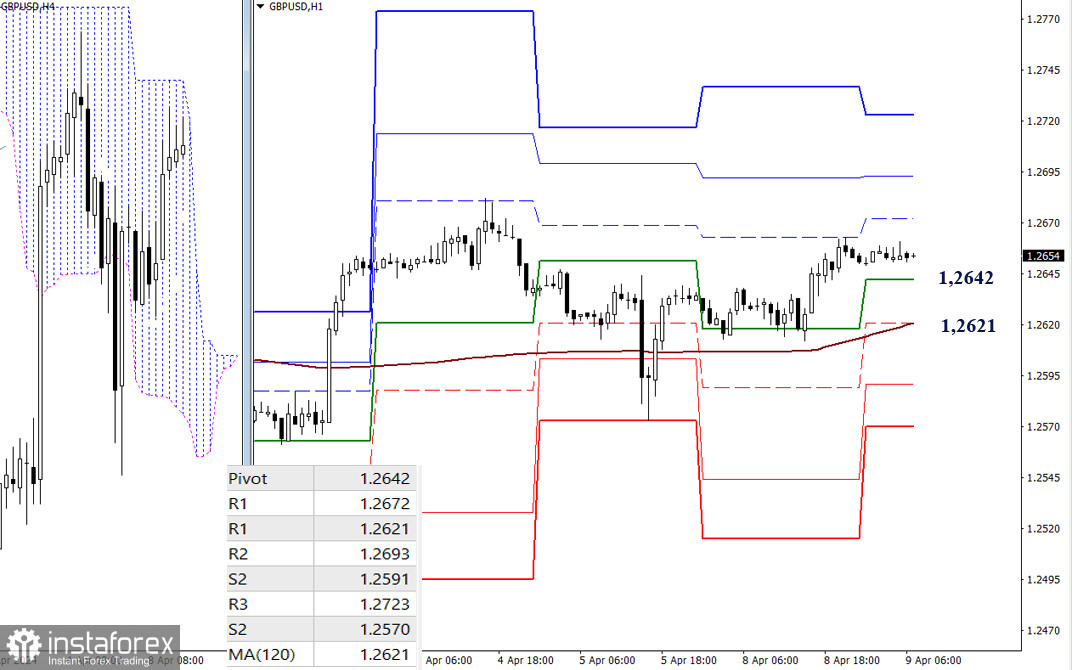

H4 – H1

At the moment, on the lower timeframes, the main advantage remains on the bulls' side. The pair is trading in the correction zone. Intraday upward targets for today can be noted at the levels of 1.2672 – 1.2693 – 1.2723 (resistances of classic pivot points). Breaking through and consolidating below the key levels of 1.2642 – 1.2621 (central pivot point of the day + weekly long-term trend) can change the current balance of power, shifting the equilibrium and possibilities towards strengthening bearish sentiments. Additional targets for bears today may be the supports of classic pivot points (1.2591 – 1.2570).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)