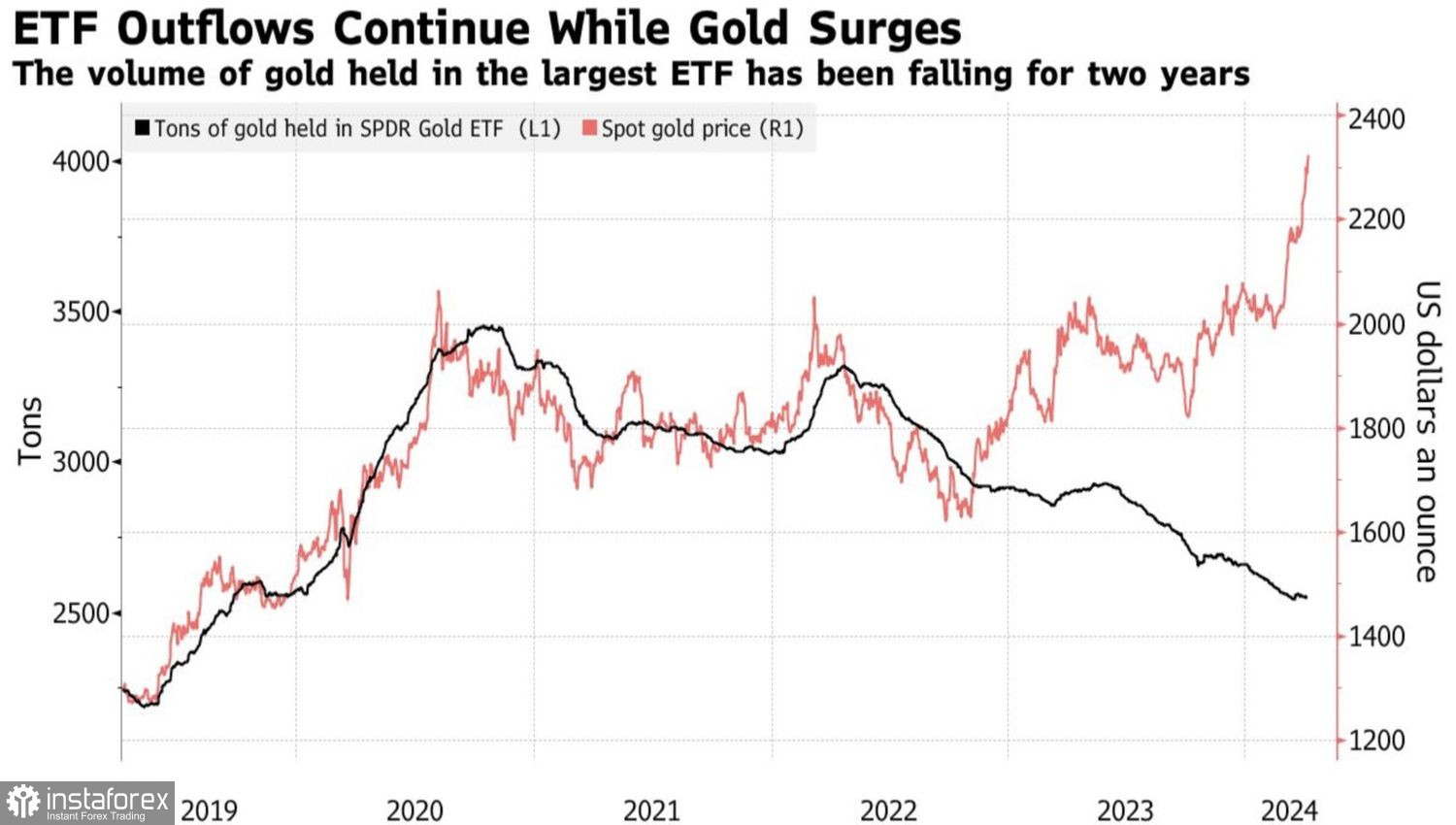

If everyone is selling, someone is buying. Capital outflow from gold ETFs amid a strong dollar and rising yields of U.S. Treasury bonds is gaining momentum. However, the precious metal doesn't tire of rewriting historical highs and has surged 18% since mid-February. Clearly, there are buyers. High demand from central banks, China, and investors hedging geopolitical and political risks laid the foundation for the swift XAU/USD rally in 2024.

Gold ETF Dynamics

Legends already circulate about central banks' increased interest in gold. Their reserves have increased by 1,000 tons or more each of the past two years. In March, the People's Bank of China increased its gold reserves for the 17th time from 72.58 to 72.74 million ounces. Their value is estimated at $161.1 billion compared to $148.6 billion at the end of February. Regulators have taken up de-dollarization, abandoning assets denominated in U.S. dollars and acquiring gold.

Speculators are doing the same. Asset managers have increased net longs in precious metals to four-year highs. They are guided by persistent geopolitical risks amid armed conflicts in Ukraine and the Middle East, and concerns about market turmoil if Donald Trump returns to the White House.

Gold Speculative Position Dynamics

According to U.S. intelligence, Iran is preparing massive airstrikes on Israeli military targets, which would escalate the six-month conflict in the Middle East. TD Securities believes that if this does not happen, XAU/USD will undergo a correction amid profit-taking by speculators with long positions. Especially since markets increasingly wonder if the Fed will cut rates in 2024.

Expectations of a significant monetary policy easing have been one of the main drivers of risky assets and commodity market assets. The Golden Age regime, where the economy grows above trend while inflation slows, created ideal conditions for rallies in stock indices, oil, and gold. However, the third consecutive acceleration of inflation in the U.S. suggests that the Golden Age has left the room.

Currently, the futures market does not believe that the federal funds rate will be cut in June, doubts about July, and prefers September. This leads to rallies in U.S. Treasury yields and the U.S. dollar. Usually, this becomes a headwind for precious metals. However, so far, gold has managed to advance in unfavorable conditions. Is there a limit to the ability of XAU/USD bulls to resist?

Technically, on the daily chart, the failure of buyers to breach the important pivot level of $2,366 per ounce became the first sign of their weakness. A drop below the $2,331 mark will allow the bears to continue to attack towards at least $2,300 and provide a basis for forming short positions. The further fate of the precious metal will depend on its ability to rebound from the EMA.