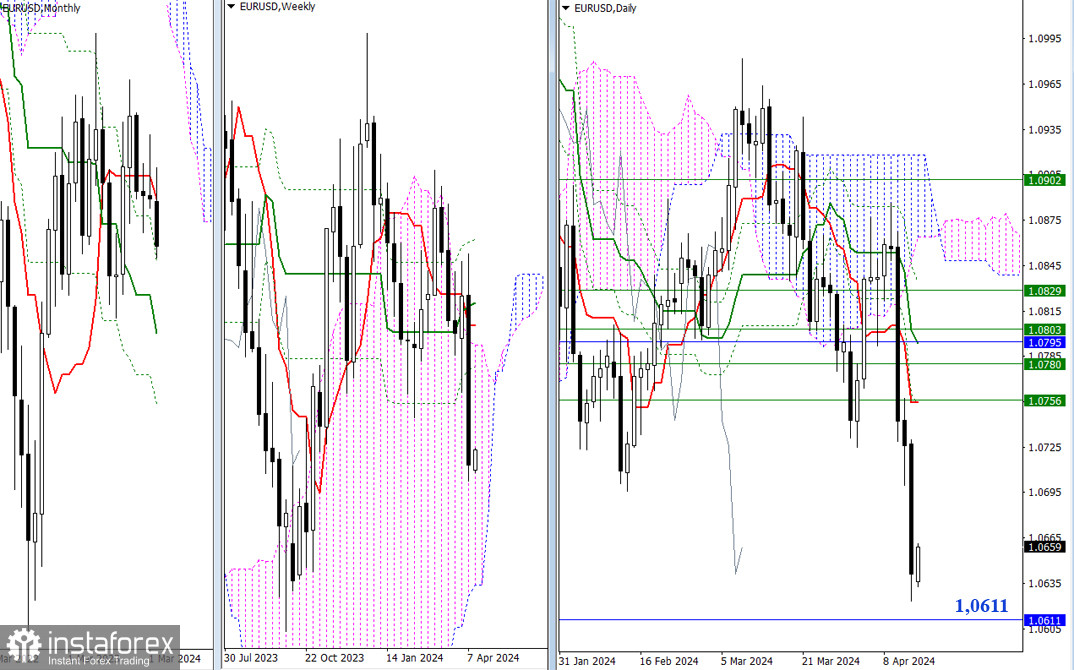

EUR/USD

Higher Timeframes

Last week had a pronounced bearish character due to the significant downward momentum. Bears approached the influence zone of the monthly support at 1.0611, so the results of testing and interaction may determine further priorities and opportunities. The levels passed today act as supports, but due to the remote location (1.0755), they are unlikely to be relevant in the near future.

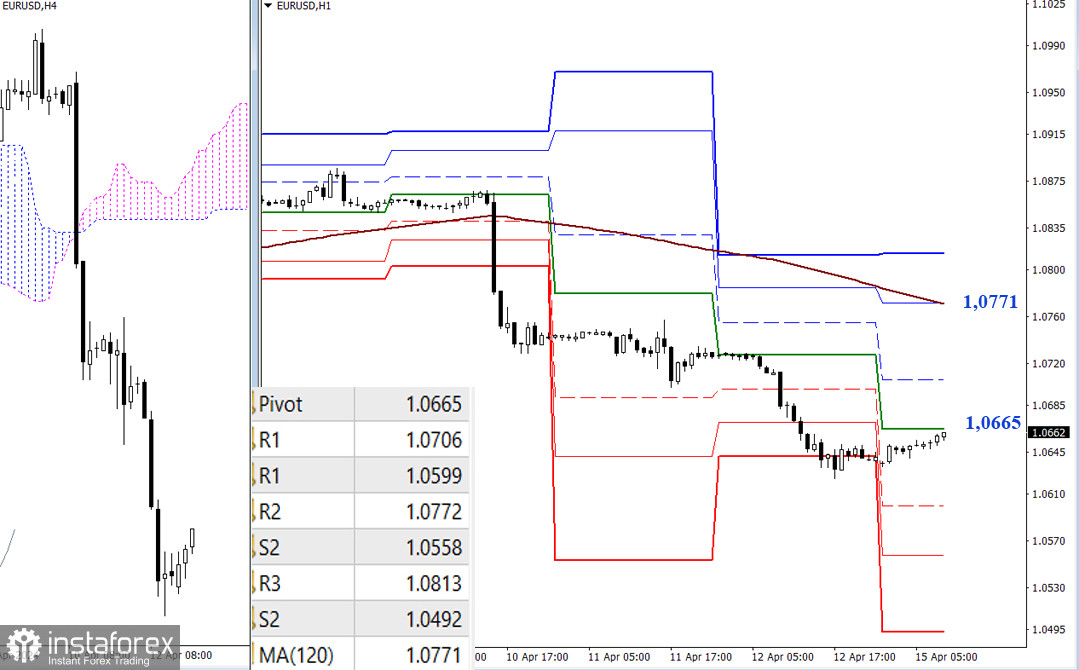

H4 - H1

The main advantage on the lower timeframes currently belongs to the bearish players. However, the pair is trading within an upward correction zone, now testing the central pivot point (1.0665). The next resistance in the development of the correction today can be noted at 1.0706 (R1), but the meeting with the weekly long-term trend (1.0771), which governs the current balance of power, will be of greater significance. A breakout and reversal of the trend could change the market's preferences. If the current correction is completed and the pair returns to the downward trend's development, the bears' focus will be on passing through the supports of classic pivot points (1.0599 - 1.0558 - 1.0492).

