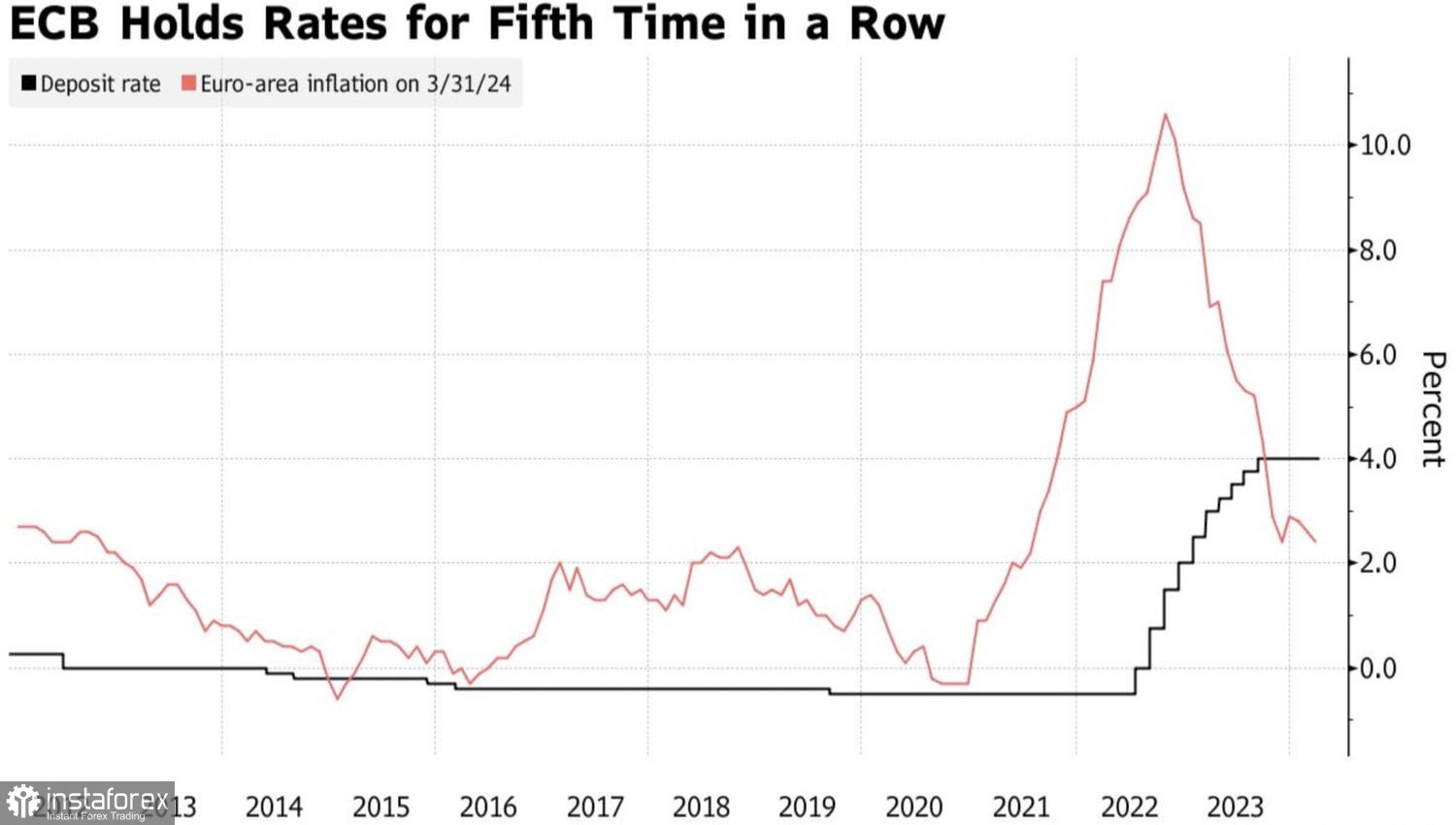

The European Central Bank (ECB) decided not to kick the fallen euro and kept the deposit rate at 4% at the fifth consecutive Governing Council meeting. This did not come as a surprise to the financial markets as the day before, only 1 out of 62 Bloomberg experts forecasted the beginning of a monetary policy easing cycle in April. As a result, the bulls on the EUR/USD caught their breath, slightly recovering after the rout against the backdrop of strong statistics on U.S. inflation for March.

The ECB had reasons to start a cycle of monetary expansion. The eurozone's weak economy and the steady movement of inflation towards the 2% target hint at the inevitability of rate cuts. If this is not done now, the risks of deflation return will increase, something the European Central Bank fought against for a long time in the past. It will be necessary to reduce borrowing costs either at each meeting or cut rates by 50 basis points at one of the meetings.

