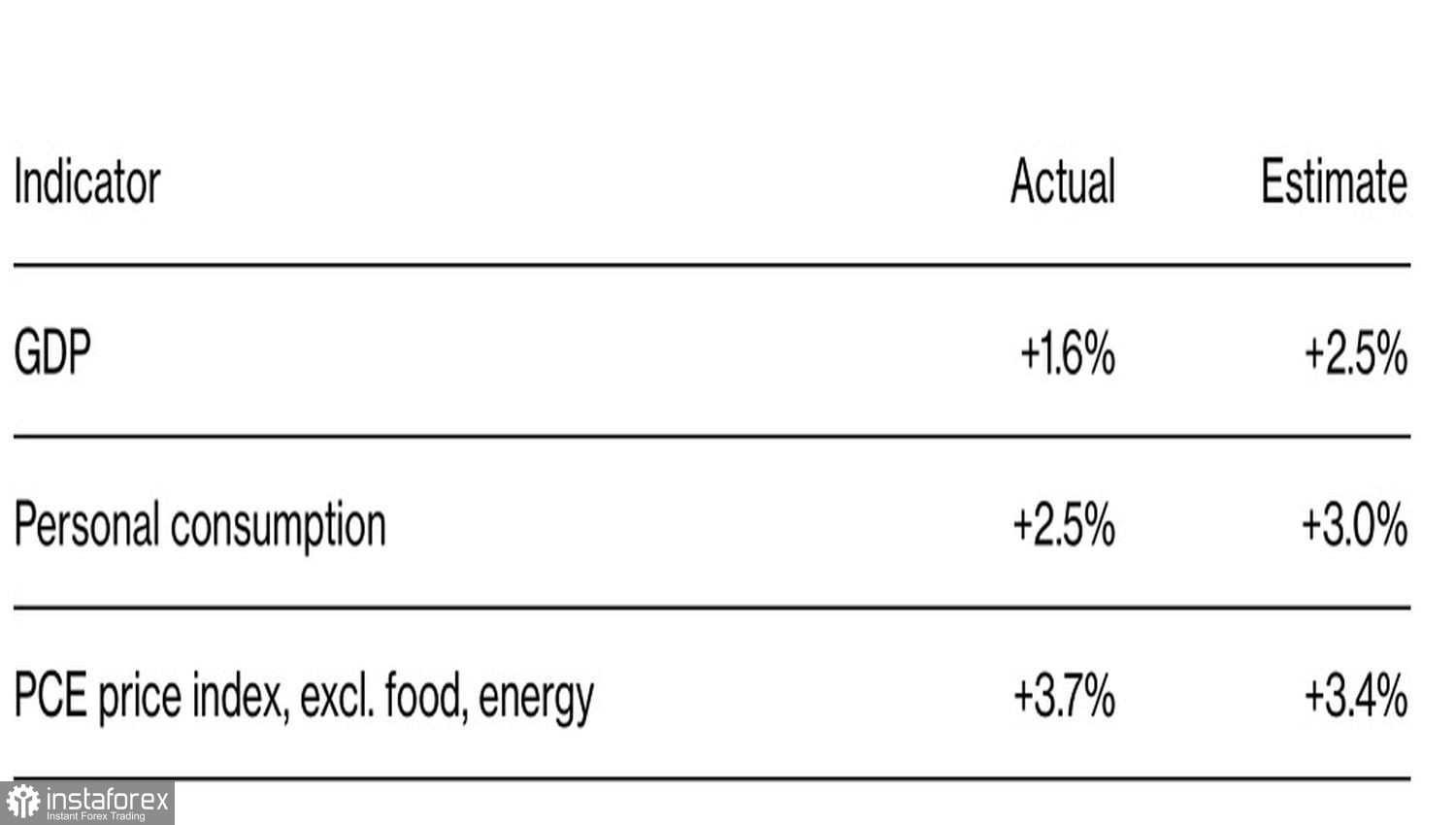

"Buy the rumor, sell the fact." US economic growth fell short of expectations, yet investors were so convinced of its slowdown that they were selling the US dollar from the beginning of the week until April 26. As soon as it became known that GDP expanded by 1.6%, rather than the anticipated 2.5% as forecasted by Bloomberg experts, it was time to take profit. As a result, EUR/USD failed to stay above the 1.07 mark.

