Analysis of EUR/USD 5M

EUR/USD did not show any interesting movements on Tuesday. The pair has been trading in a sideways channel for the third consecutive day, bounded by levels 1.0757 and 1.0797. Therefore, the price cannot leave the 40-pip range. There were no reasons to rise or fall. The euro area retail sales report was released in the morning, which was slightly above forecasts, but it did not provoke any market reaction as it wasn't considered important. Among other events, we can highlight speeches by representatives of the European Central Bank and the Federal Reserve. The former spoke about three rate cuts this year and readiness to start easing in June. The latter mentioned the possible need to further tighten monetary policy since inflation has ceased to slow down.

As before, we believe that such rhetoric, as well as the overall fundamental background, only works in favor of the dollar. The euro cannot constantly and continuously decline, so the current bullish correction is also logical. However, the correction has been persistent for three weeks now, so it's time for it to end. The end of the correction can be determined once the price overcomes the lines of the Ichimoku indicator and exits the ascending channel.

Yesterday, three trading signals were formed around the level of 1.0757. The price bounced from this level thrice, and it only managed to rise by at least 20 pips on the third attempt. Traders could only open one long position, as they duplicated each other. The price did not reach the target level of 1.0797, so traders could only gain a small profit from this trade. In conditions of volatility slightly over 30 pips, even such profit is a good result.

COT report:

The latest COT report is dated April 30. The net position of non-commercial traders has been bullish for quite some time, but now the situation has finally changed. The net position of non-commercial traders (red line) has been decreasing in recent months, while that of commercial traders (blue line) has been increasing. This shows that market sentiment is turning bearish, as speculators increasingly sell the euro. Currently, their positions coincide in terms of volume. We don't see any fundamental factors that can support the euro's strength, while technical analysis also suggests a downtrend. Three descending trend lines on the weekly chart indicate that there's a good chance of sustaining the decline.

The red and blue lines have crossed, and now bears may have a significant advantage. So we strongly believe that the euro will fall further. During the last reporting week, the number of long positions for the non-commercial group decreased by 100, while the number of short positions decreased by 3,200. Accordingly, the net position increased by 3,100. Overall, both the euro and the net position continue to decline. The number of buy contracts is now lower than the number of sell contracts among non-commercial traders by 7,000.

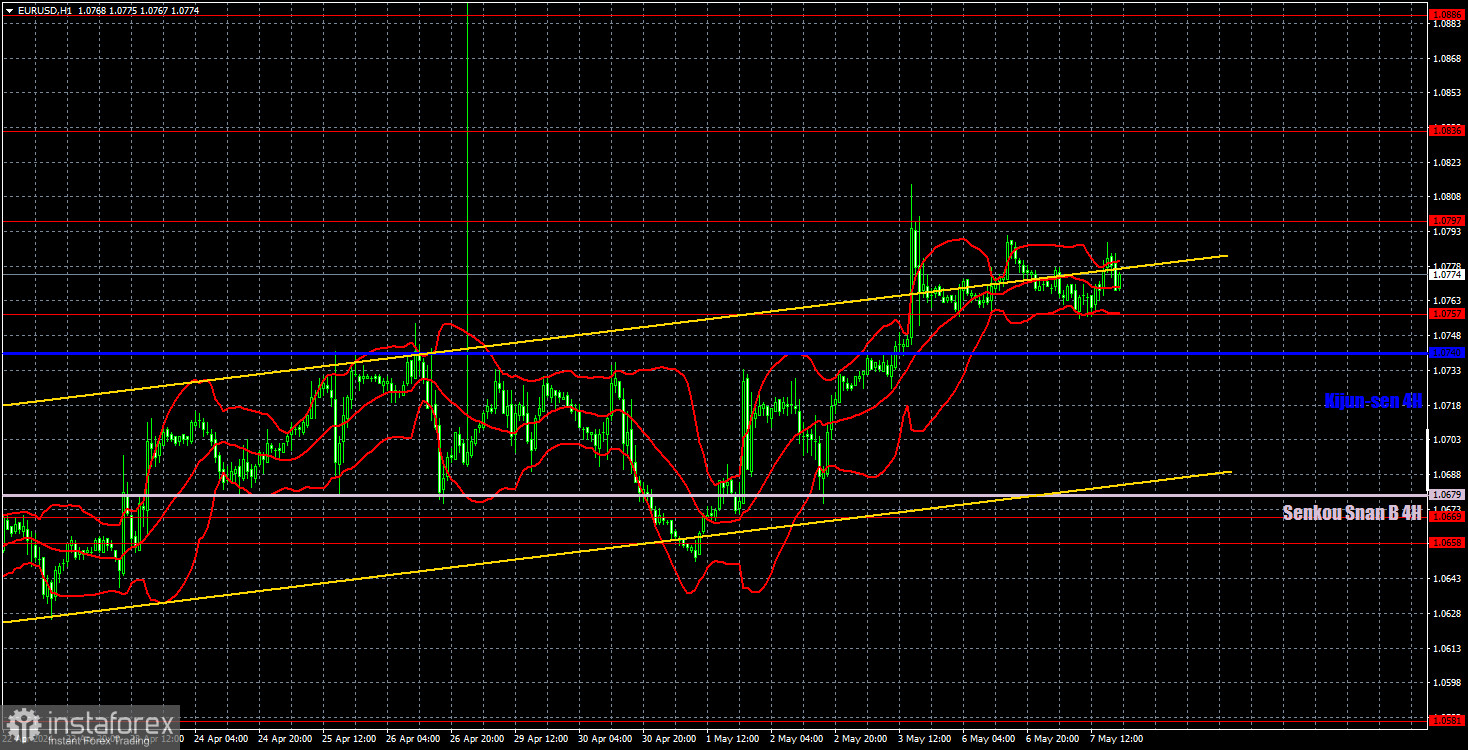

Analysis of EUR/USD 1H

On the 1-hour chart, the EUR/USD pair has been going through a weak bullish correction against a global downward trend for three weeks now. Since expectations for a Federal Reserve rate cut in 2024 have significantly decreased, the US should rise in the medium term. We still expect the current correction to end, and after that traders can consider selling the pair again. The targets in the 1.00-1.02 range remain unchanged for now.

On May 8, we highlight the following levels for trading: 1.0530, 1.0581, 1.0658-1.0669, 1.0757, 1.0797, 1.0836, 1.0886, 1.0935, 1.1006, 1.1092, as well as the Senkou Span B line (1.0679) and the Kijun-sen line (1.0740). The Ichimoku indicator lines can move during the day, so this should be taken into account when identifying trading signals. Don't forget to set a Stop Loss to breakeven if the price has moved in the intended direction by 15 pips. This will protect you against potential losses if the signal turns out to be false.

On Wednesday, there are no crucial reports. We can only highlight the report on industrial production in Germany, which is a minor report. Overall, we expect another boring day.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;