Tuesday was interesting not only with a whole series of interesting reports in the US and the UK but also because of the speeches by Andrew Bailey and Jerome Powell. The reports turned out to be quite dull and secondary, with the market hardly reacting to them. In general, the market ignored the speeches of both Powell and Bailey, with the only difference being that the governor of the Bank of England didn't provide any interesting information to the market, while Powell did.

Federal Reserve chair Jerome Powell has said there's been a "lack of further progress" on tackling the record-high inflation rates in the US. It's strange that it took Powell so long to understand the obvious. Most likely, optimistic expectations, in which both the market and the Fed itself are drowning in, played a role. Since the end of 2023, the market has been expecting the first rate cut by the Fed, and it just can't grasp a simple thing: if inflation doesn't decrease, the FOMC won't vote for rate cuts. The situation in America is more than favorable from an economic perspective. GDP is growing, the labor market is stable, and unemployment is low. So why rush events? After all, there are no particular deadlines for rate cuts.

The Fed may start lowering rates next year, and nothing will change. Some analysts may say that the longer the rate remains at its peak, the more the US economy may slow down. This is true, but the past year has shown us that the slowdown is quite mild and manageable. Therefore, the US central bank can afford to wait under the current circumstances.

Powell basically said the same thing. He highlighted the strength of the American economy and the stability of the labor market, implying that there is no reason to panic about high inflation. The Consumer Price Index stubbornly resists the Fed's actions, but sooner or later, it will retreat while the hawkish policy is maintained. This only means one thing: the US dollar should rise further, and the market should increase demand for it. Such a scenario fully corresponds to the current wave layout. Therefore, I expect both instruments to fall further. It's unlikely to be a daily decline, but gradually, the euro and the pound should move lower, with the euro likely to be affected more.