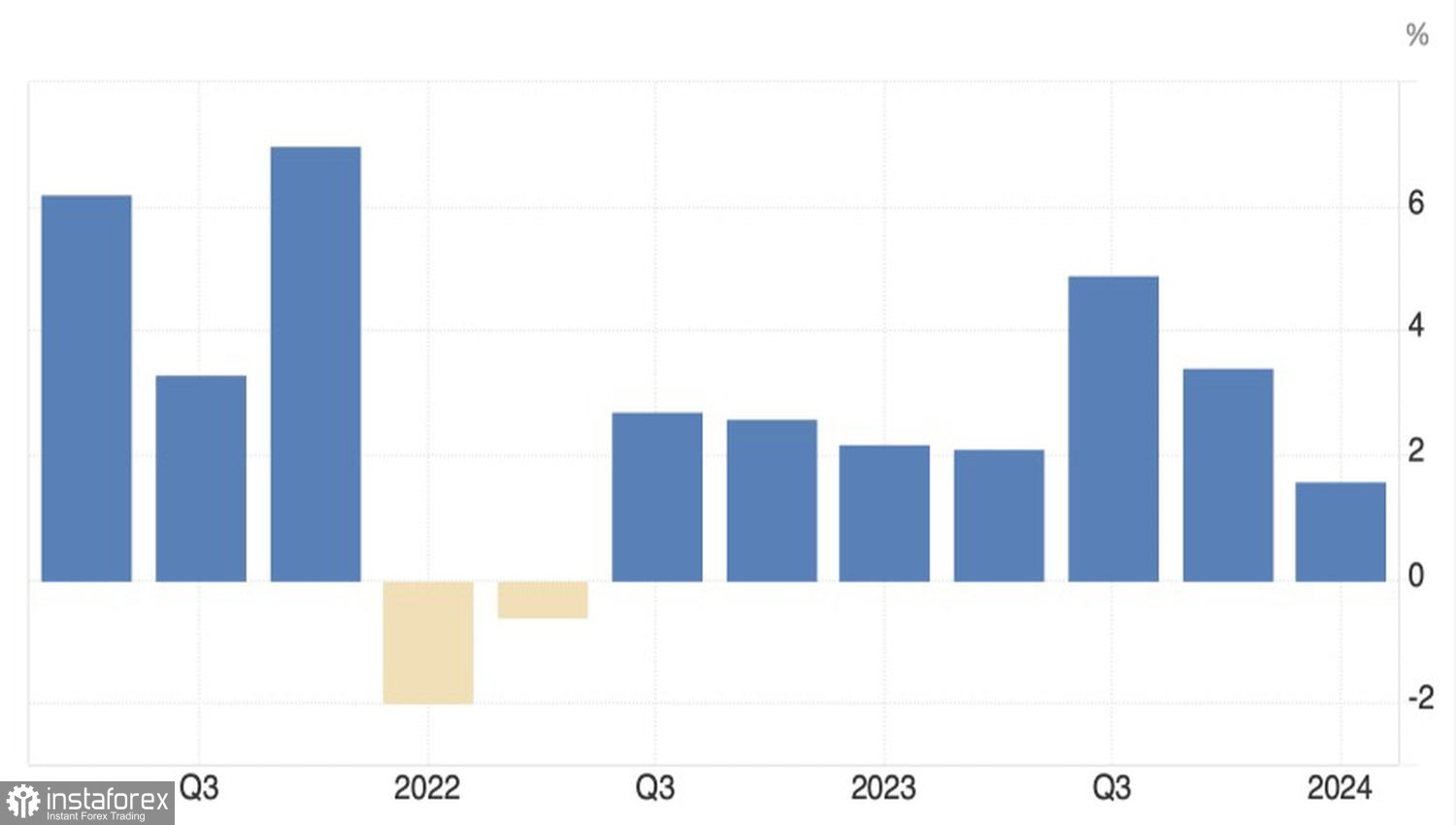

The US economy grew at its slowest pace since the start of the Federal Reserve's tightening cycle in 2022, which had initially spooked American consumers. This time around, they became the main driving force behind gross domestic product expansion. Personal spending in the first quarter increased by 2.5%, while PCE jumped to 3.7%, exceeding expectations of +3.4%. In my opinion, it was the inflation dynamics alongside confirmed unemployment benefit claims that spooked EUR/USD bulls.

US GDP Dynamics

Investors received a slowing economy and accelerating inflation, which makes it more complicated for the Fed. The US central bank needs time to reflect and gather new data. It's no wonder that the chances, as indicated by CME derivatives, of the Fed cutting the federal funds rate in June fell from 18% to 13% the day before the important release, and in July, from 43% to 38%. The futures market extended a helping hand to the EUR/USD bears.

Wells Fargo believes that the GDP report raised the possibility that the US economy might be heading for stagflation, where prices are significantly higher than what Fed Chair Jerome Powell and his colleagues would prefer, while the economy loses steam. Essentially the same thing happened in the UK at the beginning of the year, and its currency, the pound, felt very confident. Should we be surprised by the dollar's success?