European Inflation Dynamics and the ECB Rate

On the other hand, the labor market remains strong, and service prices have anchored near 4%. Moreover, if the ECB moves earlier and faster than the Fed, the euro exchange rate will sharply weaken against the U.S. dollar. This entails an increase in import prices and an acceleration of inflation.

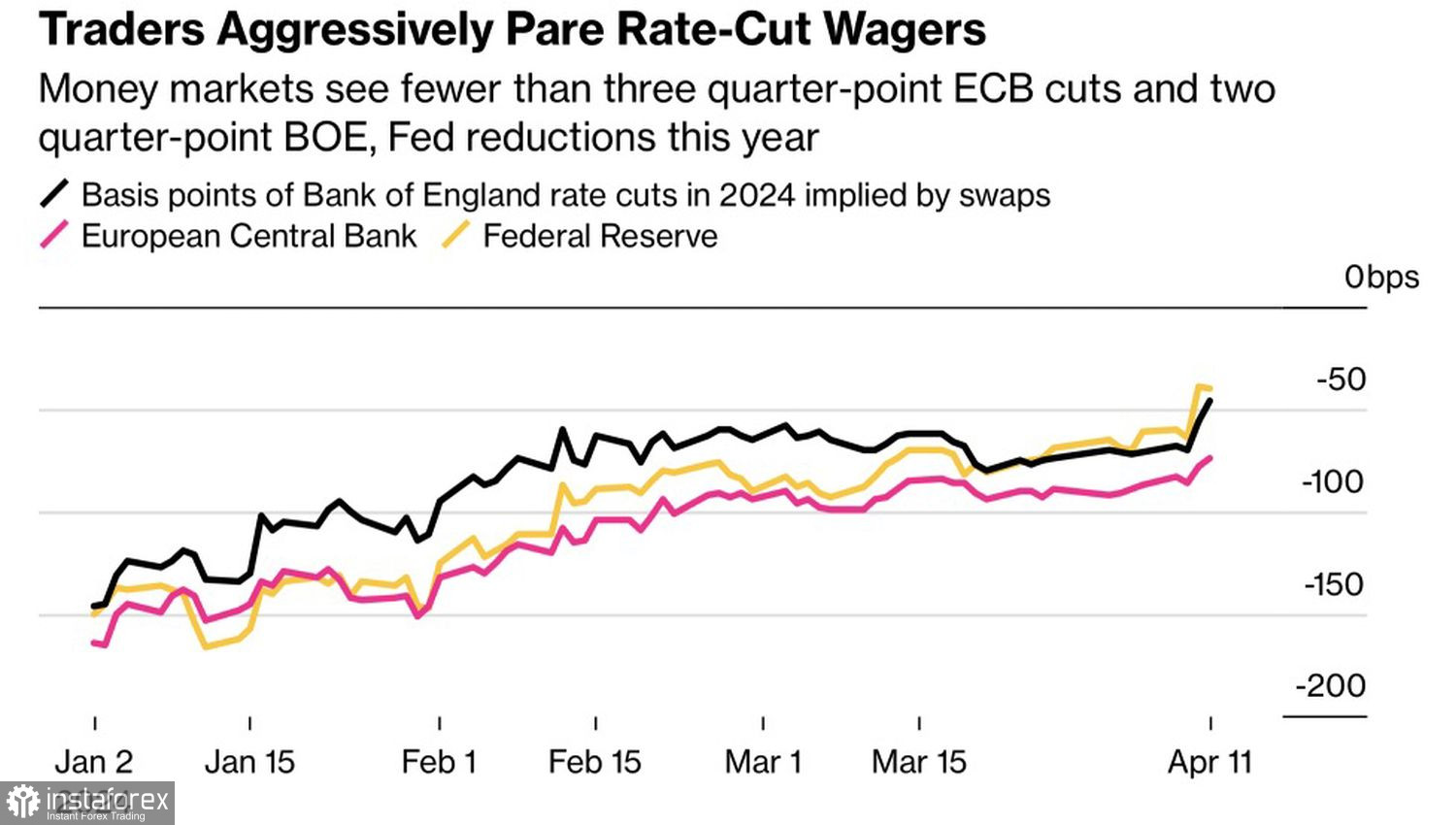

Interestingly, after the release of CPI data for March in the USA, the futures market reduced, not only the expected scale of the Fed's monetary expansion to 45 basis points but also that of the ECB. Derivatives now see a rate cut of less than 75 basis points, although previously they predicted three acts of monetary expansion with a 50% probability of the fourth in 2024.

It is obvious that central banks still act in concert, with the Fed remaining the leader. Although, it is not intending to be the first to embark on a path of easing monetary policy.

