EUR/USD

The market's nervousness ahead of the European Central Bank meeting, which is expected to show a firm dovish stance, finally manifested - the euro slumped by 113 pips after yesterday's US inflation data. The Core CPI inflation held steady at 3.8% y/y, against expectations of falling to 3.7% y/y, while total CPI consumer inflation accelerated to +3.5% from 3.2. However, expectations for CPI were up to 3.4% y/y, so it seemed excessive for the euro to fall by more than a figure when the latest CPI figure only exceeded forecasts by 0.1%. Obviously, investors are already preempting today's ECB rate decision. Now, few doubt the possibility of an earlier start to the ECB monetary easing cycle compared to the Federal Reserve. Even if the ECB signals a rate cut in June, expectations for the Fed's first rate cut have shifted all the way to September(!). Today, we expect a dovish tone from the ECB, indicating a rate cut in the summer. We also mentioned that it wouldn't be surprising if the ECB decides to lower rates at today's meeting, as the central bank has suggested it.

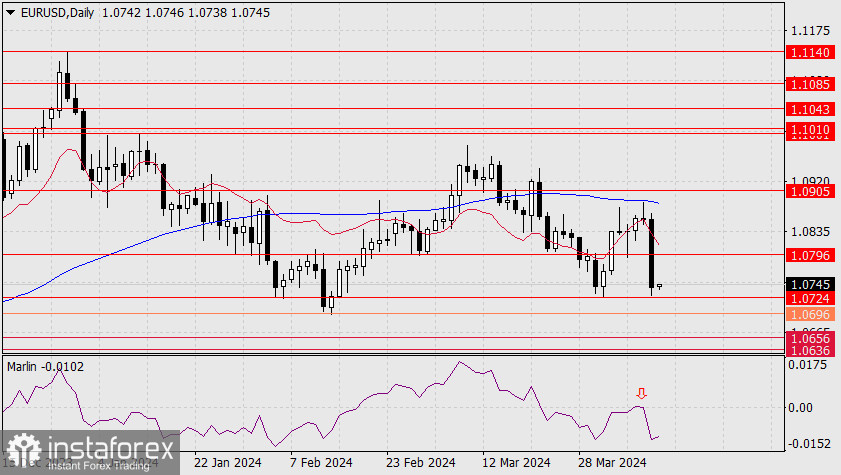

After surpassing the nearest support level at 1.0724, the euro may even fall towards the target range of 1.0636/56 (the area of the May 2023 low). There is an intermediate level at 1.0696, which may serve as a speculative frenzy point or the price could even breach this mark, as was the case yesterday with the level at 1.0796.

The 4-hour chart does not provide us with additional information. A short-term downward trend has been established, with the price consolidating ahead of the support at 1.0724. We are for the ECB's decision and the subsequent press conference by ECB President Christine Lagarde.