America will take the lead in delivering news to the currency market. The market is entirely focused on news surrounding the US, so this will have the greatest impact on the dollar exchange rate, which is embedded in both EUR/USD and GBP/USD.

If Monday and Tuesday are relatively quiet in terms of news, Wednesday will be quite eventful. The ISM Manufacturing Purchasing Managers' Index (PMI) will start off the week. I want to remind you that the market puts greater importance on the ISM indices than the S&P indices, so it may show a much stronger reaction. The S&P indices showed weak values in April, but the ISM indices are not obligated to match them. They could be stronger.

In addition to the ISM index, Wednesday will see the release of the ADP Employment Report on changes in non-farm payrolls and the JOLTS report on job openings in March. Both of these reports reflect the state of the labor market, which is very important for the Federal Reserve. And Wednesday evening will mark the conclusion of the FOMC meeting. The market is not expecting a rate cut in the May meeting, although not long ago it anticipated the first round of monetary policy easing in March. Therefore, the most important event will be Fed Chair Jerome Powell's speech. If Powell says that the Fed is not considering a rate cut in the near future and inflation has stopped slowing down, demand for the US dollar may increase, which is what we need. I also want to note that Powell could hint at further policy tightening, since the Fed is not pleased with the current pace of inflation. Any hawkish comments will allow market participants to increase demand for the dollar once again.

On Friday, the market will receive another package of crucial information. The Nonfarm Payrolls report, the unemployment rate, wage growth, and the ISM Services PMI. All four reports are of immense importance for the US economy, the Fed, monetary policy, and the dollar exchange rate. The latest GDP report was quite disappointing, so it is very important for the upcoming US reports to exceed market expectations. Without this, both instruments may struggle to return to a downward trend.