***

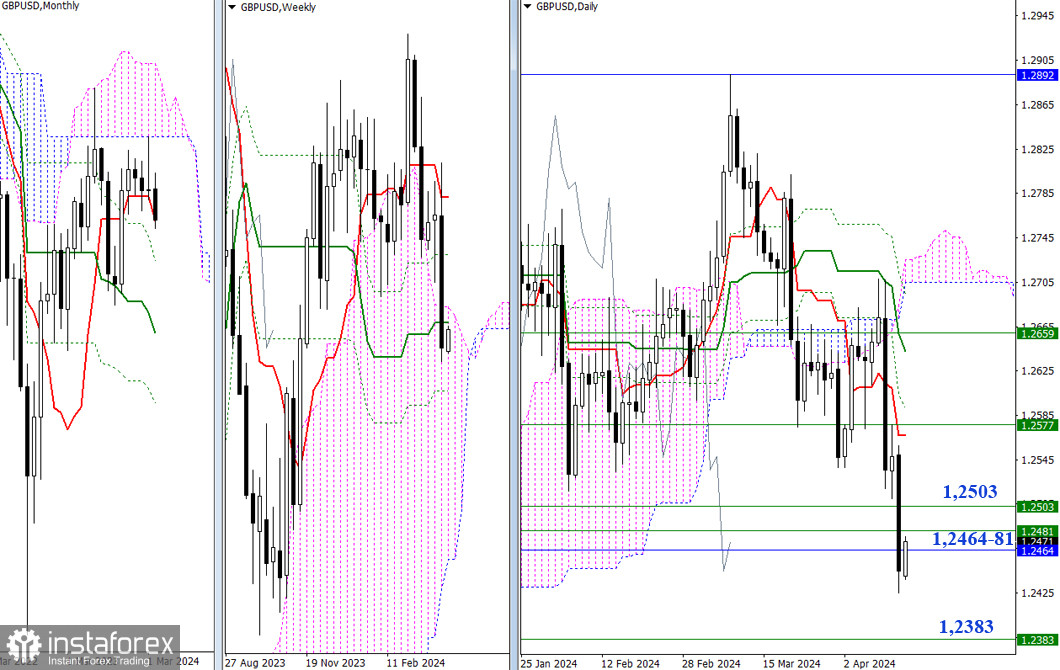

GBP/USD

Higher Timeframes

Last week, bearish players managed to assert themselves by closing the week below the current supports (1.2464 - 1.2481 - 1.2503). The main task now is to maintain the achieved level. The next bearish target on the higher timeframes is the final level of the golden cross of the weekly Ichimoku cloud (1.2383). For bullish players to re-enter the market under current conditions, they need to form a rebound from the encountered support zone (1.2464 - 1.2481 - 1.2503).

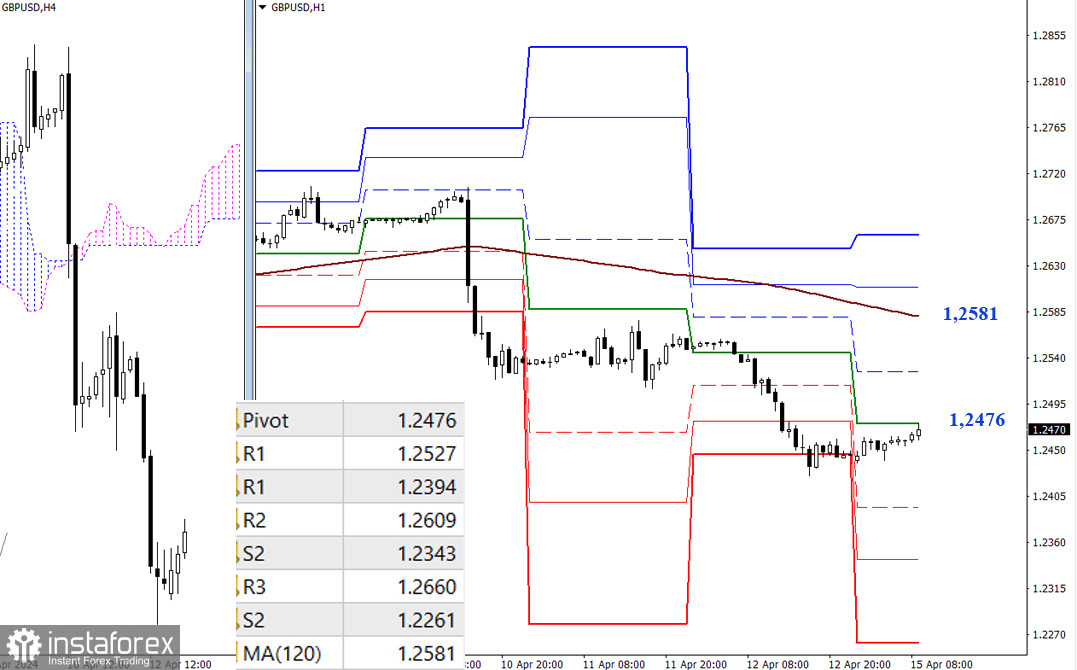

H4 - H1

At the moment, on the lower timeframes, the pair is developing an upward correction, with the main advantage belonging to bearish players. The market is currently testing the resistance of the central pivot point (1.2476). Further development of the correction may shift focus to the R1 resistance (1.2527) and then to the weekly long-term trend (1.2581). The trend determines the current balance of power, so consolidation above and reversal of the trend will contribute to changing priorities, transferring the main advantages to bullish players. The completion of the correction will direct the intraday situation for bears to work through support levels of classic pivot points (1.2394 - 1.2343 - 1.2261).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)