Anticipated Scales of Monetary Expansions Dynamics

Be that as it may, the ECB decided not to drown the euro. And although ECB President Christine Lagarde stated that some doves on the Governing Council were ready to cut the deposit rate as early as April, the majority of officials decided to wait for new data and render a verdict on the start of monetary expansion in June. According to Lagarde, inflation in the eurozone is likely to stabilize at the current level and return to the 2% target on a sustainable basis only in 2025. This is a clear contradiction to Bloomberg's forecast, which predicts a slowdown in consumer prices to 1.8% by summer.

In response to a question about parity in the EUR/USD pair, Lagarde noted that the euro exchange rate is not the target of the ECB's monetary policy. As for the impact of the acceleration of American CPI on the currency bloc, in the Frenchwoman's opinion, the ECB should focus on what is happening in Europe and not look at North America.

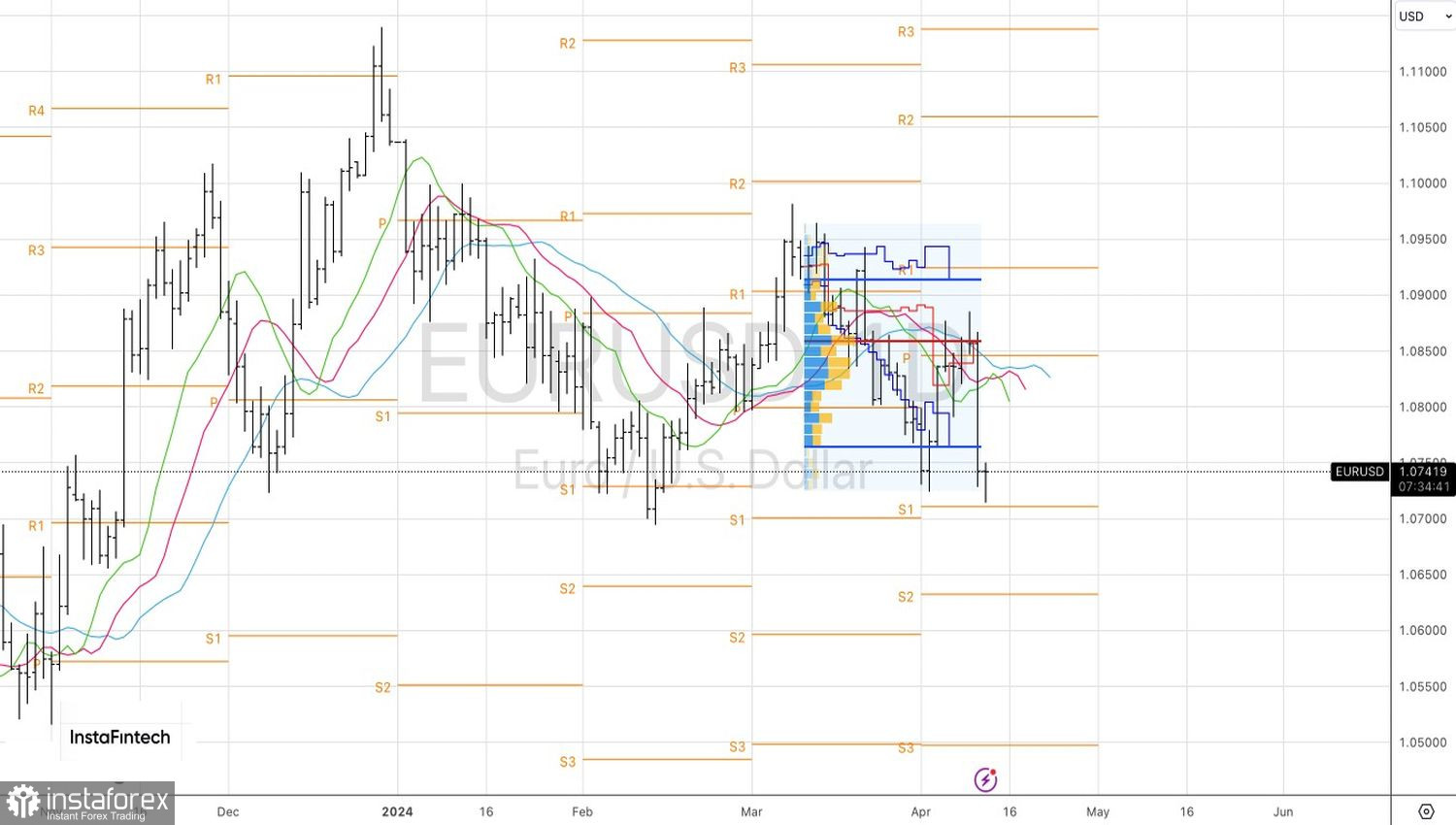

Technically, on the EUR/USD daily chart, the bulls are trying to counterattack. If they manage to form a pin bar, its realization may lead to an increase in quotes of the main currency pair to resistances at 1.0765 and 1.08. Nevertheless, a rebound from these levels is a reason to sell the euro against the U.S. dollar.