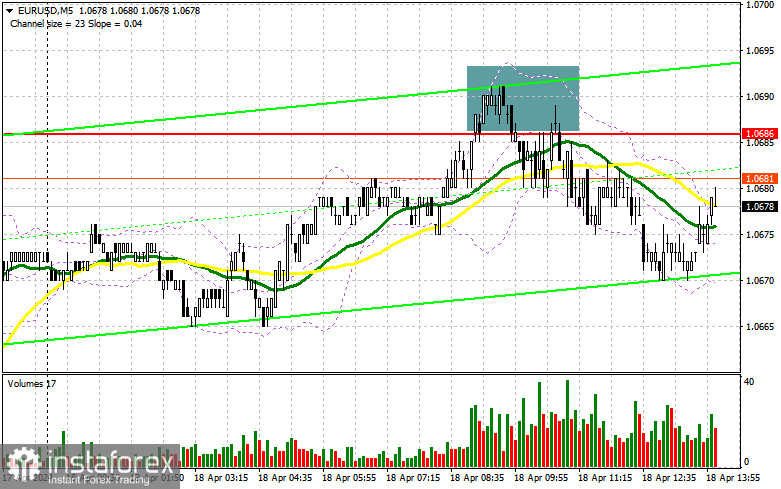

In my morning article, I paid attention to the level of 1.0686 and planned to make decisions on entering the market from there. Let's look at the 5-minute chart and discuss what happened there. The growth and a false breakout in the area of 1.0686 produced a sell signal, which was never fully realized. Having moved down by 15 pips, EUR/USD returned back to 1.0686, where trading is now taking place. In the afternoon, the technical picture changed only slightly.

What is needed to open long positions on EUR/USD

The empty economic calendar for the eurozone allowed the euro to continue its rise, but, as expected, it failed to break above 1.0686. There are probably few people willing to buy at such highs amid a bear market that is not going away. Ahead we have figures on the weekly number of initial claims for unemployment benefits, the Philadelphia Fed manufacturing index, and existing home sales in the US. As a rule, strong economic data support the US dollar. Buyers of the European currency will be ready for this if EUR/USD declines to the area of 1.0647.

A false breakout would be a suitable option for buying in anticipation of another attempt to test 1.0688, which was not possible in the first half of the day. A breakout and update from top to bottom of this range will lead to growth in EUR/USD with a chance of a breakthrough to 1.0726. The farthest target will be a high at 1.0754, where I will take profit. If EUR/USD declines and there is no activity in the area of 1.0647, where the moving averages are slightly higher, playing on the side of buyers, pressure on the euro will return as part of the bearish trend. In this case, I will enter the market only after a false breakout in the area of the next support 1.0605. I plan to open long positions immediately on a dip from 1.0569, bearing in mind an upward correction of 30-35 pips within the day.

What is needed to open short positions on EUR/USD

The euro sellers have every chance of a further decline. A false breakout in the area of the morning resistance at 1.0688, which has been slightly shifted upward, will be an ideal scenario for entering short positions with the prospect of updating support at 1.0647, where I expect more robust buying activity. A breakout and consolidation below this range, as well as a reverse test from bottom to top, will give another selling point with the price moving to the area of 1.0605, which will revive the bearish trend. I expect more active participation from large buyers there. The farthest target will be at least 1.0569, where I will take profits. If EUR/USD moves upward in the afternoon, and there are no bears at 1.0688, and this level has already been tested for strength once today, the bulls will try to continue the correction. In this case, I will postpone short positions until the test of the next resistance at 1.0726. I will also sell there, but only after unsuccessful consolidation. I plan to open short positions immediately during a rebound from 1.0754, anticipating an intraday downward correction of 30-35 pips.

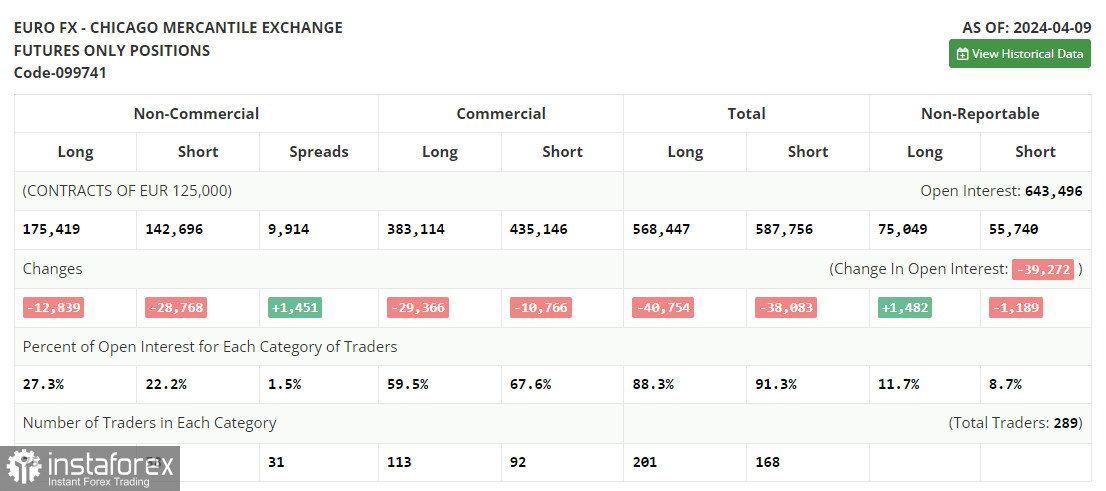

The COT (Commitment of Traders) report for April 9 showed a decrease both in long and short positions. The meeting of the European Central Bank and the dovish tone of policymakers, as well as the large fall in the euro that followed, indicate the lingering problems of the buyers of risky assets. Considering that the rhetoric of the Federal Reserve, on the contrary, will remain hawkish for a longer period, there is no reason to count on a return in demand for the euro yet. For this reason, I bet on further development of the bullish trend in the US dollar and a decline in the euro. The COT report indicated that long non-commercial positions fell by 12,839 to 175,419, while short non-commercial positions dropped by 28,768 to 142,696. As a result, the spread between long and short positions increased by 1,451.

Indicators' signals

Moving averages

The instrument is trading slightly above the 30 and 50-day moving averages. It indicates that the euro is making attempts to extend its growth.

Note: The period and prices of the moving averages are considered by the analyst on the 1-hour chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

In case EUR/USD goes down, the indicator's lower border at about 1.0650 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.