The upcoming news background for the US will be quite interesting. Although there will be few significant events, news from the US often has the greatest impact on the currency market. However, the news will have local significance for investors. I will highlight reports on business activity indexes, new home sales, durable goods orders, GDP in the first quarter, initial jobless claims, changes in personal income and spending of American consumers, consumer sentiment index, and the PCE index.

As we can see, there will be quite a few reports, and some of them may affect market sentiment. In my opinion, the most valuable reports are durable goods orders and GDP. Economists expect US economic growth in the first quarter to be 2.5%, which is noticeably lower than in the fourth quarter (+3.4%) or the third quarter (+4.9%). Despite the slowdown in the US economy, its current growth rates still indicate a healthy state. Therefore, even a slowdown in GDP should not have a negative impact on the US dollar, considering the monetary policy of the Federal Reserve. Also, I would like to remind you that the latest inflation reports suggest that the US central bank will not be softening its stance in the coming months. Therefore, a slowdown in economic growth is an absolutely natural side effect of the hawkish policy.

The report on durable goods orders is traditionally important for the market, as the goods are quite expensive and they reflect the population's prosperity, as well as their desire and ability to spend large sums. Take note that the Fed aims to reduce spending and slow down wage growth. Therefore, if the latest report shows that orders have increased, this would signify that it may take a long time for inflation to slow down at an ideal pace. This would give the Fed more reason to maintain the current interest rate level for even longer, which will support the dollar. I believe that the news background from the US will not hinder the market from increasing demand for the dollar.