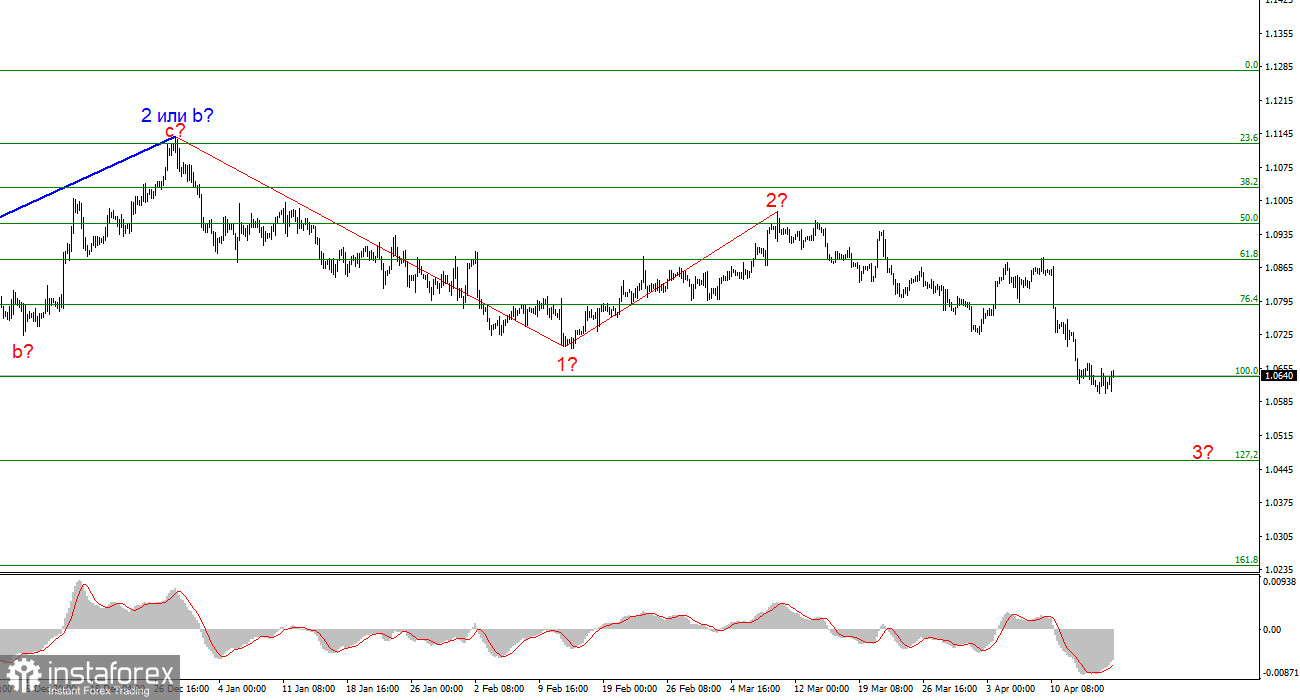

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Waves 2 or b and 2 in 3 or c are complete, so in the near future, I expect an impulsive downward wave 3 in 3 or c to form with a significant decline in the instrument. I am considering short positions with targets near the 1.0463 mark, as the news background works in the dollar's favor. The sell signal we need near 1.0880 was formed (an attempt at a breakthrough failed).

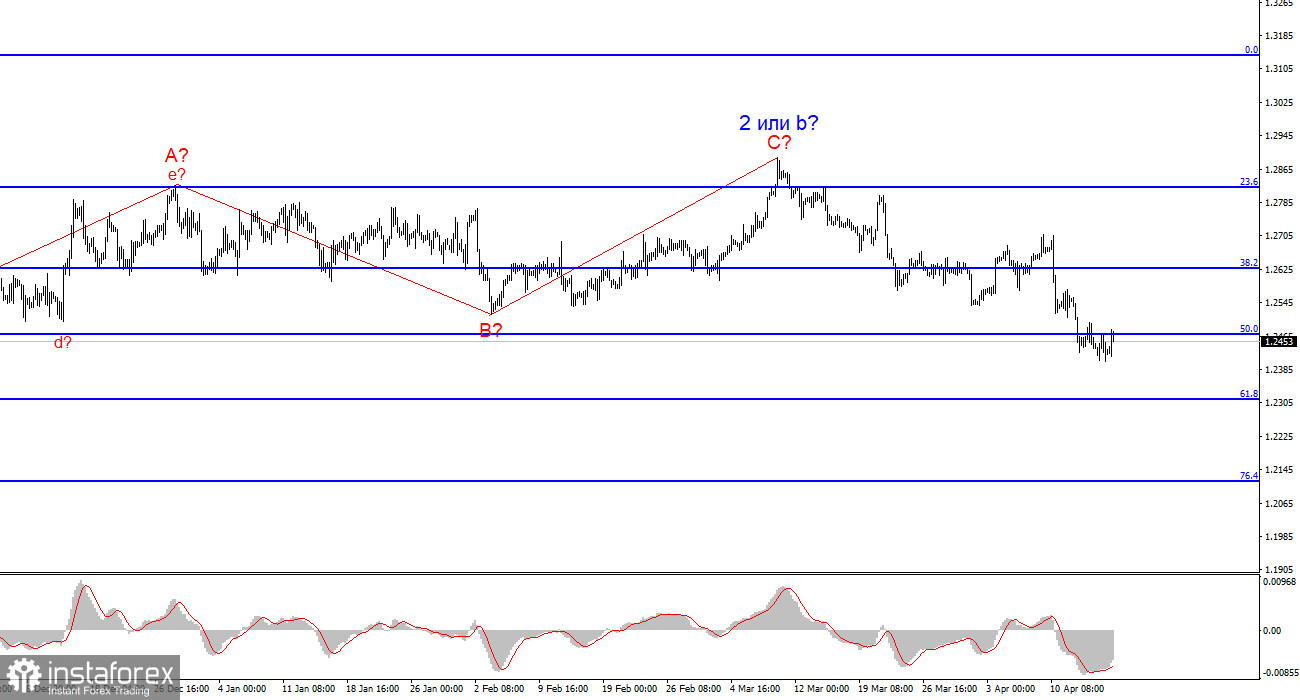

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c will have started to form. A successful attempt to break 1.2472, which corresponds to 50.0% Fibonacci, indicates that the market is finally ready to build a downward wave.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.