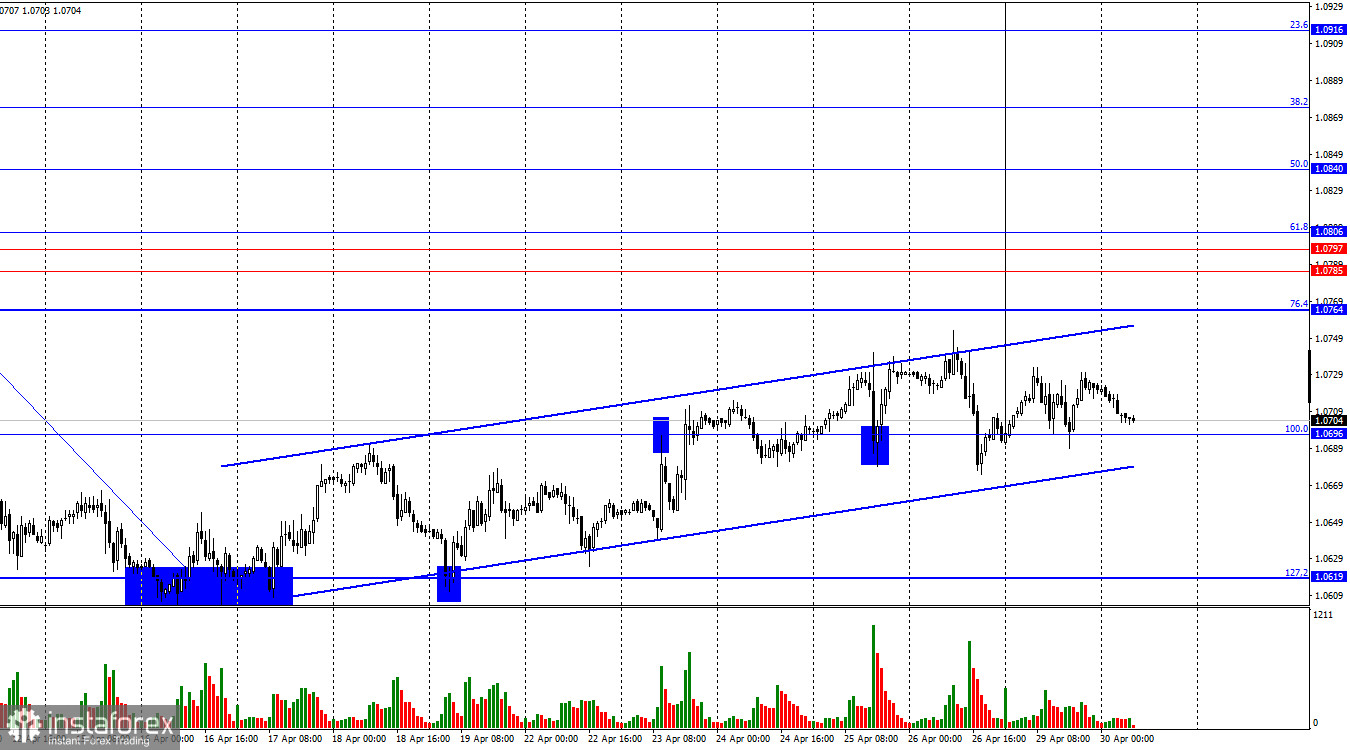

The EUR/USD pair on Monday retraced to the corrective level of 100.0%-1.0696, rebounded from it, experienced slight growth, and returned to this level again. Another rebound of quotes will allow for a small upward movement toward the upper line of the ascending trend channel. If the pair's exchange rate consolidates below the channel, it will work in favor of the US currency and resume the decline toward the corrective level of 127.2%-1.0619.

The wave situation remains unchanged. The last completed downward wave broke the low of the previous wave (from April 2nd), and the new upward wave is still too weak to break the last peak from April 9th. Thus, we are dealing with a "bearish" trend, and there is currently no sign of its completion. For such a sign to appear, the new upward wave must break the peak of the previous wave (from April 9th). If the next downward wave fails to break the last low from April 16th, this will also be a sign of a trend change to "bullish." Until then, bears will maintain the upper hand.

The information background on Monday was interesting but scarce. The inflation level in Germany in April remained unchanged at 2.2% y/y, while the core inflation slightly accelerated to 2.4% y/y. These changes, or rather their almost complete absence, did not affect traders' sentiment. However, today is a different story. In the European Union, five important reports will be released simultaneously, which must be noticed by the market. The most important ones are GDP and inflation in the EU. Given the current state of the EU economy, people are still waiting for strong growth. And strong growth is necessary for bull traders to have grounds for new purchases of the euro. The same applies to the inflation report. Since inflation in Germany has not accelerated, a weak value can be expected in the EU as well. The Consumer Price Index continues to move towards the 2.0% mark, so the ECB Governing Council may begin easing at the next meeting. For traders, this is a reason to start selling the euro again.

On the 4-hour chart, the pair rebounded from the corrective level of 23.6%-1.0644 after forming two "bullish" divergences in the CCI indicator and RSI indicator, moving below 20. Thus, a reversal in favor of the European currency occurred, and the process of growth toward the corrective level of 38.2%-1.0765 began. A "bearish" divergence has formed in the CCI indicator, which may put an end to the euro's growth at this stage. A rebound of quotes from the level of 1.0765 will work in favor of the US currency and resume the decline toward the Fibonacci level of 0.0%–1.0450.