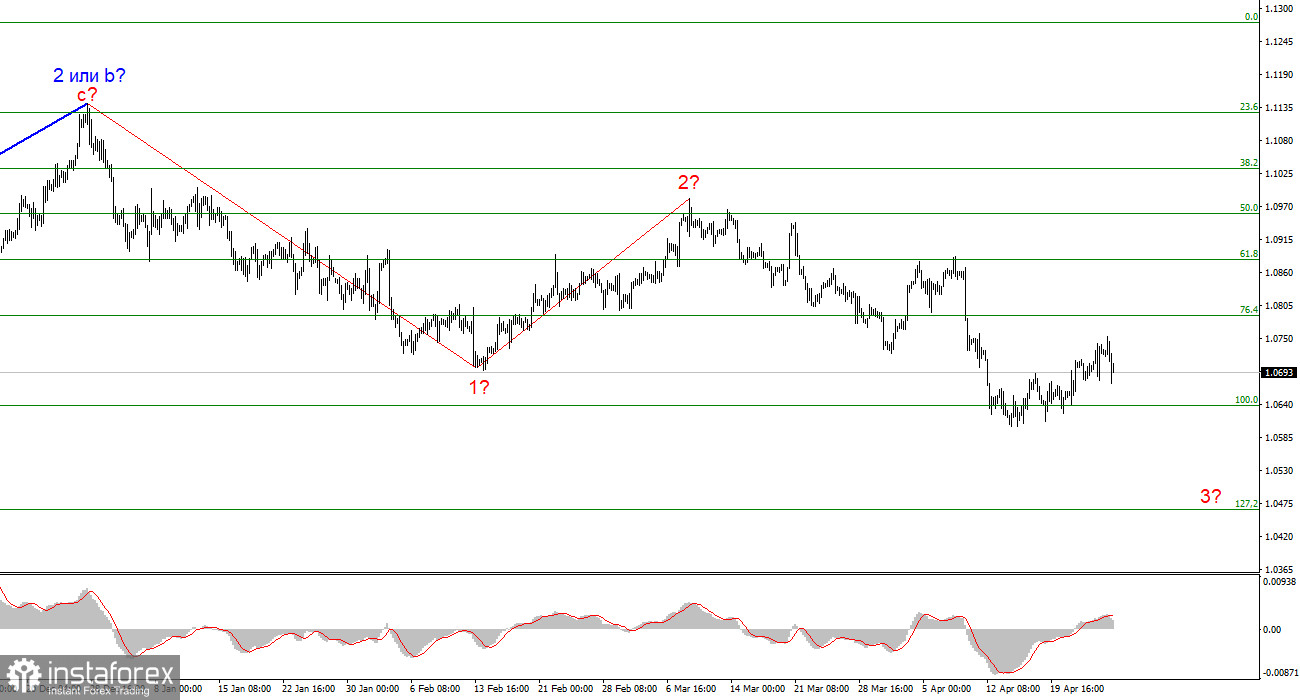

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Waves 2 or b and 2 in 3 or c are complete, so in the near future, I expect an impulsive downward wave 3 in 3 or c to form with a significant decline in the instrument. I am considering short positions with targets near the 1.0462 mark, as the news background works in the dollar's favor. A successful attempt to break 1.0637, which is equal to 100.0% Fibonacci, will indicate that the market is ready for new short positions.

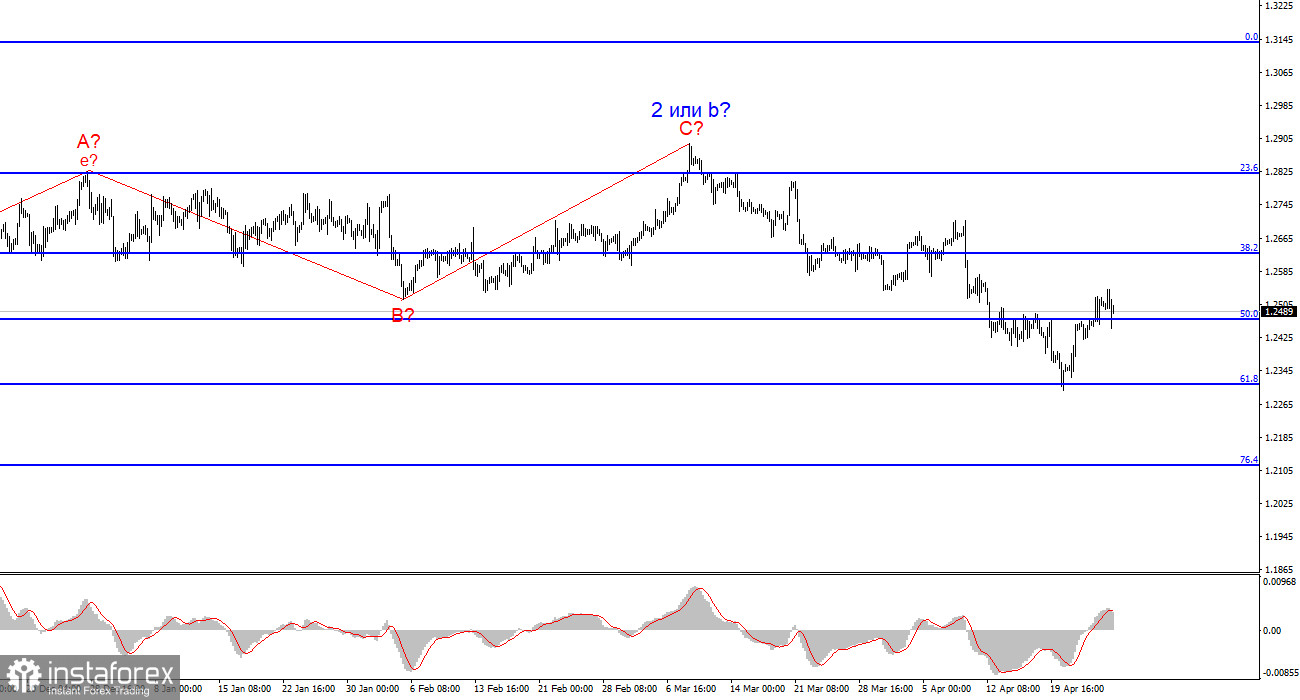

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c has started to form. A successful attempt to break 1.2472, which corresponds to 50.0% Fibonacci, indicates that the market is ready to build a descending wave.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.