Forex intervention is effective when it is carried out on time. Japan has mastered this art in the course of time. The monetary authorities entered Forex for the second time with large-scale purchases of the yen against the US dollar on the back of rapid USD/JPY's growth after Jerome Powell's press conference after the FOMC meeting. The Fed Chairman did not scare investors with hints of raising the federal funds rate, which pushed Treasury yields down. This became the green light for the next currency intervention by Japan's finance ministry in the USD/JPY pair.

Meanwhile, traders are watching with bated breath the struggle between financial markets and central banks. Regulators do not always notch success. The story of George Soros, who brought the Bank of England to its knees in the 1990s, is still on everyone's lips. However, at that time, the financier's opponent acted too straightforwardly. Now central banks are cunning and resourceful.

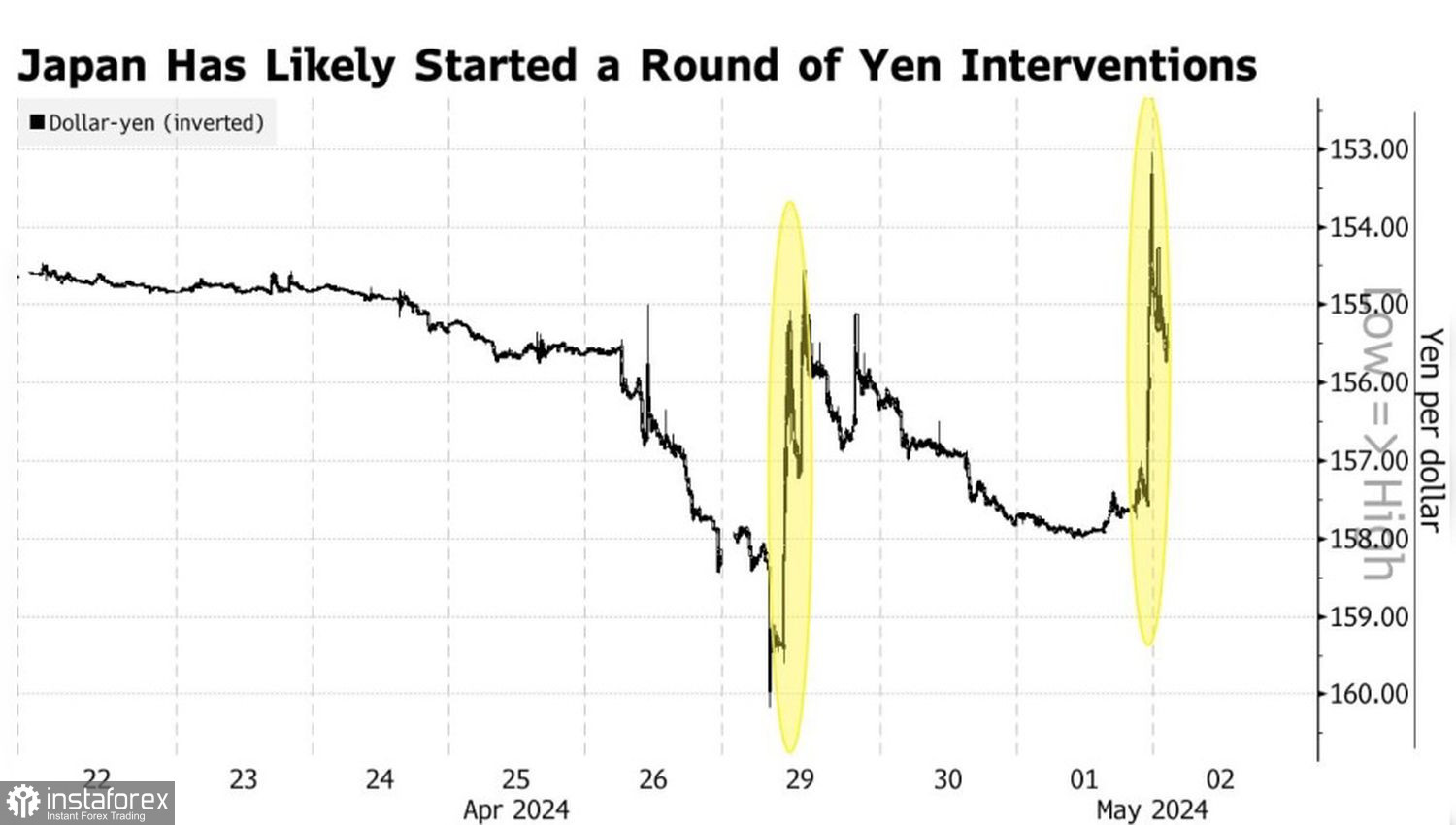

Japan's government has remained silent on the Forex intervention, and traders must figure out whether it has occurred and assess the extent of it. In the first case, we were most likely talking about 5 trillion yen equivalent to $35 billion. In the second intervention, the amount of cash injections could have increased. USD/JPY slipped below 153, after which the currency pair went up again.

Dynamic of USD/JPY and forex interventions

In such conditions, holding long positions in the US dollar against Japan's currency is extremely dangerous. Despite Deputy Finance Minister Masato Kanda's reluctance to directly answer the question of whether the intervention actually happened, he reiterates that Japan will act at any time, be it during the Asian, European or American Forex session. The threat looks serious, and after two sharp declines in USD/JPY, speculators will think twice before getting involved into a venture.

Moreover, currency interventions bring windfall profits to the government. The country acquired foreign assets when the yen was weaker, and now sells them using the principle of "buy at lows, sell at highs." However, the finance ministry officials will hardly keep this in mind.

The fundamentally upward trend in USD/JPY remains valid. The difference in interest rates between the Federal Reserve and the Bank of Japan is 500 basis points. So, thumps up that money continues to flow from Asia to North America. Rumors that Kazuo Ueda could raise borrowing costs to 0.5% in 2024 and 1% in 2025 if the yen continues to weaken may have some grounds, but with a government debt level of 250% of GDP, this could cost Tokyo dearly. These debts need to be serviced.

Therefore, the monetary authorities will forge ahead with currency interventions. I believe that the matter will not end with two occasions. Hedge funds are not scared and do not intend to give up. On the contrary, they place pending orders lower in order to buy the US dollar cheaper. I believe that the same strategy should be used by an ordinary trader.

Technically, on the daily chart of USD/JPY, the story of a sharp collapse of the instrument and its subsequent recovery was repeated and resembles the implementation of the Adam and Eve pattern. It makes sense to place limit buy orders from the levels of 154.0, 153.4, and 152.4.