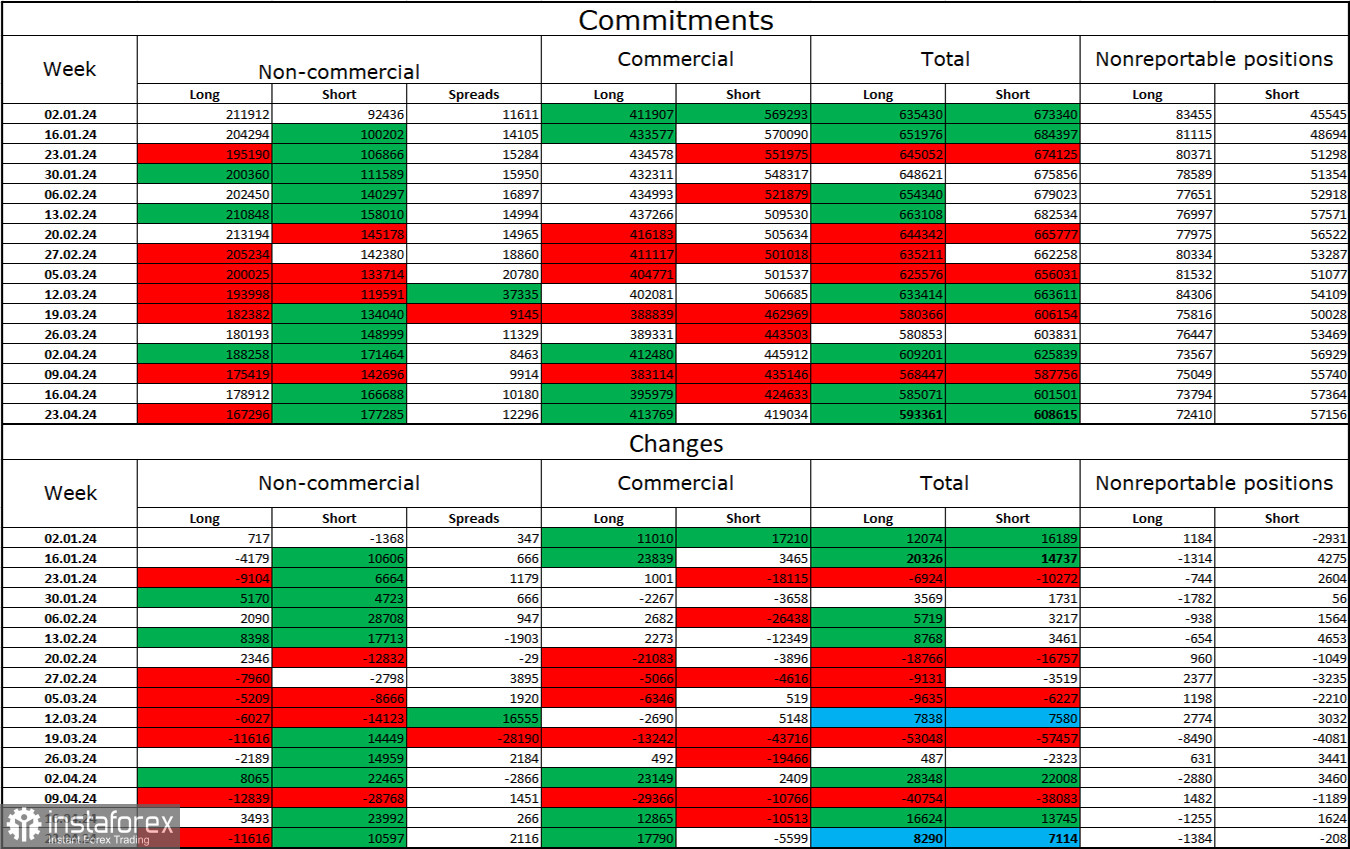

Commitments of Traders (COT) report:

During the last reporting week, speculators closed 11,616 long contracts and opened 10,597 short contracts. The sentiment of the "non-commercial" group has become "bearish" and is rapidly strengthening. The total number of long contracts held by speculators now stands at 167,000, while short contracts amount to 177,000. The situation will continue to shift in favor of the bears. In the second column, we see that the number of short positions has increased from 92,000 to 177,000 over the last three months. During the same period, the number of long positions decreased from 211,000 to 167,000. Bulls have dominated the market for too long, and now they need strong fundamental support to resume the "bullish" trend. However, the recent information background is more supportive of bears.

News calendar for the US and EU:

EU - Change in retail trade volume in Germany (06:00 UTC).

EU - Unemployment rate in Germany (07:55 UTC).

EU - Change in GDP volume in the first quarter in Germany (08:00 UTC).

EU - Change in GDP volume in the first quarter (09:00 UTC).

EU - Consumer Price Index (09:00 UTC).

On April 30th, the economic events calendar contains five entries, all of which are important in their own right. The influence of the information background on traders' sentiment today may be moderately strong throughout the day.

Forecast for EUR/USD and advice for traders:

Selling the pair is possible today upon consolidation below the ascending corridor on the hourly chart with a target at 1.0619. Buying the euro was possible upon closing (and upon rebound) above the level of 1.0696 on the hourly chart with a target at 1.0764, but bulls are currently quite weak, and they have yet to manage to reach the level of 1.0764. Caution is advised with purchases.