EUR/USD

Yesterday, the euro was up 0.49%, while the S&P 500 dropped 0.58%, gold fell 1.04%, and yields on US government bonds decreased. Even Israel's statement about a pending "retaliatory" strike against Iran did not dampen such a risky rise in the euro.

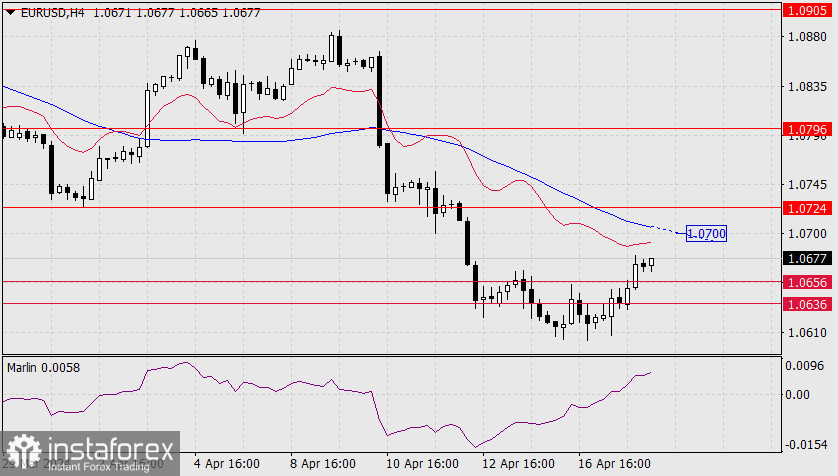

We believe that the euro has used up all its strength. The single currency rose above the range of 1.0636/56, but it may return to this mark by today as representatives of the FOMC will speak in the evening (officials are not expected to show a dovish stance) and the Unemployment Claims data will also be released. Another drop below the lower boundary of the range at 1.0636 will open up the target of 1.0567.

On the 4-hour chart, the Marlin oscillator has entered the positive territory. The sharp rise is caused by the price breaking above strong technical resistance. The MACD indicator line marks the limit of the corrective movement, which is around the level of 1.0700. It may not reach the MACD line as the price's growth above the range and the oscillator's rise above the zero line seems to be a false move.