Overview of trading and tips on GBP/USD

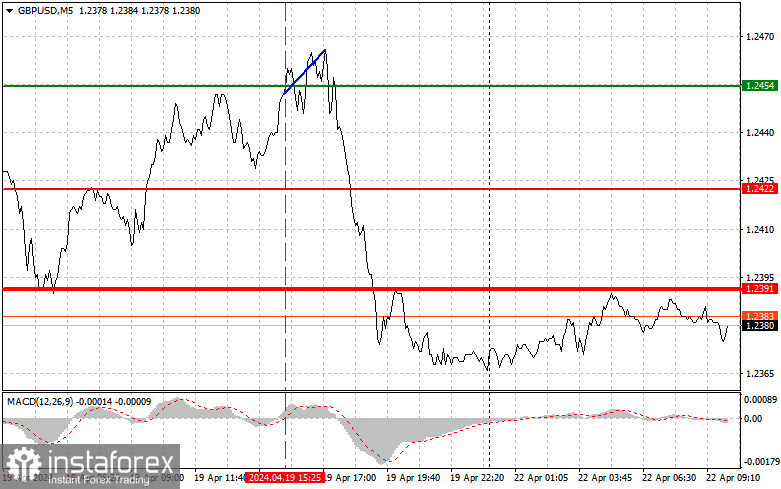

The price test of 1.2454 in the afternoon occurred at a time when the MACD indicator was just starting to move up from the zero mark, which confirmed the correct entry point to buy the pound. However, despite the bulls' efforts, the pair did not sharply rise. The weak UK retail sales data did not have much impact on the pair in the morning, but disagreements within the Bank of England about when and how to lower interest rates, which will have costly consequences for the economy, intensified pressure on the pound by the end of the US session. Today, the UK will only release a report on the balance of industrial orders from the Confederation of British Industry, which may only have a minor impact on the market. For this reason, the pair will remain under pressure, especially if the bulls fail to regain control of the daily high. As for the intraday strategy, I will rely more on the implementation of scenarios No. 1 and No. 2.

Buy signals

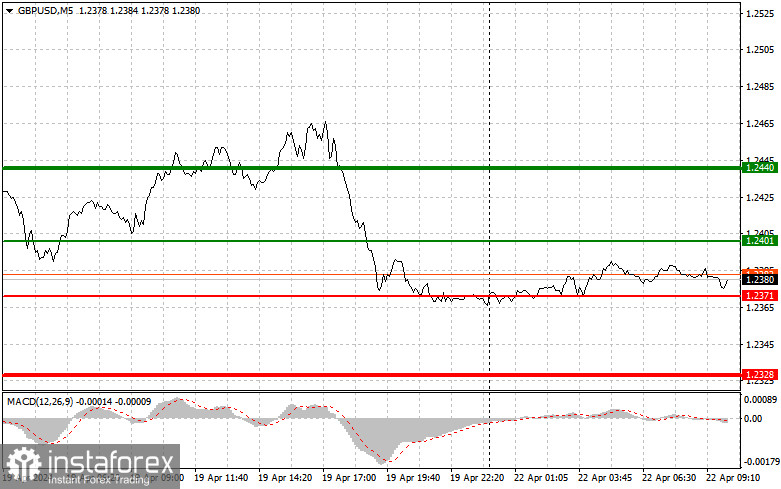

Scenario No. 1. I plan to buy the pound today when GBP/USD reaches the area around 1.2401 plotted by the green line on the chart, aiming for growth to 1.2440 plotted by the thicker green line on the chart. In the area of 1.2440, I'm going to close long positions and open short ones in the opposite direction (expecting a movement of 30-35 pips in the opposite direction from the level). You can count on the pound's growth today if the bulls are active around last week's low. Before buying, make sure that the MACD indicator is above the zero mark and is just starting to rise from it.

Scenario No. 2. I also plan to buy the pound today in case of two consecutive tests of the price of 1.2371 at the time when the MACD indicator is in the oversold area. This will limit the downward potential of the instrument and lead to an upward reversal of the market. We can expect growth to the opposite levels of 1.2401 and 1.2440.

Sell signals

Scenario No. 1. I plan to sell the pound today after it revisits the level of 1.2371 (the red line on the chart), which will lead to a rapid decline in GBP/USD. The key target for sellers will be 1.2328, where I am going to close short positions and also immediately open long positions in the opposite direction (expecting a movement of 20-25 pips in the upward direction from that level). You can sell the pound after the pair fails to consolidate near the local high. Before selling, make sure that the MACD indicator is below the zero mark and is just starting to decline from it.

Scenario No. 2: I also plan to sell the pound today in case of two consecutive tests of 1.2401 at the time when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a downward reversal of the market. We can expect a decline to the opposite level of 1.2371 and 1.2328.

What's on the chart:

The thin green line is the entry price at which you can buy the trading instrument.

The thick green line is the price where you can set Take-Profit (TP) or manually fix profits, as further growth above this level is unlikely.

The thin red line is the entry price at which you can sell the trading instrument.

The thick red line is the price where you can set Take-Profit (TP) or manually fix profits, as further decline below this level is unlikely.

MACD line: it is important to be guided by overbought and oversold areas when entering the market

Important: Novice traders in the cryptocurrency market need to be very cautious when making decisions to enter the market. It is best to stay out of the market before important fundamental reports are released to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always place stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you don't use money management and trade with large volumes.

Remember, for successful trading, it is necessary to have a clear trading plan, similar to the one I presented above. Spontaneously making trading decisions based on the current market situation is inherently a losing strategy for an intraday trader.