Key Indicators from the US GDP Report

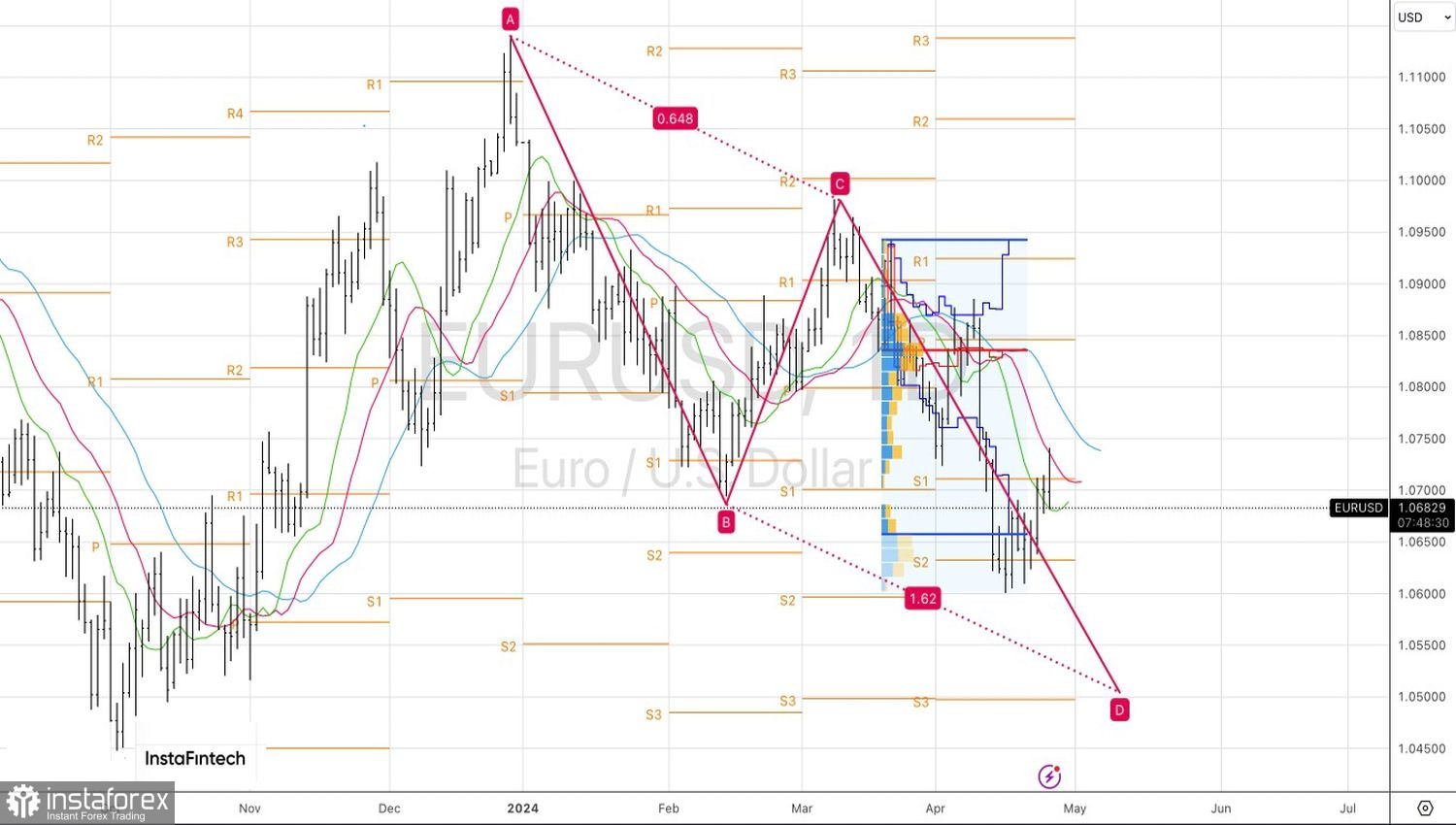

Thus, the market's initial reaction was to be shocked; however, EUR/USD is gradually recovering. If the divergence in economic growth between the US and the Eurozone diminishes, bulls shouldn't throw in the towel just yet. The latest data on German business activity, business climate, and consumer confidence indicate positive shifts in the German economy. Meanwhile, France continues to remain the workhorse of the currency bloc. Let's see if the euro can capitalize on this.

Once the GDP fervor subsides, investors will focus on the Personal Consumption Expenditure data – the Fed's preferred inflation gauge. According to Bloomberg experts' forecasts, the March PCE is expected to accelerate from 2.5% to 2.6% on an annual basis and maintain its previous 0.3% monthly growth. This isn't the kind of dynamic that will make everyone rush to the US dollar.

Technically, the formation of a daily EUR/USD candlestick with a long upper shadow shows the bulls' weakness. They failed to lift the pair's quotes out of the previously defined consolidation range of 1.061–1.071. Furthermore, if the euro falls below $1.068, it will catalyze a peak towards its lower boundary and serve as a trigger for selling.