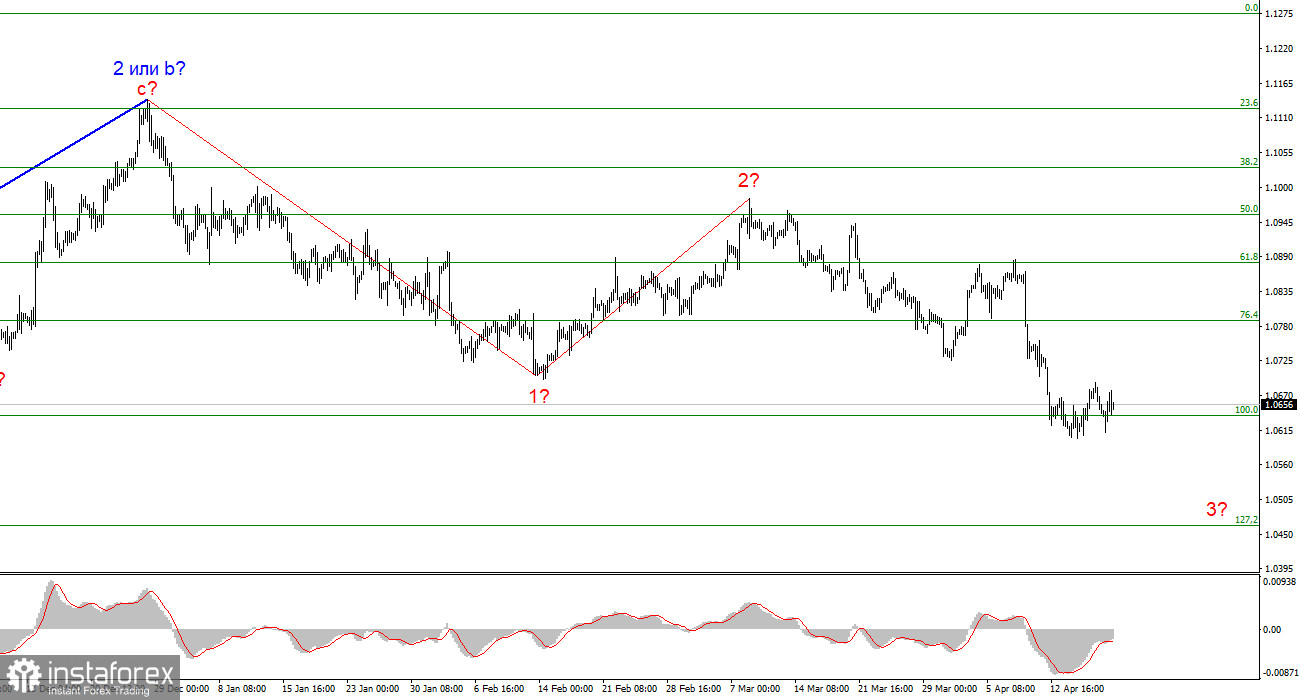

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Waves 2 or b and 2 in 3 or c are complete, so in the near future, I expect an impulsive downward wave 3 in 3 or c to form with a significant decline in the instrument. I am considering short positions with targets near the 1.0463 mark, as the news background works in the dollar's favor. The sell signal we need near 1.0880 was formed (an attempt at a breakthrough failed).

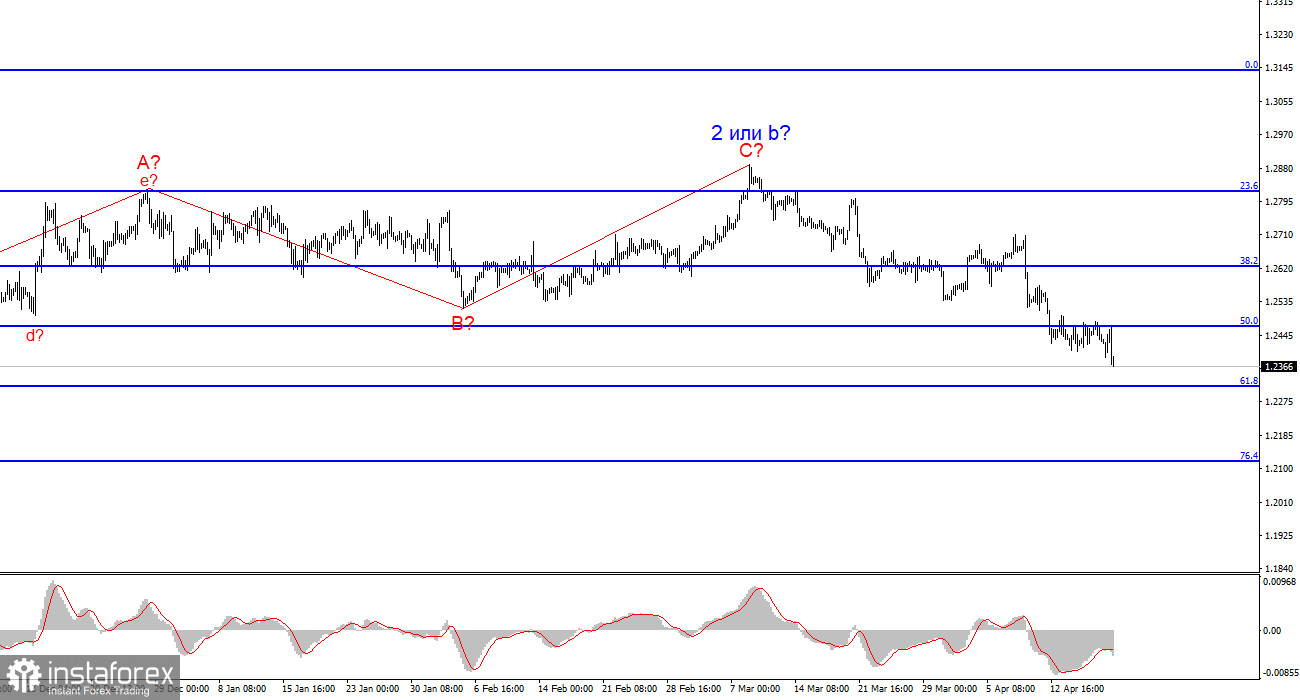

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c has started to form. A successful attempt to break 1.2472, which corresponds to 50.0% Fibonacci, indicates that the market is ready to build a descending wave.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.